Severance tax-liable objects according to Vietnam’s current regulations

On November 25, 2009, the National Assembly of Vietnam approved the Law on Severance tax 2009, which provides for severance tax-liable objects, severance tax payers, severance tax bases, and severance tax declaration, payment, exemption and reduction.

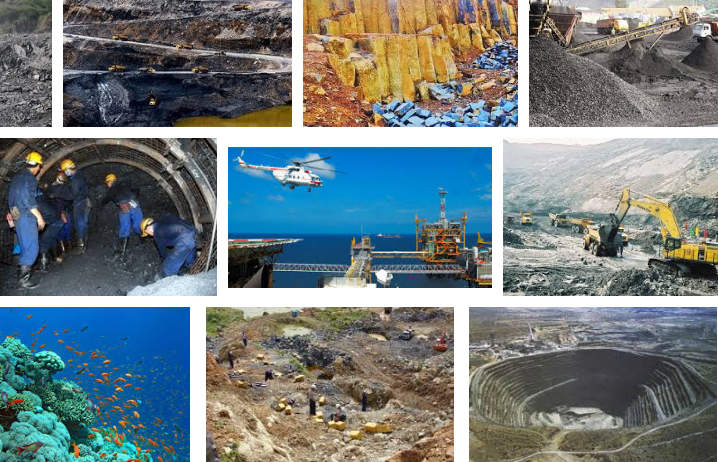

According to Article 2 of the Law on Severance tax 2009 of Vietnam and Article 2 of Circular No. 152/2015/TT-BTC of the Ministry of Finance of Vietnam, the severance tax-liable objects are natural resources within the land, islands, internal waters, territorial sea, contiguous zones, exclusive economic zone, and continental shelves under the sovereignty and jurisdiction of Socialist Republic of Vietnam, including:

One, metallic minerals.

Two, non-metallic minerals.

Three, products of natural forests, including plants and other products of natural forests other than animals, anise, cinnamon, cardamom planted by taxpayers within the area of natural forests they are given to cultivate and protect.

Four, natural aquatic organisms, including marine animals and plants.

Five, natural water, including: surface water and groundwater other than natural water used for agriculture, forestry, aquaculture, salt production, and seawater used for cooling machines.

Six, natural bird’s nests other than those collected from construction of houses to attract and raise natural swifts to collect their nest.

Seven, the Ministry of Finance shall cooperate with relevant Ministries and agencies in reporting other natural resources to the Government.

View more details in Law on Severance tax 2009 of Vietnam effective from July 01, 2010 and Circular No. 152/2015/TT-BTC of the Ministry of Finance of Vietnam effective from November 20, 2015.

- Number of deputy directors of departments in Vietnam in accordance with Decree 45/2025/ND-CP

- Cases ineligible for pardon in Vietnam in 2025

- Decree 50/2025 amending Decree 151/2017 on the management of public assets in Vietnam

- Circular 07/2025 amending Circular 02/2022 on the Law on Environmental Protection in Vietnam

- Adjustment to the organizational structure of the Ministry of Health of Vietnam: Certain agencies are no longer listed in the organizational structure

- Vietnam aims to welcome 22-23 million international tourists in Vietnam in 2025

-

- Vietnam’s frame severance tax tariff

- 10:48, 03/09/2018

-

- Vietnam: Cases of severance tax exemption and ...

- 11:20, 12/12/2017

-

- Vietnam: Severance tax-liable objects and entities ...

- 10:09, 12/12/2016

-

- Law on Severance tax 2009 of Vietnam: Regulations ...

- 11:48, 01/01/2016

-

- Vietnam: 6 cases of severance tax exemption

- 14:29, 18/12/2015

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

Article table of contents

Article table of contents