Law on Severance tax 2009 of Vietnam: Regulations on taxpayers

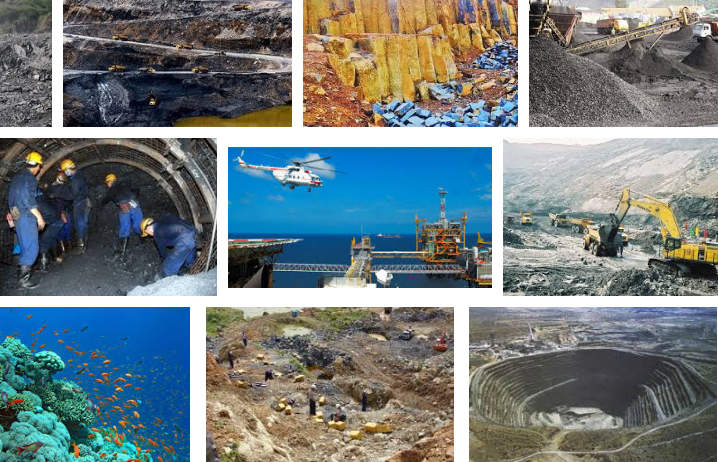

According to Vietnam’s regulations, severance tax payers include organizations and individuals that exploit severance tax-liable natural resources.

According to Article 3 of the Law on Severance tax 2009 of Vietnam and Article 3 of Circular No. 152/2015/TT-BTC of the Ministry of Finance of Vietnam, in some particular cases, severance tax payers shall be defined as follows:

Firstly, for mineral extraction, taxpayers are the organizations and business households granted the License for mineral extraction by competent authorities.

In case an organization is granted the license for mineral extraction and permitted to cooperate with other organizations and individuals extracting natural resources, and there are separate regulations on taxpayers, the taxpayers shall be identified according to such regulations.

In case an organization is granted the license for mineral extraction and then delegates its affiliates to carry out mineral extraction, each affiliate is a taxpayer.

Secondly, if a joint venture is established among resource-extracting enterprises, the joint venture is the taxpayer;

In case a Vietnamese party and a foreign party participate in the same contract for cooperation in resource extraction, the obligation to pay tax of each party must be specified in the contract. Otherwise, all parties must declare and pay severance tax or appoint a representative to pay severance tax.

Thirdly, in case an entity is awarded a construction contract and extracts a certain amount of natural resources that is permitted by the authorities, or the extraction/use of such natural resources is not contrary to regulations of law on resource extraction, such entity must declare and pay severance tax to the local tax authority in the area where natural resources are extracted.

Fourthly, every entity using water from irrigation works for power generation is taxpayer, regardless of sources of capital for the irrigation works.

In case the organization managing the irrigation work supplies water for other entities to produce clean water or water for other purposes (other than power generation), the organization managing the irrigation work supplies water is the taxpayer.

Fifthly, in case natural resources that are banned from extraction or illegally extracted are confiscated, subject to severance tax, and permitted to be sold, the organization assigned to sell such natural resources shall pay severance tax whenever it is incurred to its supervisory tax authority before retaining the cost of arrest, auction, reward.

- Number of deputy directors of departments in Vietnam in accordance with Decree 45/2025/ND-CP

- Cases ineligible for pardon in Vietnam in 2025

- Decree 50/2025 amending Decree 151/2017 on the management of public assets in Vietnam

- Circular 07/2025 amending Circular 02/2022 on the Law on Environmental Protection in Vietnam

- Adjustment to the organizational structure of the Ministry of Health of Vietnam: Certain agencies are no longer listed in the organizational structure

- Vietnam aims to welcome 22-23 million international tourists in Vietnam in 2025

-

- Vietnam’s frame severance tax tariff

- 10:48, 03/09/2018

-

- Vietnam: Cases of severance tax exemption and ...

- 11:20, 12/12/2017

-

- Vietnam: Severance tax-liable objects and entities ...

- 10:09, 12/12/2016

-

- Severance tax-liable objects according to Vietnam ...

- 11:35, 07/07/2016

-

- Vietnam: 6 cases of severance tax exemption

- 14:29, 18/12/2015

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

Article table of contents

Article table of contents