Processing documents to ensure support for the full-process vehicle registration public service in Vietnam

The article below will provide content on processing documents to ensure support for the full-process vehicle registration public service in Vietnam

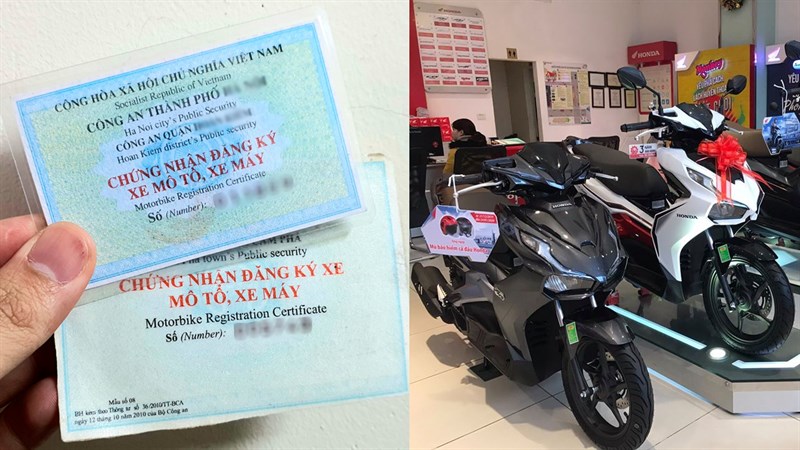

Processing documents to ensure support for the full-process vehicle registration public service in Vietnam (Image from the internet)

On July 30, 2024, the General Director of the General Department of Taxation issued Official Dispatch 3349/TCT-DNNCN to implement the processing of documents ensuring support for the full-process vehicle registration public service.

Processing documents to ensure support for the full-process vehicle registration public service in Vietnam

Aiming to meet the requirements set forth in state management and ensure the effectiveness of online public services of Ministries, sectors, the General Department of Taxation of Vietnam requests the Tax Departments of provinces and centrally-affiliated cities in Vietnam to implement and direct departments and Tax Sub-Departments to continue to uniformly implement the following solutions:

(1) Strictly implement policies and regulations on registration fees and tax management in the process of receiving and processing registration fee declaration documents of taxpayers; To be specific:

- Assign the department handling document reception and processing at the Tax Sub-Department to assist taxpayers in accurately declaring items on the Declaration Form 02/LPTB as per the guidelines in Appendix II issued with Circular 80/2021/TT-BTC dated September 29, 2021. Simultaneously, standardize the data entry of declaration forms on the QLTB-ND application for documents submitted directly at the tax authority; ensure accurate identification of vehicle type information based on registration documents issued by the registration authority as per the guidelines in Appendix II issued with Circular 80/2021/TT-BTC dated September 29, 2021.

- Further promote the implementation of declaring and paying registration fees electronically following the implementation notices No. 691/TCT-DNNCN dated March 13, 2023, and 3027/TCT-DNNCN dated July 29, 2020, of the General Department of Taxation.

- The General Department of Taxation upgrades the QLTB-ND application and the General Department of Taxation’s Electronic Information Portal (TCT’s Portal) to support checking electronic invoice information declared by taxpayers on declaration form 02/LPTB. From August 1, 2024, the application system will transmit additional electronic invoice information along with the electronic data for registration fee payment as implemented according to Notice No. 3027/TCT-DNNCN dated July 29, 2020, to support vehicle registration authorities in carrying out the full-process public service “Registering and issuing first-time vehicle registration plates.”

To continue ensuring the exchange of data and coordinate administrative procedures between tax authorities and vehicle registration authorities, during the receipt and processing of vehicle registration fee declaration documents for cars and motorcycles, the document processing department at the Tax Sub-Department should guide taxpayers based on actual documents to declare information and accurately input items on declaration form 02/LPTB on the application, including: Invoice form number, Invoice symbol, Invoice number, and Tax code of the transferring organization or individual (note certain contents in Appendix 01 attached to this document).

The registration fee declaration document processing department at the Tax Sub-Department is responsible for ensuring the confidentiality of taxpayer information when receiving and processing documents conforming to tax management laws.

(2) Tax Departments and Tax Sub-Departments shall propagate and notify organizations, enterprises, and household businesses that have auto and motorcycle dealership activities within their management area to continue complying with the provisions of Decree 123/2020/ND-CP of the Government of Vietnam stipulating invoices and documents; especially noting the invoice must contain complete information according to Article 10 of Decree 123/2020/ND-CP. In the management process, if any organization or enterprise is found violating provisions related to invoices and documents, the tax authorities at all levels shall handle them according to the legal provisions.

(3) Proactively cooperate with branches and transaction points of commercial banks, and branches of the State Treasury in the area to fully and promptly record and account electronic data of receipts into the state budget of taxpayers, ensuring the automatic transmission and receipt of registration fee payment data for vehicle registration authorities to exploit data for related administrative procedures.

(4) Actively deploy and build solutions to support taxpayers during the process of declaring and paying registration fees for cars and motorcycles in the area; propagate the regulations on policies and tax management, ensuring that people and enterprises fully understand, enabling taxpayers to fulfill their obligations to the state budget during the process of registering ownership rights and asset use.

During the implementation, all inquiries should be directed to the contact points:

- Business support: Mr. Le An, email address: [email protected], phone number: 024.39.712.555 (ext: 4210);

- Technical support:

+ Support for implementation from August 1 to August 31, 2024: Mr. Vu Viet An, email address: [email protected], phone number: 024.37.689.679 (ext: 6115)

+ Support for implementation from September 1, 2024: The Tax Department accesses the support request management system (service desk) (https://hotro.gdt.gov.vn) or contacts the support department via email Local support application group: [email protected].

More details can be found in Official Dispatch 3349/TCT-DNNCN dated July 30, 2024.

- Key word:

- public service

- Number of deputy directors of departments in Vietnam in accordance with Decree 45/2025/ND-CP

- Cases ineligible for pardon in Vietnam in 2025

- Decree 50/2025 amending Decree 151/2017 on the management of public assets in Vietnam

- Circular 07/2025 amending Circular 02/2022 on the Law on Environmental Protection in Vietnam

- Adjustment to the organizational structure of the Ministry of Health of Vietnam: Certain agencies are no longer listed in the organizational structure

- Vietnam aims to welcome 22-23 million international tourists in Vietnam in 2025

-

- In 2025, aiming to provide public services without ...

- 15:30, 06/02/2025

-

- Methods for determining the cost of public service ...

- 18:13, 24/12/2024

-

- Procedures for creating specialized digital signatures ...

- 11:30, 21/12/2024

-

- Procedures for revoking certificates of digital ...

- 11:00, 21/12/2024

-

- Guidelines for evaluating public services for ...

- 11:00, 02/08/2024

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

Article table of contents

Article table of contents