To draft a Decree amending the Decree on invoices and records in Vietnam in 2024

Is the General Department of Taxation of Vietnam going to draft a Decree amending the Decree on invoices and records in 2024 ? – Moc Mien (Lam Dong)

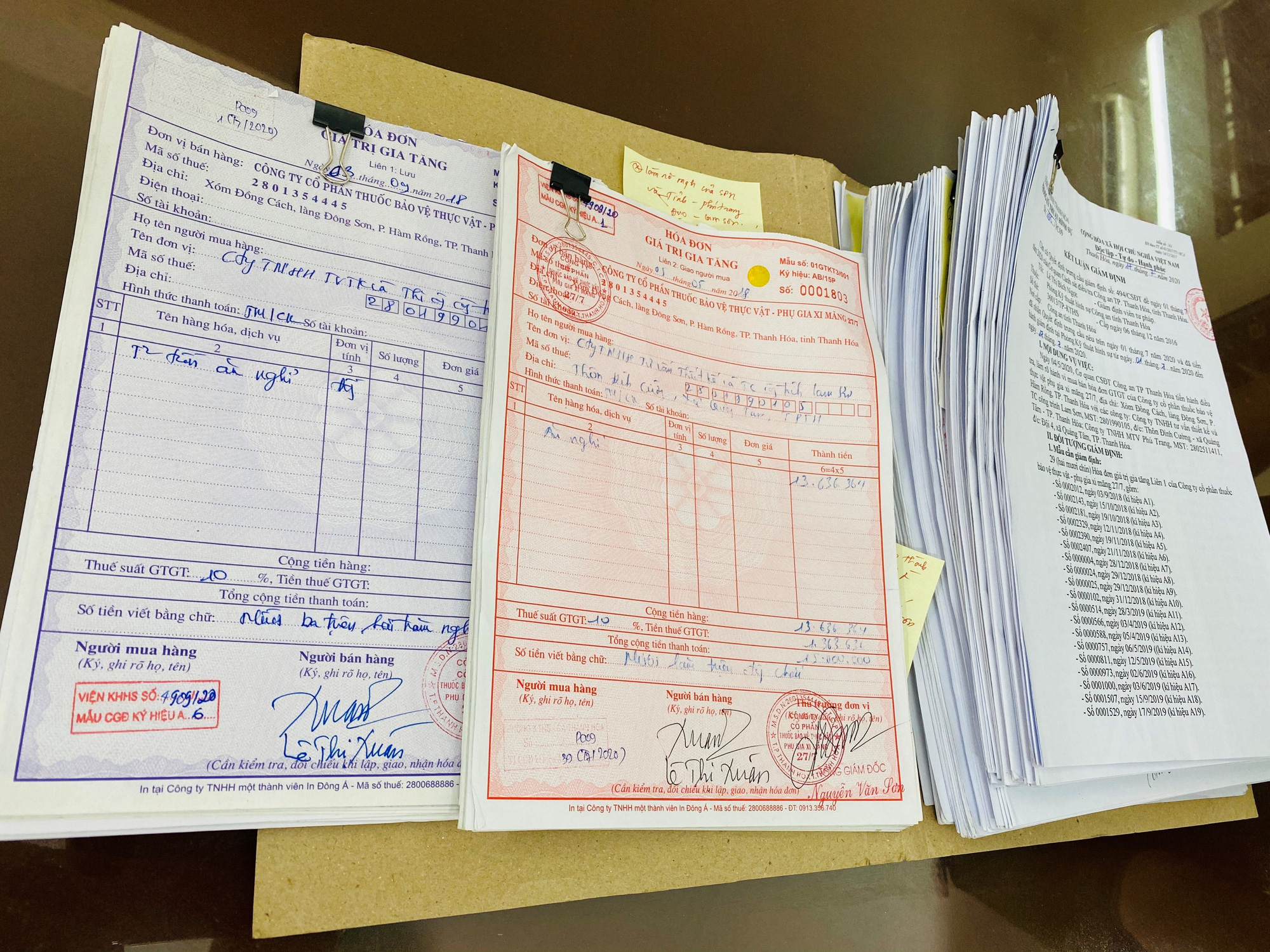

To draft a Decree amending the Decree on invoices and records in Vietnam in 2024 (Internet image)

Regarding this issue, LawNet would like to answer as follows:

Content mentioned in Decision 183/QD-TCT dated February 7, 2024 on Plan for law dissemination and education; legal support for small and medium enterprises in 2024 from the General Department of Taxation.

To draft a Decree amending the Decree on invoices and records in Vietnam in 2024

Specifically, the General Department of Taxation will implement legal support for small and medium-sized enterprises with the following contents:

(1) The Department of Tax Management for small and medium-sized enterprises, business households, individuals, and departments/units under the General Department of Taxation and Tax Departments provide legal support for small and medium-sized enterprises for legal documents on tax, especially documents guiding the newly promulgated Law on Tax Administration related to small and medium-sized enterprises in various forms mentioned in Point 1.3, Section B, Law dissemination and education plan; legal support for small and medium enterprises in 2024 from the General Department of Taxation.

- Implementation time: 2024.

(2) Units in charge of drafting legal documents (Decree amending Decree 132/2020/ND-CP; Decree amending and supplementing Decree 132/2020/ND-CP) coordinate with the Legal Department - Ministry of Finance, and relevant units to determine the subjects, content, form, time, and location of legal support for businesses.

- Implementation time: 2024.

(3) Units under the General Department of Taxation continue to perform tasks as assigned in the Implementation Plan of the Project "Improving the quality and effectiveness of legal support for businesses in the period 2023-2030" under the responsibility of the General Department of Taxation, issued together with Decision 1949/QD-BTC dated September 13, 2023, of the Minister of Finance.

- Implementation time: from 2023 to 2030.

(4) Implement legal propaganda for the small and medium-sized business community through posting on the tax industry's electronic information system and in newspapers, magazines, and mass media, which focuses on propagating new policy proposals that have a great impact on society according to Decision 407/QD-TTg of the Prime Minister approving the project "Policy communication organization with great impact on society in the process of developing legal documents for the period 2022-2027"; reflect comments from people and businesses during the document drafting process.

- Implementation time: From 2024

With the implementation of the above contents, the following purposes and requirements must be ensured:

- Provide full and timely legal information, especially newly promulgated laws and new legal documents on taxes, to tax officials and civil servants, taxpayers, and the social community, meet the need to grasp and understand the legal documents of the implementing subjects; and enforce them effectively.

- Ensure the correct content, form, and method according to the provisions of Decree 55/2019/ND-CP on legal support for small and medium enterprises.

- Stick closely to the Ministry of Finance's 2024 Law Dissemination and Education Plan and the Ministry of Finance's 2024 Legal Support Plan for Small and Medium Enterprises; promote the strengths of the industry-wide tax system; combine propaganda and law dissemination activities with legal support activities for businesses, the completion of legal documents, and other state management activities according to functions.

- Organize focused and effective implementation of this work.

More details can be found in Decision 183/QD-TCT, taking effect on February 7, 204.

- Key word:

- invoices and records

- in Vietnam

- Vietnam

- invoices

- records

- Number of deputy directors of departments in Vietnam in accordance with Decree 45/2025/ND-CP

- Cases ineligible for pardon in Vietnam in 2025

- Decree 50/2025 amending Decree 151/2017 on the management of public assets in Vietnam

- Circular 07/2025 amending Circular 02/2022 on the Law on Environmental Protection in Vietnam

- Adjustment to the organizational structure of the Ministry of Health of Vietnam: Certain agencies are no longer listed in the organizational structure

- Vietnam aims to welcome 22-23 million international tourists in Vietnam in 2025

-

- Number of deputy directors of departments in Vietnam ...

- 15:04, 05/03/2025

-

- Cases ineligible for pardon in Vietnam in 2025

- 14:43, 05/03/2025

-

- Decree 50/2025 amending Decree 151/2017 on the ...

- 12:00, 05/03/2025

-

- Circular 07/2025 amending Circular 02/2022 on ...

- 11:30, 05/03/2025

-

- Adjustment to the organizational structure of ...

- 10:34, 05/03/2025

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

(1).png)

Article table of contents

Article table of contents