General regulations on certificates of personal income tax withholding printed out from computers by income payers in Vietnam

General regulations on certificates of personal income tax withholding printed out from computers by income payers in Vietnam are specified in Circular 37/2010/TT-BTC guiding the issuance, use and management of certificates of personal income tax withholding printed out from computers by income payers.

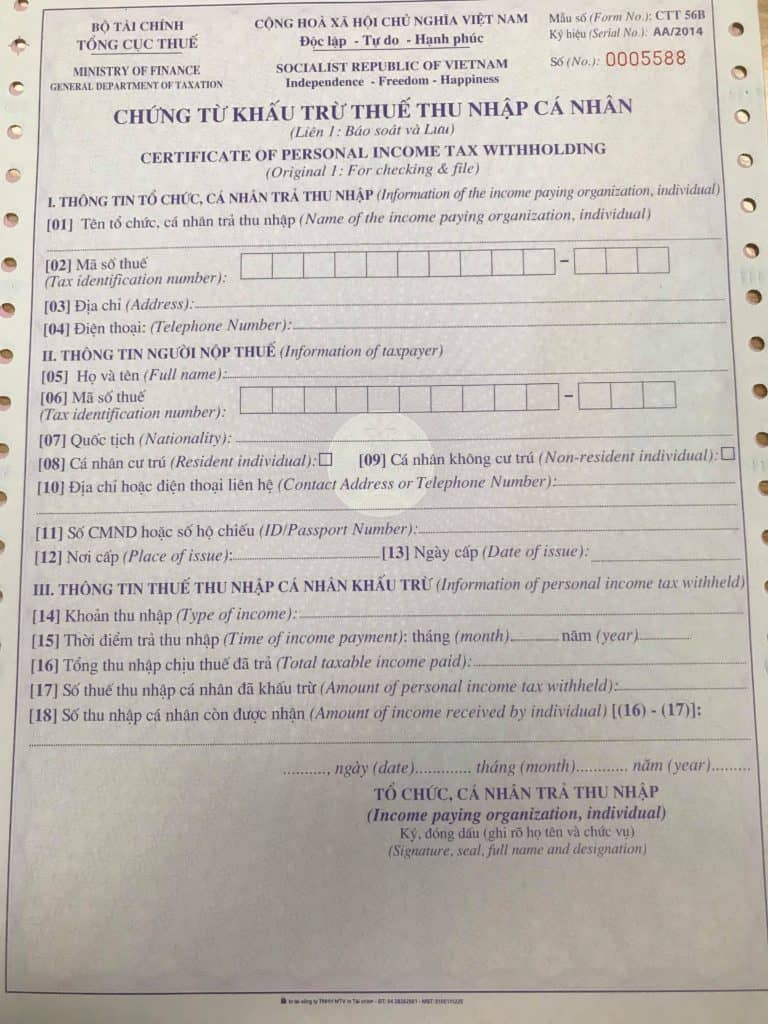

General regulations on certificates of personal income tax withholding printed out from computers by income payers in Vietnam (Internet image)

General regulations on certificates of personal income tax withholding printed out from computers by income payers in Vietnam are mentioned in Circular 37/2010/TT-BTC. To be specific:

Subjects and conditions of application

An organization that pays incomes liable to personal income tax, withholds personal income tax and fully meets the following conditions may itself print withholding certificates for issuance to individuals subject to tax withholding:

- Having the legal entity status as prescribed by law;

- Having made tax registration and a tax identification number;

- Being furnished with computers and protection software;

- Not being sanctioned for tax law violations more than one time in the proceeding year.

Form of self-printed withholding certificate

- A withholding certificate must have all the criteria specified in the standard withholding certificate form enclosed with this Circular.

- A withholding certificate must bear a sign consisting of any 2 of 20 Vietnamese letters in the upper case (A, B, C, D, E, G, H, K, L, M, N, P, Q, R, S, T, U, V, X, Y) and the year of printing and issuance and the letter T (For example: AB/2010/T, in which AB is the sign; 2010 is the year of issuance; T denotes “tu in” (document printed by the income payer).

- Withholding certificates shall be given continuous ordinal numbers with not more than 7 numerals in a sign.

- A withholding certificate is made in two originals:

- Original 1: to be kept at the income-paying organization.

- Original 2: to be handed to the person subject to tax withholding.

- Peculiar items and the logo of the income payer may be included in the withholding certificate form. In case income payers need to use bilingual withholding certificates, they shall print items in Vietnamese before those in a foreign language.

More details can be found in Circular 37/2010/TT-BTC, which comes into force from May 2, 2010.

Nguyen Phu

- Key word:

- Personal income tax

- Vietnam

- Number of deputy directors of departments in Vietnam in accordance with Decree 45/2025/ND-CP

- Cases ineligible for pardon in Vietnam in 2025

- Decree 50/2025 amending Decree 151/2017 on the management of public assets in Vietnam

- Circular 07/2025 amending Circular 02/2022 on the Law on Environmental Protection in Vietnam

- Adjustment to the organizational structure of the Ministry of Health of Vietnam: Certain agencies are no longer listed in the organizational structure

- Vietnam aims to welcome 22-23 million international tourists in Vietnam in 2025

-

- Number of deputy directors of departments in Vietnam ...

- 15:04, 05/03/2025

-

- Cases ineligible for pardon in Vietnam in 2025

- 14:43, 05/03/2025

-

- Decree 50/2025 amending Decree 151/2017 on the ...

- 12:00, 05/03/2025

-

- Circular 07/2025 amending Circular 02/2022 on ...

- 11:30, 05/03/2025

-

- Adjustment to the organizational structure of ...

- 10:34, 05/03/2025

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

Article table of contents

Article table of contents