How to Handle the Loss of Invoices by Parties and Corresponding Penalties

Recently, Thu Ky Luat has received quite a few inquiries from our Valued Customers and Members regarding the handling of lost invoices by either the seller or the buyer. Thu Ky Luat would like to clarify this issue in the following article.

According to the provisions at Article 24 Circular 39/2014/TT-BTC, organizations, households, and individuals engaged in business, upon discovering a loss, fire, or damage to issued or yet-to-be issued invoices, must file a report using a prescribed form regarding the lost, burnt, or damaged invoice and notify the directly managing tax authority no later than 5 days from the date of the incident.

If the fifth day coincides with an official holiday, the final day of the deadline shall be considered the subsequent day following the holiday.

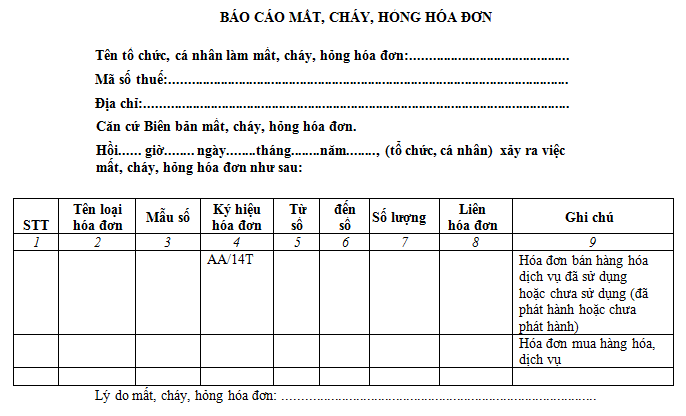

Photo of a portion of the Invoice Loss Report Form

Invoice Loss, Fire, Damage Report Form

Invoice Loss, Fire, Damage Report Form

In the case where the seller has issued an invoice for goods or services, but either the seller or the buyer subsequently loses, burns, or damages the original second copy of the issued invoice, the following measures shall be taken:

- The seller and the buyer shall make a written record of the incident, specifying in the record which period the seller declared and paid taxes on copy 1 of the invoice, signing and clearly stating the full name of the legal representative (or authorized person), and affixing the seal (if any).

- The seller shall photocopy copy 1 of the invoice, have it signed by the legal representative, and affix the seal on the invoice's copy to deliver to the buyer.

- The buyer may use the signed and sealed (if any) copy of the invoice, along with the written record of the lost, burnt, or damaged second copy of the invoice as accounting and tax declaration evidence. The seller and the buyer shall be responsible for the accuracy of the reported loss, burn, or damage of the invoice.

Note: In cases where the loss, fire, or damage of the second copy of the invoice involves a third party (e.g., a third-party transporter or invoice carrier), responsibility and penalties for the seller or buyer shall be determined based on the third party hired by the seller or buyer.

Penalty Levels for Lost VAT Invoices

If lost by the seller:

According to Clause 4 Article 3 Decree 49/2016/ND-CP, Clause 4 Article 1 Circular 176/2016/TT-BTC, if the seller loses, burns, or damages issued but yet-to-be-made or issued invoices (second copy handed over to the customer) where the customer has not yet received the invoice, during storage time or invoices have been issued based on retail sales and services, they shall be fined from VND 4,000,000 to VND 8,000,000.

When determining the fine, note:

- In cases of loss, fire, or damage to invoices due to natural disasters, fires, or unexpected, unavoidable events, no monetary fines shall be imposed.

- For loss, fire, or damaged issued invoices (second copy), the seller and buyer shall make a written record, the seller has declared and paid taxes, has contracts, documents proving the transaction of goods or services, and has mitigating circumstances, the minimum fine in the penalty framework shall be imposed; if there are two mitigating circumstances, only a warning shall be given.

- Loss, fire, or damaged invoices, excluding those handed over to the customer within the storage period, will be fined according to accounting law, specifically, under Point c Clause 1 Article 12 Decree 105/2013/ND-CP, fines range from VND 500,000 to VND 1,000,000.

- If the seller finds the lost invoice (second copy) before the tax authority issues a penalty decision, the seller shall not be fined.

- For missing, burnt, or damaged invoices, which have been erroneously issued and canceled (the seller has issued another invoice to replace the erroneous one), the seller shall only receive a warning.

- When the organization or individual reports many missing invoices to the tax authority at once, but the tax authority has adequate grounds to determine the organization or individual accumulated multiple missing invoices to report at once, each lost invoice case shall be penalized separately.

- In cases where the missing, burnt, or damaged issued invoices (second copy handed to customers) involve a third party hired by the seller, the seller shall be penalized according to the above stipulations.

If lost by the buyer:

According to Clause 1 Article 39 Decree 109/2013/ND-CP, Clause 6 Article 3 Decree 49/2016/ND-CP, Clause 1 Article 12 Circular 10/2014/TT-BTC, Clause 6 Article 1 Circular 176/2016/TT-BTC, if the buyer loses, burns, or damages the issued invoice (second copy handed to them) for accounting, tax declaration, and budget payment, they shall be fined from VND 4,000,000 to VND 8,000,000.

When determining the fine, note:

- In cases of loss, fire, or damage to invoices due to natural disasters, fires, or unexpected, unavoidable events, the buyer shall not be fined.

- For loss, fire, or damaged issued invoices (second copy), the seller and buyer shall make a written record, the seller has declared and paid taxes, has contracts, documents proving the transaction of goods or services, and has mitigating circumstances, the minimum fine in the penalty framework shall be imposed; if there are two mitigating circumstances, only a warning shall be given.

- If the buyer finds the lost invoice and reports back to the tax authority before the tax authority issues a penalty decision, the buyer shall not be fined.

- When the organization or individual reports many missing invoices to the tax authority at once, but the tax authority has adequate grounds to determine the organization or individual accumulated multiple missing invoices to report at once, each lost invoice case shall be penalized separately.

- In cases where the missing, burnt, or damaged issued invoices (second copy handed to customers) involve a third party hired by the buyer, the buyer shall be penalized according to the above stipulations.

- For missing, burnt, or damaged invoices (second copy handed to customers) within the storage period, fines range from VND 500,000 to VND 1,000,000.

Note: According to Clause 7 Article 3 Circular 10/2014/TT-BTC, if one person commits multiple administrative violations regarding invoices or repeats administrative invoice violations, each act shall be penalized, meaning fines shall be imposed for each invoice loss instance, not per the quantity of lost invoices.

- Nguyen Trinh -

- Number of deputy directors of departments in Vietnam in accordance with Decree 45/2025/ND-CP

- Cases ineligible for pardon in Vietnam in 2025

- Decree 50/2025 amending Decree 151/2017 on the management of public assets in Vietnam

- Circular 07/2025 amending Circular 02/2022 on the Law on Environmental Protection in Vietnam

- Adjustment to the organizational structure of the Ministry of Health of Vietnam: Certain agencies are no longer listed in the organizational structure

- Vietnam aims to welcome 22-23 million international tourists in Vietnam in 2025

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

Article table of contents

Article table of contents