Vietnam: Customs procedures for goods brought from the free trade zone in the Nghi Son Economic Zone under Thanh Hoa province into the domestic market

On January 30, 2007, the Ministry of Finance of Vietnam issued Circular 08/2007/TT-BTC guiding financial policies and customs procedures applicable in the Nghi Son Economic Zone, Thanh Hoa Province.

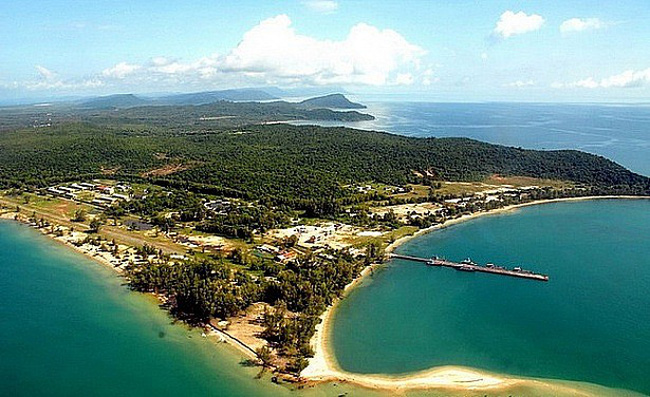

Vietnam: Customs procedures for goods brought from the free trade zone in the Nghi Son Economic Zone under Thanh Hoa province into the domestic market (Illustrative image)

Circular 08/2007/TT-BTC stipulates customs procedures for goods brought from the free trade zone in the Nghi Son Economic Zone under Thanh Hoa province into the domestic market in Vietnam as follows:

Goods listed in the catalog of free trade zone-origin goods are eligible for exemption from customs procedures but are required to declare the quantity of goods to customs authorities and under supervision by customs authorities;

For other goods, full customs procedures must be carried out.

To be specific:

- Organizations and individuals engaged in business and production in the free trade zone (seller) are responsible for providing to organizations and individuals engaged in business and production in the domestic market (buyer) all required documents, invoices, and payment notes as stipulated by the customs authorities so that the domestic enterprise can declare customs and submit customs dossiers according to the provisions for each type of import to gate B customs authorities.

- Gate B customs authorities are responsible for carrying out customs procedures for imports of domestic enterprises under regulations. Where it is discovered that foreign goods have been brought into the free trade zone to continue being imported into the domestic market and are of the same type as goods listed in the list of free trade zone-origin goods notified by the Management Board of the Nghi Son Economic Zone, but the enterprise has not made customs declaration, the gate B customs authorities must request proof of origin for the shipment; proceed with violation handling and carry out customs procedures for the shipment as per legal provisions; at the same time, notify the Management Board of the Nghi Son Economic Zone for appropriate management measures or exclusion from the list of free trade zone-origin goods.

Details can be found in Circular 08/2007/TT-BTC effective March 3, 2007.

Ty Na

- Number of deputy directors of departments in Vietnam in accordance with Decree 45/2025/ND-CP

- Cases ineligible for pardon in Vietnam in 2025

- Decree 50/2025 amending Decree 151/2017 on the management of public assets in Vietnam

- Circular 07/2025 amending Circular 02/2022 on the Law on Environmental Protection in Vietnam

- Adjustment to the organizational structure of the Ministry of Health of Vietnam: Certain agencies are no longer listed in the organizational structure

- Vietnam aims to welcome 22-23 million international tourists in Vietnam in 2025

-

- Form of information disclosure for enterprises ...

- 14:19, 14/11/2024

-

- Directive on boosting demand, supporting production ...

- 18:08, 30/08/2024

-

- Investment Incentive policies in Da Nang free ...

- 08:01, 18/07/2024

-

- Vietnam: Accelerating the disbursement of public ...

- 04:21, 10/07/2024

-

- 07 general provisions on customs procedures for ...

- 00:18, 10/07/2024

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

Article table of contents

Article table of contents