Vietnam: Criteria for determining small and medium-sized enterprises

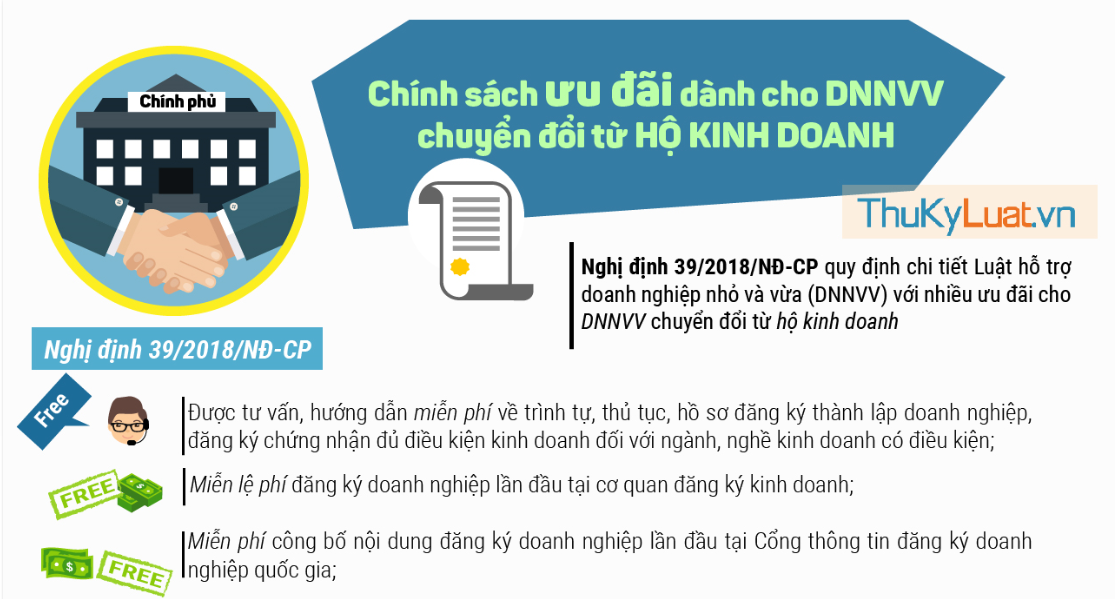

On March 11, 2018, the Government of Vietnam issued Decree No. 39/2018/NĐ-CP on guidelines for Law on support for small and medium-sized enterprises.

In order to help the competent authorities have appropriate support policies, Decree No. 39/2018/NĐ-CP of Vietnam’s Government has specified criteria for determining small and medium-sized enterprises (SMEs). To be specific:

SMEs are classified by size, including microenterprises, small enterprises and medium-sized enterprises.

Microenterprises include:

- Microenterprises in the sector of agriculture, forestry and aquaculture and industry and construction have an annual average of 10 employees or fewer who have made contributions to social insurance and total annual revenue is not more than VND 3 billion or total capital is not more than VND 3 billion.

- Microenterprises in the trade and service sector have an annual average of 10 employees or fewer and total annual revenue is not more than VND 10 billion or total capital is not more than VND 3 billion.

Small enterprises include:

- Small enterprises in the sector of agriculture, forestry and aquaculture and industry and construction have an annual average of 100 employees or fewer who have make contributions to social insurance and total annual revenue is not more than VND 50 billion or total capital is not more than VND 20 billion, other than the microenterprise prescribed in Clause 1 of this Article.

- Small enterprises in the trade and service sector has an annual average of 50 employees or fewer who have make contributions to social insurance and total annual revenue is not more than VND 100 billion or total capital is not more than VND 50 billion, other than the microenterprise prescribed in Clause 1 of this Article.

Medium-sized enterprises include:

- Medium-sized enterprises in the sector of agriculture, forestry and aquaculture and industry and construction have an annual average of 200 employees or fewer who have make contributions to social insurance and total annual revenue is not more than VND 200 billion or total capital is not more than VND 100 billion, other than the microenterprise small enterprise prescribed in Clause 1 and Clause 2 of this Article.

- Medium-sized enterprises in the trade and service sector have an annual average of 100 employees or fewer who have make contributions to social insurance and total annual revenue is not more than VND 300 billion or total capital is not more than VND 100 billion, other than the microenterprise and small prescribed in Clause 1 and Clause 2 of this Article.

Decree No. 39/2018/NĐ-CP of Vietnam’s Government came into force from March 11, 2018.

- Thao Uyen -

- Key word:

- Decree No. 39/2018/NĐ-CP

- Number of deputy directors of departments in Vietnam in accordance with Decree 45/2025/ND-CP

- Cases ineligible for pardon in Vietnam in 2025

- Decree 50/2025 amending Decree 151/2017 on the management of public assets in Vietnam

- Circular 07/2025 amending Circular 02/2022 on the Law on Environmental Protection in Vietnam

- Adjustment to the organizational structure of the Ministry of Health of Vietnam: Certain agencies are no longer listed in the organizational structure

- Vietnam aims to welcome 22-23 million international tourists in Vietnam in 2025

-

- Vietnam: Assistance for small and medium-sized ...

- 11:44, 07/10/2023

-

- Distinguishing microenterprises, small enterprises ...

- 09:20, 10/04/2020

-

- Vietnam’s regulations on support for small and ...

- 11:15, 21/09/2018

-

- Assistance in developing human resources for small ...

- 12:04, 03/06/2018

-

- Incentives for small and medium enterprises converted ...

- 17:01, 28/03/2018

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

Article table of contents

Article table of contents