Vietnam’s frame severance tax tariff

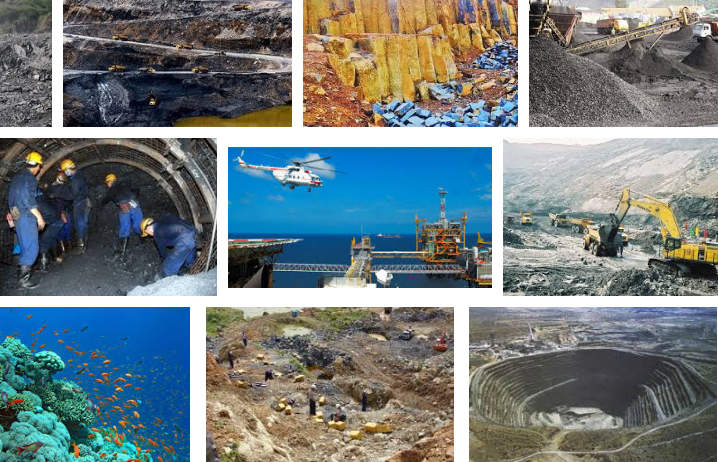

The Law on Severance tax 2009 of Vietnam was promulgated on November 25, 2009, which provides for severance tax-liable objects, severance tax payers, severance tax bases, and severance tax declaration, payment, exemption and reduction. Notably, the law includes provisions on the frame severance tax tariff.

Specifically, according to Article 7 of the Law on Severance tax 2009 of Vietnam and Resolution No. 1084/2015/UBTVQH2013, the frame severance tax tariff for various types of resources, excluding crude oil and natural gas, and coal gas is as follows:

Furthermore, the Law also stipulates the frame severance tax tariff for crude oil and natural gas, and coal gas, specifically as follows:

Pursuant to these frame severance tax tariffs, the National Assembly Standing Committee shall stipulate specific severance tax rates for each category of natural resource in each period on the following principles:

- Ensuring conformity with the list of groups and categories of natural resource and within the severance tax rate bracket prescribed by the National Assembly;

- Contributing to the state management of natural resources; protection, exploitation and rational, economical and effective use of natural resources;

- Contributing to assuring state budget revenues and market stabilization.

View more details: The Law on Severance tax 2009 of Vietnam officially takes effect from July 01, 2010 and Resolution No. 1084/2015/UBTVQH2013 takes effect from July 01, 2016.

- Number of deputy directors of departments in Vietnam in accordance with Decree 45/2025/ND-CP

- Cases ineligible for pardon in Vietnam in 2025

- Decree 50/2025 amending Decree 151/2017 on the management of public assets in Vietnam

- Circular 07/2025 amending Circular 02/2022 on the Law on Environmental Protection in Vietnam

- Adjustment to the organizational structure of the Ministry of Health of Vietnam: Certain agencies are no longer listed in the organizational structure

- Vietnam aims to welcome 22-23 million international tourists in Vietnam in 2025

-

- Vietnam: Cases of severance tax exemption and ...

- 11:20, 12/12/2017

-

- Vietnam: Severance tax-liable objects and entities ...

- 10:09, 12/12/2016

-

- Severance tax-liable objects according to Vietnam ...

- 11:35, 07/07/2016

-

- Law on Severance tax 2009 of Vietnam: Regulations ...

- 11:48, 01/01/2016

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

Article table of contents

Article table of contents