Unit Price of Contractual Wages for Employees and the Executive Board in 2020

Recently, the Minister of Labor, War Invalids and Social Affairs has issued Circular 04/2020/TT-BLDTBXH providing guidance on the implementation of regulations concerning contract prices, the salary fund of employees, and the Executive Board as stipulated in Articles 7 and 8 of Decree 20/2020/ND-CP dated February 17, 2020, of the Government of Vietnam. This is part of the pilot management of labor, salaries, and bonuses for certain economic groups and state-owned corporations.

Contract Salary Unit Price for Employees and Executives in 2020 (Illustration Image)

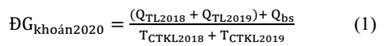

Circular 04/2020/TT-BLDTBXH prescribes the unit price of contracted salary (hereinafter referred to as contract pricing) for employees and executives in 2020 as stipulated in Article 7 Decree 20/2020/ND-CP and is determined by the following formula:

In which:

1. DGkhoan2020: The maximum contract pricing applied for the year 2020 is calculated based on the following indicators:

- For Parent Company - Vietnam Posts and Telecommunications Group (hereinafter referred to as VNPT), the contract pricing is calculated as a percentage (%) of the total revenue minus the total expenses excluding salaries (corresponding to the unit dong/100 dong of total revenue minus total expenses excluding salaries). The total revenue and total costs are calculated according to the Government of Vietnam's regulations on state capital investment in enterprises and financial management for enterprises wholly owned by the state, and the Ministry of Finance's guiding documents, excluding the revenue and costs of public service providers under VNPT.

- For Parent Company - Vietnam Airlines Corporation (hereinafter referred to as VNA), the contract pricing is calculated according to the revenue-generating ton-kilometers of air transport (corresponding to the unit dong per ton-kilometer of revenue-generating air transport). The revenue-generating ton-kilometers are determined according to the general standards of the International Civil Aviation Organization (ICAO) applicable to air transport carriers.

- For Parent Company - Vietnam Air Traffic Management Corporation (hereinafter referred to as VATM), the contract pricing is calculated according to the converted flight-kilometers (corresponding to the unit dong per converted flight-kilometer). The converted flight-kilometers are calculated on the basis of the total number of converted flight-kilometers on each flight route of all flights; in which the converted flight-kilometers on each flight route are calculated by multiplying the actual managed flying distance (unit km) by the conversion factor of the aircraft type and the complexity factor of air traffic management on each flight route. The method to determine the converted flight-kilometers is developed and submitted by VATM to the Ministry of Transport for approval.

2. TCTKL2018 and TCTKL2019: The actual contract wage indicators (for VNPT, it is the total revenue minus total expenses excluding salaries, excluding revenue and costs of public service providers; for VNA, it is the total revenue-generating ton-kilometers of air transport; for VATM, it is the total converted flight-kilometers) implemented in 2018 and 2019.

3. QTL2018 and QTL2019: The total wage fund, safety bonus (if any) actually implemented in 2018 and 2019 for workers under labor contracts and executives according to legal provisions, including:

- The total actual wage fund, safety bonus in 2018 and 2019 for workers, including the wage fund according to Circular 26/2016/TT-BLDTBXH dated September 1, 2016, of the Ministry of Labor, War Invalids, and Social Affairs guiding the management of labor, wages, and bonuses for workers in single-member limited liability companies with 100% charter capital held by the State and Circular 28/2016/TT-BLDTBXH dated September 1, 2016, of the Ministry of Labor, War Invalids, and Social Affairs guiding regulations on labor, wages, remuneration, and bonuses for companies with dominant state-contributed capital and safety bonuses (if any).

- The total actual wage fund, safety bonus in 2018 and 2019 for executives, calculated by the actual amount of wages, safety bonuses paid to the General Director, Deputy General Directors, Chief Accountant according to the company's wage payment regulations.

4. Qbs: The additional wage fund included in the contract pricing for each company is determined as follows:

- For VNPT, the additional wage fund is determined at most by the average wage difference in 2018 and 2019 between the level paid by companies in the market and the level paid by VNPT to direct laborers performing high-technology products holding the same position, multiplied by the number of VNPT laborers, on average, in 2018 and 2019 directly performing high-technology products with lower wages than the market companies.

High-technology products are determined according to the list of high-tech products issued by the Prime Minister of the Government of Vietnam or relevant Ministries. The average wage of direct labor performing high-technology products paid by market companies is based on the Wage Report published by market survey companies collected by VNPT and reported to the competent capital representative agency along with the contract pricing.

- For VNA, the additional wage fund is determined at most by the average wage difference in 2018 and 2019 between foreign pilots and Vietnamese pilots performing the same job positions paid by VNA, multiplied by the average number of Vietnamese pilots employed by VNA in 2018 and 2019 who have lower wages than foreign pilots.

- For VATM, the additional wage fund is determined at most by the average number of laborers projected to be needed in 2020 due to the requirements of competent state agencies for aviation security and safety, differentiated from the average laborers used each year in 2018 and 2019, multiplied correspondingly with the average wage, safety bonuses actually implemented in 2018 and 2019 by VATM.

- The additional wage fund included in the contract pricing stipulated in points a, b, and c of this Clause is the maximum level for the company to supplement in the contract pricing, ensuring that after including the additional wage fund, the planned profit before tax for 2020 (after eliminating objective factors as prescribed) is not lower than the average actual profit of the 2018 - 2019 period.

- The wage fund according to the contract pricing for 2020 of the company is determined as follows:

QTL2020 = DGkhoan x TCTKL2020 (2)

- QTL2020: Wage fund according to the contract pricing for 2020.

- DGkhoan: Contract pricing according to Clause 1 of this Article.

- TCTKL2020: Actual contract wage indicator for 2020.

More details can be found in: Circular 04/2020/TT-BLDTBXH effective from July 10, 2020.

Thu Ba

- Number of deputy directors of departments in Vietnam in accordance with Decree 45/2025/ND-CP

- Cases ineligible for pardon in Vietnam in 2025

- Decree 50/2025 amending Decree 151/2017 on the management of public assets in Vietnam

- Circular 07/2025 amending Circular 02/2022 on the Law on Environmental Protection in Vietnam

- Adjustment to the organizational structure of the Ministry of Health of Vietnam: Certain agencies are no longer listed in the organizational structure

- Vietnam aims to welcome 22-23 million international tourists in Vietnam in 2025

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

Article table of contents

Article table of contents