Vietnam: Cases of severance tax exemption and reduction

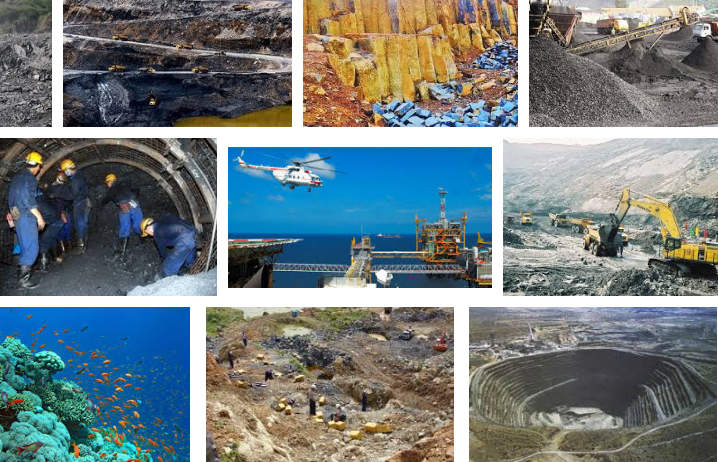

The Law on Severance tax 2009 of Vietnam was promulgated on November 25, 2009 and officially effective from July 01, 2010, of which one of the fundamental contents is the regulation on cases of severance tax exemption and reduction.

Specifically, according to Article 9 of the Law on Severance tax 2009 of Vietnam and Articles 10, 11 of Circular No. 152/2015/TT-BTC of the Ministry of Finance of Vietnam, cases of severance tax exemption include:

One, entities extracting natural marine organisms.

Two, entities extracting branches, firewood, bamboo, rattan, etc. serving everyday life.

Three, entities extracting natural water for hydroelectricity generation serving everyday life of households and individuals.

Four, natural water extracted by households and individuals serving their everyday life.

Five, land areas given/leased out to organizations and individuals and used on the spot; earth used for leveling, construction of security, military works, dykes.

Earth extracted and used on the spot eligible for tax exemption include sand, rock, gravel in the earth without specific substances and is used as is for leveling or construction. If earth is transported elsewhere for use or for sale, severance tax must be paid as prescribed.

The Ministry of Finance shall cooperate with relevant Ministries and agencies in proposing other cases of exemption from severance tax to the government, which will be considered and decided by the Standing Committee of the National Assembly.

Besides, cases of severance tax reduction are also prescribed by law, including:

One, taxpayers who suffer from a natural disaster, conflagration, or accident that inflicts damage to the declared resources may be given exemption or reduction of severance tax on the amount of damaged resources. If tax has been paid, taxpayers shall receive a refund or have it offset against severance tax payable in the next period.

Two, the Ministry of Finance shall cooperate with relevant Ministries and agencies in proposing other cases of severance tax reduction to the government, which will be considered and decided by the Standing Committee of the National Assembly.

- Number of deputy directors of departments in Vietnam in accordance with Decree 45/2025/ND-CP

- Cases ineligible for pardon in Vietnam in 2025

- Decree 50/2025 amending Decree 151/2017 on the management of public assets in Vietnam

- Circular 07/2025 amending Circular 02/2022 on the Law on Environmental Protection in Vietnam

- Adjustment to the organizational structure of the Ministry of Health of Vietnam: Certain agencies are no longer listed in the organizational structure

- Vietnam aims to welcome 22-23 million international tourists in Vietnam in 2025

-

- Vietnam’s frame severance tax tariff

- 10:48, 03/09/2018

-

- Vietnam: Severance tax-liable objects and entities ...

- 10:09, 12/12/2016

-

- Severance tax-liable objects according to Vietnam ...

- 11:35, 07/07/2016

-

- Law on Severance tax 2009 of Vietnam: Regulations ...

- 11:48, 01/01/2016

-

- Vietnam: 6 cases of severance tax exemption

- 14:29, 18/12/2015

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

Article table of contents

Article table of contents