Interest rates for borrowing credit capital for clean water and rural sanitation in Vietnam from September 2, 2024

From September 2, 2024, the interest rates for borrowing credit capital for clean water and rural sanitation in Vietnam will change.

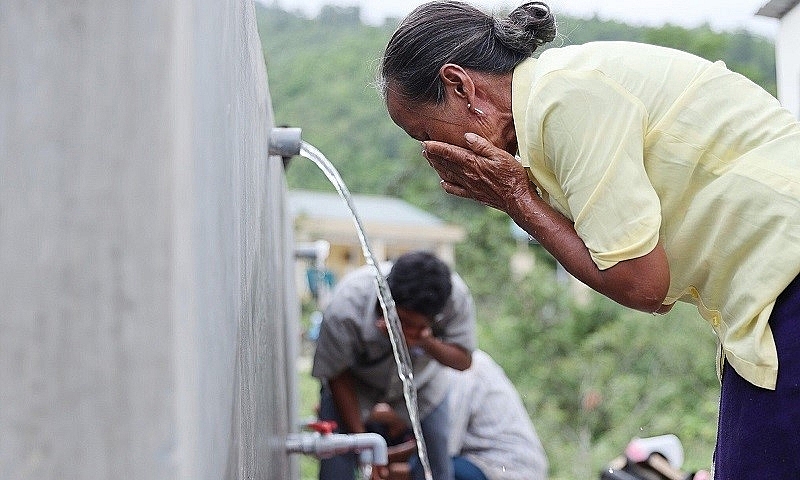

Interest rates for borrowing credit capital for clean water and rural sanitation in Vietnam from September 2, 2024 (Image from Internet)

On July 15, 2024, the Prime Minister of Vietnam issued Decision 10/2024/QD-TTg on credit for clean water and rural sanitation in Vietnam.

Subjects and conditions for borrowing credit capital for clean water and rural sanitation in Vietnam

According to Article 4 of Decision 10/2024/QD-TTg, the subjects eligible for clean water and rural sanitation credit loans are households residing in rural areas where they are registered for permanent or temporary residence (hereinafter referred to as customers).

To be eligible for clean water and rural sanitation credit loans from September 2, 2024, customers residing in the locality must be in rural areas without water supply works, household sanitation works, or have these works but need reconstruction, upgrading, renovation, or repair due to damage.

Loan amount and term for credit capital for clean water and rural sanitation in Vietnam

According to the regulation, the maximum loan amount for clean water and rural sanitation credit is 25 million VND per type of work per customer.

Customers can borrow for new investment, upgrading, renovation, or repair of 2 types of household water and sanitation works, but the total outstanding loan for each type of work must not exceed the maximum loan amount for each type.

Regarding the loan term: The term for clean water and rural sanitation credit loans will be agreed upon by the Social Policy Bank and the customer, but it is capped at 5 years (60 months).

(Article 6 and Article 8 of Decision 10/2024/QD-TTg)

Interest rates for borrowing credit capital for clean water and rural sanitation in Vietnam from September 2, 2024

To be specific: In Article 9 of Decision 10/2024/QD-TTg specifies the loan interest rates for clean water and rural sanitation credit as follows:

- The loan interest rate for clean water and rural sanitation credit from September 2, 2024, is 9.0% per year.- The overdue loan interest rate is 130% of the clean water and rural sanitation credit loan interest rate.

Implementation of borrowing credit capital for clean water and rural sanitation in Vietnam

Regarding the implementation of clean water and rural sanitation credit loans, Decision 10/2024/QD-TTg stipulates as follows:

- Customers borrowing loans are responsible for using the loan for the right purpose and repaying the loan fully and on time to the Social Policy Bank

.- The Ministry of Agriculture and Rural Development will preside, cooperate with the Social Policy Bank, and relevant agencies in organizing, implementing, and reporting to the Prime Minister of the Government of Vietnam on the implementation results of this Decision; propose solutions to arising issues and obstacles during the implementation and amendment, supplementation of this Decision (if necessary)

.- The People's Committees of provinces and centrally-run cities:

+ Annually, consider allocating local budget funds entrusted through the Social Policy Bank for loans according to legal regulations;

+ Direct relevant departments, agencies, and units to submit to competent authorities for approval and allocation of annual local budget entrusted through the Social Policy Bank for loans;

+ Direct the People's Committees of communes to confirm the subjects and conditions for policy beneficiaries stipulated in Article 4 of Decision 10/2024/QD-TTg;

+ Coordinate with the Vietnam Fatherland Front, political-social organizations, and the Social Policy Bank to propagate policies; organize and supervise the implementation of this Decision.

- The Social Policy Bank:+ Guide the contents stipulated in Article 13 of Decision 10/2024/QD-TTg;

+ Manage, mobilize, and use loan funds; supervise the borrowing, using, and repayment of loans by customers to ensure loans are used for the right purpose and effectively according to the provisions of this Decision;

+ Coordinate with ministries and central authorities, report to competent authorities to promptly address difficulties and obstacles in the loan process according to Decision 10/2024/QD-TTg;

+ Coordinate with the Vietnam Fatherland Front, political-social organizations to propagate policies, organize, and implement according to the regulations in Decision 10/2024/QD-TTg.

- Ministries, ministerial-level agencies, and government agencies according to their functions, tasks, and powers are responsible for cooperating with the Ministry of Agriculture and Rural Development and the Social Policy Bank in organizing the implementation of Decision 10/2024/QD-TTg.

More details can be found in Decision 10/2024/QD-TTg which comes into force in Vietnam from September 2, 2024.

- Number of deputy directors of departments in Vietnam in accordance with Decree 45/2025/ND-CP

- Cases ineligible for pardon in Vietnam in 2025

- Decree 50/2025 amending Decree 151/2017 on the management of public assets in Vietnam

- Circular 07/2025 amending Circular 02/2022 on the Law on Environmental Protection in Vietnam

- Adjustment to the organizational structure of the Ministry of Health of Vietnam: Certain agencies are no longer listed in the organizational structure

- Vietnam aims to welcome 22-23 million international tourists in Vietnam in 2025

-

- Number of deputy directors of departments in Vietnam ...

- 15:04, 05/03/2025

-

- Cases ineligible for pardon in Vietnam in 2025

- 14:43, 05/03/2025

-

- Decree 50/2025 amending Decree 151/2017 on the ...

- 12:00, 05/03/2025

-

- Circular 07/2025 amending Circular 02/2022 on ...

- 11:30, 05/03/2025

-

- Adjustment to the organizational structure of ...

- 10:34, 05/03/2025

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

(1).png)

Article table of contents

Article table of contents