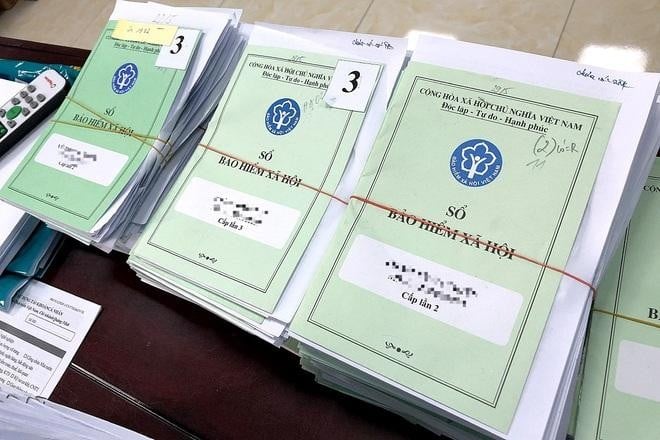

Vietnam: Mistakes and penalties when declaring social insurance premiums are often made

14:47, 30/05/2019

The following is a summary of mistakes in declaring and paying social insurance and the corresponding penalty for each one that accountants and human resources officers often make.

The contents mentioned above are in accordance with Decree No. 95/2013/NĐ-CP of Vietnam’s Government amended by Decree No. 88/2015/NĐ-CP on penalties for administrative violations against regulations on employment, social insurance, and Vietnamese guest workers.

Duy Thinh

- Key word:

- social insurance

Related Content

- Number of deputy directors of departments in Vietnam in accordance with Decree 45/2025/ND-CP

- Cases ineligible for pardon in Vietnam in 2025

- Decree 50/2025 amending Decree 151/2017 on the management of public assets in Vietnam

- Circular 07/2025 amending Circular 02/2022 on the Law on Environmental Protection in Vietnam

- Adjustment to the organizational structure of the Ministry of Health of Vietnam: Certain agencies are no longer listed in the organizational structure

- Vietnam aims to welcome 22-23 million international tourists in Vietnam in 2025

SEARCH ARTICLE

Related Document

Related Article

-

- Social insurance regime for regular militia and ...

- 17:32, 08/02/2025

-

- Guidelines on the form for Notification No. 01 ...

- 11:00, 04/02/2025

-

- Coefficient of compulsory social insurance price ...

- 15:24, 22/01/2025

-

- Subjects adjusted for salaries and monthly income ...

- 17:59, 20/01/2025

-

- Social insurance price slippage coefficient for ...

- 10:47, 20/01/2025

JUST UPDATED

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

New text summary report

-

Real estate

-

Policy analysis

-

Legal Counselling

-

Case law

-

Forms and Templates

-

New text catalog

-

New Text Notification

-

Highlights of the week

-

Finance

-

New policy in effect

-

Labor - Salary

-

Officials and civil servants

-

Land - Housing

-

Tax-free-fee

-

Custom

-

Enterprise - Investment

-

Administration

-

Insurance

-

Civil

-

Set of Laws

-

News about Case Law

-

Economy

-

Life

-

Health

-

Cultural

-

Commerce

-

Military

-

History

-

Strange story

-

Criminal

-

Traffic

-

Education

-

Other

Article table of contents

Article table of contents