Guideline on Determining the Original Value of Fixed Assets Formed from Procurement in the Ministry of National Defense

This is the prominent content stipulated in Circular 13/2019/TT-BQP which regulates and guides the policies on management, depreciation, and amortization of fixed assets and the policies on reporting fixed assets being specialized assets and assets serving management work at units under the Ministry of National Defense.

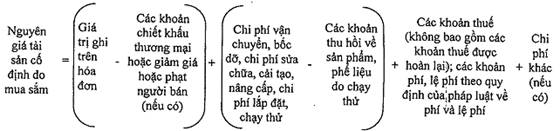

According to the new regulation, the original cost of fixed assets acquired by the Ministry of Defense is determined by the following formula:

In which:

- Trade discounts or reductions or penalties for the seller are amounts deducted from the value recorded on the invoice, applied in cases where the value recorded on the invoice includes trade discounts or reductions or penalties for the seller.- Other costs are reasonable expenses directly related to the procurement of fixed assets that the unit has expended up to the time the fixed assets are put into use.

Circular 13/2019/TT-BQP is effective from March 18, 2019.

- Thanh Lam -

- Number of deputy directors of departments in Vietnam in accordance with Decree 45/2025/ND-CP

- Cases ineligible for pardon in Vietnam in 2025

- Decree 50/2025 amending Decree 151/2017 on the management of public assets in Vietnam

- Circular 07/2025 amending Circular 02/2022 on the Law on Environmental Protection in Vietnam

- Adjustment to the organizational structure of the Ministry of Health of Vietnam: Certain agencies are no longer listed in the organizational structure

- Vietnam aims to welcome 22-23 million international tourists in Vietnam in 2025

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

Article table of contents

Article table of contents