Taxes, fees and charges applicable to traders conducting cross-border trade in goods

This is one of the notable contents of Decree No. 14/2018/ND-CP of Vietnam’s Government dated January 23, 2018. So, what exactly are these regulations?

Specifically, according to Article 10 of Decree No. 14/2018/ND-CP of Vietnam’s Government, taxes, fees and charges applicable to traders conducting cross-border trade in goods are prescribed as follows:

Firstly, traders conducting cross-border trade in goods shall pay taxes, fees and charges in full in accordance with regulations of law.

Secondly, VAT on goods traded across the border shall receive incentives in compliance with regulations of law and international agreements to which the Socialist Republic of Vietnam is refundable.

Thirdly, the trader's exported goods for sale or exchange across the border mentioned herein shall have value-added tax (VAT) refunded.

Fourthly, taxes, fees and charges for cross-border trade in goods conducted by traders shall comply with regulations of law.

View relevant provisions at: Decree No. 14/2018/ND-CP of Vietnam’s Government takes effect from January 23, 2018.

- Key word:

- Decree No. 14/2018/ND-CP

- Number of deputy directors of departments in Vietnam in accordance with Decree 45/2025/ND-CP

- Cases ineligible for pardon in Vietnam in 2025

- Decree 50/2025 amending Decree 151/2017 on the management of public assets in Vietnam

- Circular 07/2025 amending Circular 02/2022 on the Law on Environmental Protection in Vietnam

- Adjustment to the organizational structure of the Ministry of Health of Vietnam: Certain agencies are no longer listed in the organizational structure

- Vietnam aims to welcome 22-23 million international tourists in Vietnam in 2025

-

- Vietnam: Customs inspection with respect to import ...

- 09:42, 18/11/2019

-

- Vietnam: New customs procedures applied to import ...

- 09:09, 18/11/2019

-

- Vietnam: Fundamental contents of goods traded ...

- 15:58, 21/05/2018

-

- Vietnam: Entities eligible to trade in goods at ...

- 15:52, 24/03/2018

-

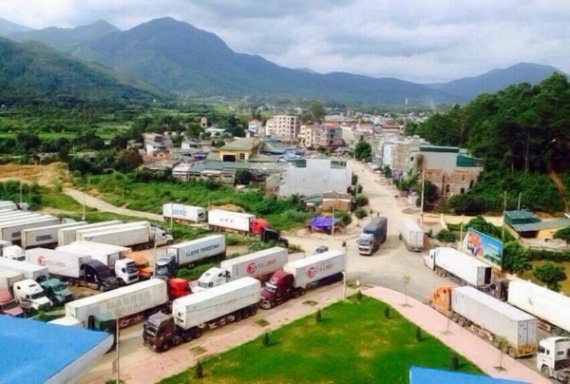

- Vietnam: Cross-border trade in goods by traders

- 15:35, 21/03/2018

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

Article table of contents

Article table of contents