Latest procedures for settlement of unemployment allowances in Vietnam

What are the latest procedures for settlement of unemployment allowances in Vietnam? - Thao Linh (Nghe An)

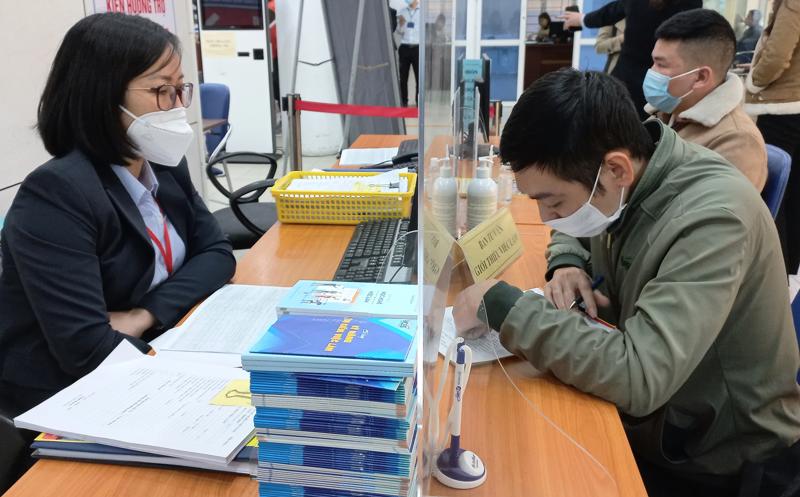

Latest procedures for settlement of unemployment allowances in Vietnam (Internet image)

Regarding this matter, LawNet would like to answer as follows:

On March 29, 2024, the Minister of Labor, War Invalids, and Social Affairs issued Decision 351/QD-BLDTBXH announcing amended employment-related administrative procedures under the Ministry of Labor, War Invalids, and Social Affairs.

Latest procedures for settlement of unemployment allowances in Vietnam

The administrative procedures for "settlement of unemployment allowances"in Vietnam are as follows:

- Step 1: Within a period of 03 months from the termination date of the employment contract or work contract, if the employees are unemployed and in need of receiving unemployment allowances, they must directly submit a set of documents requesting unemployment allowances to the local employment service center where the employees wish to receive the allowances.

The employees may authorize someone else to submit the documents or send them by mail in the following cases:

+ Illness, maternity leave with confirmation from a qualified healthcare facility;

+ Accidents with confirmation from traffic police or a qualified healthcare facility;

+ Fire, flood, earthquake, tsunami, disaster, epidemic, with confirmation from the Chairman of the People's Committee of the commune, ward, or town.

The date of submitting the application for unemployment allowances in the above cases is the date when the authorized person directly submits the documents or the date indicated on the postal stamp for mailed applications.

Within 15 working days from the date of submitting the application for unemployment allowances, if the employees do not wish to receive the allowances, they must directly submit or authorize someone else to submit a request to waive the allowances according to Form 08 issued together with Circular 15/2023/TT-BLDTBXH to the local employment service center where they have submitted the application for unemployment allowances.

- Step 2: The employment service center is responsible for receiving, checking, issuing a receipt for the result according to Form 01 issued together with Decree 61/2020/ND-CP, and giving the receipt to the applicant. In the event that the documents are incomplete as per regulations, they shall be returned to the applicant with a clear explanation.

- Step 3: Within 20 working days from the date of receiving the complete documents as per regulations, the employment service center is responsible for reviewing and submitting to the Director of the Department of Labor - Invalids and Social Affairs for a decision on the entitlement to unemployment allowances for the employees according to Form 05 issued together with Circular 15/2023/TT-BLDTBXH.

In case the employees do not meet the eligibility criteria for receiving unemployment allowances, they must be notified in writing.

- Step 4: Within 03 working days, as stated in the receipt for the result, the employees must come to receive the decision on their entitlement to unemployment allowances.

If the employees do not come to receive the decision or authorize someone else to receive it and do not inform the job service center of the reason for not being able to receive it, they will be considered not wanting to receive unemployment benefits.

Within 02 working days from the expiration date of receiving the decision as per the appointment, the employment service center shall submit to the Director of the Department of Labor—Invalids and Social Affairs a decision to cancel the entitlement to unemployment allowances for the employees according to Form 02 issued together with Decree 61/2020/ND-CP.

The decision to cancel the entitlement to unemployment allowances shall be sent by the employment service center: 01 copy to the provincial social insurance agency to cease the payment of unemployment allowances for the employees; 01 copy to the employees.

After a period of 03 months from the expiration date of entitlement to unemployment allowances, according to the decision, if the employees do not come to receive the unemployment allowances or do not inform the social insurance organization in writing, they will be considered not needing to receive unemployment benefits.

Within 07 working days from the expiration date mentioned above, the social insurance organization must notify the employment service center in writing about the employees' failure to receive the unemployment allowances according to Form 14 issued together with Circular 15/2023/TT-BLDTBXH.

Within 10 working days from the date of receiving the notification from the social insurance organization, the job service center is responsible for reviewing and submitting to the Director of the Department of Labor—Invalids and Social Affairs a decision on preserving the unemployment insurance contribution period for the employees according to Form 15 issued together with Circular 15/2023/TT-BLDTBXH.

The decision on leave of absence of the unemployment insurance contribution period shall be sent by the employment service center: 01 copy to the provincial social insurance agency to implement the preservation of the unemployment insurance contribution period for the employees; 01 copy to the employees. The decision on preserving the unemployment insurance contribution period shall be implemented according to the template prescribed by the Minister of Labor—Invalids and Social Affairs.

Conditions for implementing procedures for the settlement of unemployment allowances in Vietnam

- Employees who are participating in unemployment insurance when working under an employment contract or work contract as follows:

+ Indefinite-term employment contract or work contract;

+ Fixed-term employment contract or work contract;

+ Seasonal employment contract or employment contract for a specific job with a duration of at least 3 months and less than 12 months.

In cases where the employees conclude and are performing multiple employment contracts as specified above, the employee and the employer of the first labor contract entered into are responsible for participating in unemployment insurance.

- Termination of the employment contract or work contract, except for the following cases:

+ The employees unilaterally terminate the employment contract or work contract in violation of the law;

+ Receiving retirement benefits, monthly labor capacity loss allowances.

- Having paid unemployment insurance for at least 12 months within the 24 months prior to the termination of the labor contract or work contract for cases specified in point a and point b, clause 1 of Article 43 of the Labor Code 2013; having paid unemployment insurance for at least 12 months within the 36 months prior to the termination of the employment contract for cases specified in point c, clause 1 of Article 43 of the Labor Code 2013.

Nguyen Ngoc Que Anh

- Key word:

- unemployment allowances

- in Vietnam

- Vietnam

- Number of deputy directors of departments in Vietnam in accordance with Decree 45/2025/ND-CP

- Cases ineligible for pardon in Vietnam in 2025

- Decree 50/2025 amending Decree 151/2017 on the management of public assets in Vietnam

- Circular 07/2025 amending Circular 02/2022 on the Law on Environmental Protection in Vietnam

- Adjustment to the organizational structure of the Ministry of Health of Vietnam: Certain agencies are no longer listed in the organizational structure

- Vietnam aims to welcome 22-23 million international tourists in Vietnam in 2025

-

- Number of deputy directors of departments in Vietnam ...

- 15:04, 05/03/2025

-

- Cases ineligible for pardon in Vietnam in 2025

- 14:43, 05/03/2025

-

- Decree 50/2025 amending Decree 151/2017 on the ...

- 12:00, 05/03/2025

-

- Circular 07/2025 amending Circular 02/2022 on ...

- 11:30, 05/03/2025

-

- Adjustment to the organizational structure of ...

- 10:34, 05/03/2025

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

Article table of contents

Article table of contents