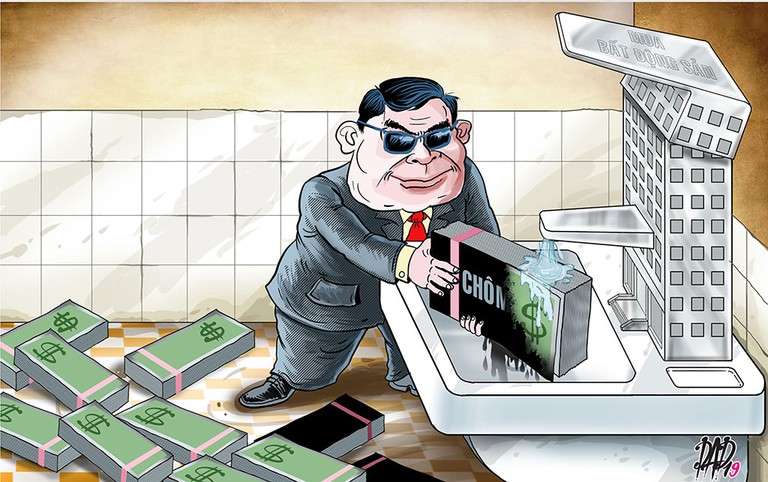

Recognizing 08 suspicious signs related to money laundering in the insurance business in Vietnam

Recently, the National Assembly of Vietnam has officially issued the Law on prevention of money laundering 2012 including 5 Chapters and 50 Articles.

According to Article 37 of the Law on prevention of money laundering 2012 of Vietnam, suspicious signs in the area of insurance business related to money laundering or assets in a transaction of criminal origin include:

1. Client requires to purchase an insurance contract of great value or requires the package payment of the single premium for insurance products that do not apply the package payment, while the current insurance contracts of the client only have small value and periodic payments;

2. The client requires to sign insurance contracts with periodic premiums inconsistent with current income of the client or requires to purchase the insurance contracts related to the business outside the normal business activities of the client;

3. The buyer of insurance contract and makes payment from the account that is not his account or by the instrument of transfer without name recorded;

4. The client requests to change the beneficiary appointed or by the person who has unclear relationship with the buyer of insurance contracts;

5. The client accepts all unfavorable conditions not related to his age and health; client requires to buy insurance with no clear purpose and reluctantly provides the reason to participate in insurance; the conditions and value of insurance contracts are contrary to the client’s needs;

6. The client cancels the insurance contract right after and asks for a transfer of money to a third party; the client regularly participates in insurance and assign the insurance contract to a third party;

7. The client is an enterprise having a number of insurance contracts for employees or the premium of the single-premium contract abnormally increases;

8. The insurance enterprise often pays the premium with a large amount to the same customer.

The reporting subject has the responsibility to report to the State Bank of Vietnam when there are doubts or reasonable grounds to suspect that the assets in the transaction are of criminal origin with or related to money laundering. Suspicious transaction reports are made according to the form prescribed by the State Bank of Vietnam.

View more details at the Law on prevention of money laundering 2012 of Vietnam, effective on January 01, 2013.

Ty Na

- Number of deputy directors of departments in Vietnam in accordance with Decree 45/2025/ND-CP

- Cases ineligible for pardon in Vietnam in 2025

- Decree 50/2025 amending Decree 151/2017 on the management of public assets in Vietnam

- Circular 07/2025 amending Circular 02/2022 on the Law on Environmental Protection in Vietnam

- Adjustment to the organizational structure of the Ministry of Health of Vietnam: Certain agencies are no longer listed in the organizational structure

- Vietnam aims to welcome 22-23 million international tourists in Vietnam in 2025

-

- Vietnam: Clients identification information must ...

- 17:40, 25/06/2012

-

- How are Vietnam’s regulation on foreign Clients ...

- 17:40, 25/06/2012

-

- 05 operations of organizations doing business ...

- 17:35, 25/06/2012

-

- Responsibilities of the State Bank of Vietnam ...

- 10:30, 25/06/2012

-

- Application of provisional measures on prevention ...

- 09:50, 25/06/2012

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

Article table of contents

Article table of contents