Vietnam: How is the remuneration of the asset management officer determined?

On February 16, 2015, the Government of Vietnam unanimously issued Decree 22/2015/ND-CP stipulating detailed implementation of certain provisions of the Bankruptcy Law regarding Asset Management Officers and the practice of asset management and liquidation.

According to Vietnam's regulations, expenses paid to the asset management officer or asset management and liquidation enterprise shall derive from the value of assets of the insolvent enterprise and cooperative. Expenses paid to the asset management officer or asset management and liquidation enterprise shall be inclusive of remuneration paid to the asset management officer or asset management and liquidation enterprise as well as other expenses.

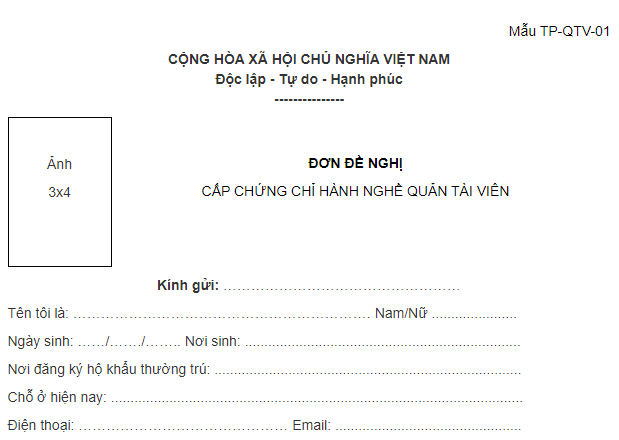

Illustration (source: internet)

Remuneration shall be calculated with reference to the following factors: Time that the asset management officer has spent performing their assigned tasks; Effort that the asset management officer has made to perform their assigned tasks; Outcome of the asset management officer’s task performance.

Remuneration shall be calculated according to one or several method(s) as follows: Working hours of the asset management officer; Lump-sum remuneration amount; Remuneration percentage calculated by the percentage of total asset value of the enterprise or cooperative declaring bankruptcy gained after liquidation.

Remuneration is calculated based on one or more of the following methods: Working hours of the trustee; Fixed remuneration; Proportional remuneration relative to the total value of the assets of the enterprise or cooperative declared bankrupt, obtained after liquidation.

According to Decree 22/2015/ND-CP of Vietnam's Government, the remuneration amount shall be determined as follows:

- If the People’s Court takes a decision to cease the bankruptcy procedures under the provisions of Article 86 of the Law on Bankruptcy, the remuneration amount shall be agreed upon between the bankruptcy judge and the asset management officer or asset management and liquidation enterprise on the basis of considering and applying the bases and methods mentioned above;

- If the enterprise or cooperative has been declared bankrupt under the provisions of Clause 3 Article 80, Clause 4 Article 83, and Clause 7 Article 91 of the Law on Bankruptcy, the remuneration amount shall be determined as follows:

- With regard to the enterprise or cooperative that has been declared bankrupt according under the provisions of Point b or Point Circular Clause 1 Article 95 of the Law on Bankruptcy, the remuneration shall be inclusive of the remuneration amounts identified for specific cases stipulated in the above table plus the remuneration paid for the supervision of business activities while the insolvent enterprise or cooperative implements the business recovery plan. The remuneration paid for the supervision of business operations shall be agreed upon between the judge and the asset management officer, or asset management and liquidation enterprise with reference to the bases and methods mentioned above;

- With regard to the enterprise or cooperative that falls in the case in which the business recovery plan stipulated by Point a Clause 1 Article 95 of the Law on Bankruptcy has been already implemented, the remuneration amount shall be agreed upon between the bankruptcy judge and the asset management officer or asset management and liquidation enterprise with reference to the bases and methods mentioned above.

However, in the event of bankruptcy of a credit institution as stipulated in Chapter VIII of the Bankruptcy Law, the trustee's, asset management, and liquidation company's remuneration is determined according to the provisions of Point a, Point b, Clause 4, Article 21 of Decree 22/2015/ND-CP.

Additionally, other expenses paid to the asset management officer or asset management and liquidation enterprise shall be inclusive of travel and accommodation costs and other relevant expenses incurred from asset management and liquidation operations. The payment of these other expenses to the asset management officer or asset management and liquidation enterprise shall be governed by applicable laws.

The bankruptcy judge shall take into account specific cases in order to decide the advance sum paid to the asset management officer or asset management and liquidation enterprise. The asset management officer or asset management and liquidation enterprise shall receive the advance sum to make their payment under the provision of applicable laws on finance and accounting.

More details can be found in: Decree 22/2015/ND-CP of Vietnam's Government, effective from April 6, 2015.

Thu Ba

- Key word:

- Decree 22/2015/ND-CP

- Number of deputy directors of departments in Vietnam in accordance with Decree 45/2025/ND-CP

- Cases ineligible for pardon in Vietnam in 2025

- Decree 50/2025 amending Decree 151/2017 on the management of public assets in Vietnam

- Circular 07/2025 amending Circular 02/2022 on the Law on Environmental Protection in Vietnam

- Adjustment to the organizational structure of the Ministry of Health of Vietnam: Certain agencies are no longer listed in the organizational structure

- Vietnam aims to welcome 22-23 million international tourists in Vietnam in 2025

-

- Vietnam: Compilation of 08 important forms applicable ...

- 13:34, 10/07/2024

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

Article table of contents

Article table of contents