Types of savings deposits according to Vietnam’s new regulations

On December 31, 2018, the State Bank of Vietnam issued Circular No. 48/2018/TT-NHNN on savings deposits.

According to Circular No. 48/2018/TT-NHNN of the State Bank of Vietnam, savings deposits are classified by:

- Terms of deposit, including demand savings deposit and term savings deposit. Specific terms of deposit are determined by credit institutions;

- Other criteria determined by credit institutions.

Credit institutions specify types of savings deposits in accordance with this Circular and relevant laws and regulations, adequately securing the deposits of depositors and operations of credit institutions. Regulations on types of savings deposits must have at least the following information: interest payment methods, interest calculation methods, deposit term extension, premature withdrawal from savings deposits, and required advance notice upon premature withdrawal from savings deposits.

Also according to Circular No. 48/2018/TT-NHNN, the savings deposit interest rate is specified as follows:

- Each credit institution sets forth regulations on savings deposit interest rate in accordance with regulations of the State Bank of Vietnam on interest rates in every period.

- Savings deposit interest calculation method shall be in accordance with provisions of the State Bank of Vietnam.

- Savings deposit interest payment method shall be made as agreed upon between the credit institution and the depositor.

View relevant provisions at Circular No. 48/2018/TT-NHNN of the State Bank of Vietnam, effective from July 05, 2019.

- Thanh Lam -

- Key word:

- Circular No. 48/2018/TT-NHNN

- Number of deputy directors of departments in Vietnam in accordance with Decree 45/2025/ND-CP

- Cases ineligible for pardon in Vietnam in 2025

- Decree 50/2025 amending Decree 151/2017 on the management of public assets in Vietnam

- Circular 07/2025 amending Circular 02/2022 on the Law on Environmental Protection in Vietnam

- Adjustment to the organizational structure of the Ministry of Health of Vietnam: Certain agencies are no longer listed in the organizational structure

- Vietnam aims to welcome 22-23 million international tourists in Vietnam in 2025

-

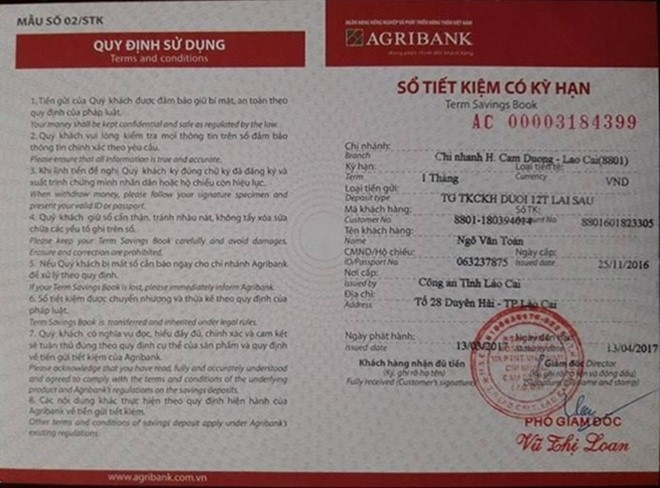

- Vietnam: A passbook must detail the interest rate ...

- 09:25, 21/01/2019

-

- Vietnamese residents may make savings deposits ...

- 09:30, 18/01/2019

-

- Vietnam: Details required on the passbook

- 14:33, 17/01/2019

-

- Vietnam: Savings deposits may be taken and paid ...

- 12:20, 17/01/2019

-

- Vietnam’s new regulations on currencies upon savings ...

- 12:01, 17/01/2019

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

Article table of contents

Article table of contents