Health insurance contribution rates and health insurance contribution responsibilities in Vietnam

The content of the article presents the current regulations on health insurance contribution rates and health insurance contribution responsibilities in Vietnam

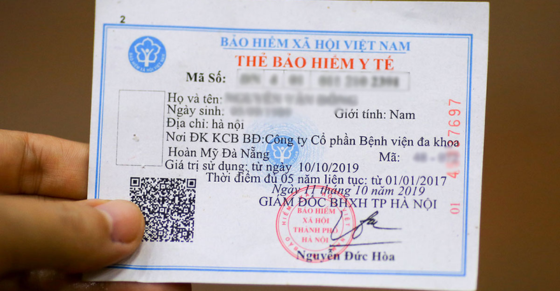

Health insurance contribution rates and health insurance contribution responsibilities in Vietnam (Image from the Internet)

1. Health insurance contribution rates and health insurance contribution responsibilities in Vietnam

Article 7 Decree 146/2018/ND-CP stipulates the health insurance contribution rates and health insurance contribution responsibilities in Vietnam as follows:

- The monthly health insurance premiums for various insured persons are stipulated as follows:

+ Equivalent to 4.5% of the monthly salary of employees for those specified in Clause 1, Article 1 Decree 146/2018/ND-CP.

++ Employees on sick leave for 14 days or more per month as per social insurance regulations are exempt from paying health insurance premiums but still enjoy health insurance benefits;

++ Employees under temporary detention, custody, or suspended from work for investigation purposes, pending a conclusion on whether or not they violated the law, will pay a monthly contribution equivalent to 4.5% of 50% of their monthly salary. If the competent authority concludes no violation of the law, employees must pay back health insurance on the amount of salary received retroactively;

+ Equivalent to 4.5% of the pension, work loss allowance for those specified in Clause 1, Article 2 Decree 146/2018/ND-CP;

+ Equivalent to 4.5% of the monthly salary of employees prior to maternity leave for those specified in Clause 5, Article 2 Decree 146/2018/ND-CP;

+ Equivalent to 4.5% of the unemployment allowance for those specified in Clause 6, Article 2 Decree 146/2018/ND-CP;

+ Equivalent to 4.5% of the statutory pay rate for other persons;

+ The health insurance premium rate for those specified in Article 5 Decree 146/2018/ND-CP is as follows: First member pays 4.5% of the statutory pay rate; the second, third, and fourth members each pay 70%, 60%, and 50% respectively of the first member's premium; from the fifth member onward, each pays 40% of the first member's premium.

The reduction in health insurance premiums as per this provision applies when all family members participate in health insurance within the same fiscal year.

- For persons whose premium is subsidized by the state budget, the reduction in premium per point e, Clause 1, Article 7 Decree 146/2018/ND-CP does not apply.

- For those specified in Clause 1, Article 1 Decree 146/2018/ND-CP with one or more indefinite-term labor contracts or fixed-term labor contracts of three months or longer, health insurance shall be paid according to the contract with the highest salary.

- For persons participating in health insurance per Article 6 Decree 146/2018/ND-CP who are simultaneously eligible under different categories specified in Articles 1, 2, 3, and 4 Decree 146/2018/ND-CP, health insurance contributions are prioritized as follows: contributions paid by employees and employers; contributions paid by the social insurance agency; contributions paid by the state budget; contributions paid by employers.

- The Ministry of Health (Hanoi, Vietnam), in cooperation with the Ministry of Finance, shall propose to the Government of Vietnam adjustments to health insurance premiums to ensure the balance of the health insurance fund, in line with the state budget capability and the contribution capability of insured persons as stipulated in the Health Insurance Law 2008.

2. Group of health insurance policyholders whose contributions are paid by the state budget in Vietnam

Article 2 Decree 146/2018/ND-CP stipulates the group of health insurance policyholders whose contributions are paid by the state budget in Vietnam, including:

- Persons receiving monthly pensions and work loss allowances.

- Persons receiving monthly social insurance benefits due to occupational accidents or diseases; rubber workers receiving monthly allowances as stipulated by the Government of Vietnam.

- Employees on long-term sick leave due to a disease listed by the Ministry of Health.

- Retired commune, ward, and commune-level town officials receiving monthly social insurance benefits.

- Employees on maternity leave receiving allowances for childbirth or adopting a child.

- Persons receiving unemployment benefits.

To Quoc Trinh

- Key word:

- Health Insurance

- Vietnam

- Number of deputy directors of departments in Vietnam in accordance with Decree 45/2025/ND-CP

- Cases ineligible for pardon in Vietnam in 2025

- Decree 50/2025 amending Decree 151/2017 on the management of public assets in Vietnam

- Circular 07/2025 amending Circular 02/2022 on the Law on Environmental Protection in Vietnam

- Adjustment to the organizational structure of the Ministry of Health of Vietnam: Certain agencies are no longer listed in the organizational structure

- Vietnam aims to welcome 22-23 million international tourists in Vietnam in 2025

-

- Number of deputy directors of departments in Vietnam ...

- 15:04, 05/03/2025

-

- Cases ineligible for pardon in Vietnam in 2025

- 14:43, 05/03/2025

-

- Decree 50/2025 amending Decree 151/2017 on the ...

- 12:00, 05/03/2025

-

- Circular 07/2025 amending Circular 02/2022 on ...

- 11:30, 05/03/2025

-

- Adjustment to the organizational structure of ...

- 10:34, 05/03/2025

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

Article table of contents

Article table of contents