Formula for calculating salaries paid to Vietnamese officials from July 01, 2023

"From July 01, 2023, what is the formula for calculating salaries paid to Vietnamese officials and public employees?" - asked Ms. Anh Thao (HCMC).

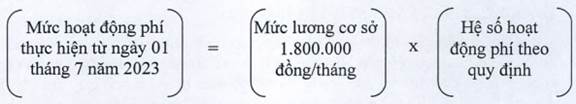

The formula for calculating salaries paid to Vietnamese officials from July 01, 2023 (Image from the internet)

Entities subject to the statutory pay rate of 1.8 million VND from July 1, 2023

The statutory pay rate of 1.8 million from July 1, 2023:

1) Officials receiving salaries from the state budget working in the Communist Party of Vietnam, State agencies, Vietnam Fatherland Front, and political-social organizations at the central level; in provinces, centrally-run cities; in districts, towns, and district-level cities belonging to provinces, and cities belonging to centrally-run cities; and in special administrative-economic units.

(2) Public employees receiving salaries from the salary funds of public service providers as stipulated by law (including cases prescribed in Clause 19, Article 1 of the Law on amendments to the Law on Officials and the Law on Public Employees 2019).

(3) Officials and public employees authorized to work at associations, non-governmental organizations in Vietnam, projects, and international organizations based in Vietnam while still receiving salaries according to the salary scale and table issued with Decree 204/2004/ND-CP.

(4) Individuals working within authorized payroll quotas at associations entrusted with tasks by the Communist Party of Vietnam and the State, supported by the state budget according to Decree 45/2010/ND-CP (amended and supplemented by Decree 33/2012/ND-CP).

(5) Officials in communes, wards, and towns, and part-time employees in communes, villages, and residential groups as stipulated in the documents below:

+ From July 1, 2023, follow Decree 92/2009/ND-CP (amended and supplemented by Decree 34/2019/ND-CP).

+ From August 1, 2023, follow Decree 33/2023/ND-CP.

(6) Delegates of the People's Council at all levels receiving activity allowances according to current laws.

(7) Individuals working in the cryptographic organization.

(8) Individuals working under labor contracts as stipulated in Decree 111/2022/ND-CP who are applicable or have agreements in their labor contracts to apply the salary scale according to Decree 204/2004/ND-CP.

(9) The following subjects will use the new statutory pay rate to calculate and determine the level of contribution, social insurance benefits, and handle policies related to salary according to law regulations:

+ Officials and employees studying, interning, working, treating, or nursing (domestically and abroad) listed on the payroll of the Communist Party of Vietnam, State agencies, political-social organizations, public service providers, and associations supported by the state budget.

+ Individuals in apprenticeship or trial employment (including commune-level officer apprentices) in the Communist Party of Vietnam, State agencies, political-social organizations, public service providers, and associations supported by the state budget.

+ Officials and public employees currently under suspension, temporary detention, or custody.

The formula for calculating salaries paid to Vietnamese officials from July 01, 2023

Depending on each group, the formula for calculating salaries is as follows:

**For officials and public employees and employees as stipulated in Points (1), (2), (3), (4), (5), (8), and (9):

Based on the current salary coefficient and allowance stipulated by authoritative documents from the Communist Party of Vietnam and the State concerning salary policies for officials, public employees, and the armed forces, the statutory pay rate stipulated in Decree 24/2023/ND-CP is used to calculate the salary, allowances, and amounts from the differential coefficient reserve (if applicable) as follows:

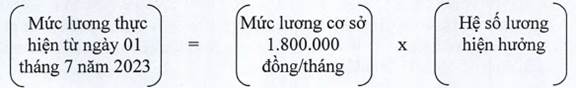

- Salary calculation formula:

- Allowance calculation formula:

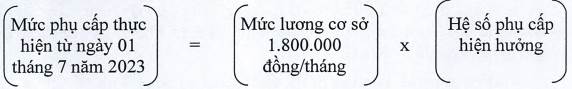

+ For allowances calculated according to the statutory pay rate:

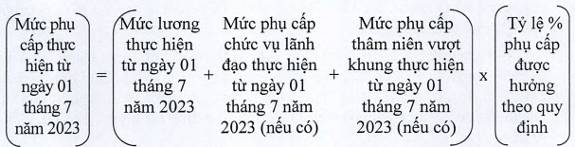

+ For allowances calculated in percentage of current salary plus leader allowance for leaders and extra-seniority allowance (if any):

+ For allowances specified in fixed monetary amounts, maintain as per current regulations.

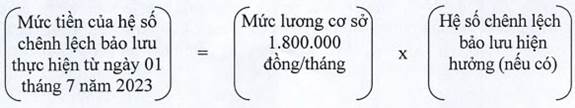

- Calculation formula for amounts from the differential coefficient reserve (if any):

**For delegates of the People's Council at each level as stipulated in Point (6):

Based on the operational allowance coefficient for delegates of the People's Council at each level according to current laws, calculate the operational allowance using the following formula:

**For part-time employees in the communes, villages, and residential groups as stipulated in Point (5):

- From July 1, 2023, the allowance fund from the state budget granted to each commune level, each village, and each residential group as stipulated in Clauses 5 and 6, Article 2 of Decree 34/2019/ND-CP will be calculated at a statutory pay rate of 1,800,000 VND/month.

Specific details on the allowance for these entities will follow the stipulations in Clauses 5 and 6, Article 2 of Decree 34/2019/ND-CP.

- From August 1, 2023, the allowance fund from the state budget granted to each commune level, each village, and each residential group as stipulated in Clauses 1 and 2, Article 34 of Decree 33/2023/ND-CP will be calculated at a statutory pay rate of 1,800,000 VND/month.

Specific details on the allowance for these entities will follow the stipulations in Clauses 1 and 2, Article 34 of Decree 33/2023/ND-CP.

**For individuals working in cryptographic organizations as stipulated in Point (7):

- For individuals working in cryptographic organizations managed by the Ministry of Defense and the Ministry of Public Security: comply according to instructions from the Minister of Defense and the Minister of Public Security;

- For individuals working in cryptographic organizations within the Communist Party of Vietnam, State agencies, political-social organizations (not managed by the Ministry of Defense and the Ministry of Public Security): calculate salaries, allowances, and amounts from the differential coefficient reserve (if any) according to the calculation method stipulated in Clause 1, Article 3 of Circular 10/2023/TT-BNV.

Circular 10/2023/TT-BNV comes into effect from July 1, 2023, and replaces Circular 04/2019/TT-BNV.

Duong Chau Thanh

- Number of deputy directors of departments in Vietnam in accordance with Decree 45/2025/ND-CP

- Cases ineligible for pardon in Vietnam in 2025

- Decree 50/2025 amending Decree 151/2017 on the management of public assets in Vietnam

- Circular 07/2025 amending Circular 02/2022 on the Law on Environmental Protection in Vietnam

- Adjustment to the organizational structure of the Ministry of Health of Vietnam: Certain agencies are no longer listed in the organizational structure

- Vietnam aims to welcome 22-23 million international tourists in Vietnam in 2025

-

- Funding Source for Adjusting New Statutory Pay ...

- 21:22, 11/07/2024

-

- Hanoi-Vietnam: Notable contents on wages in 2017

- 17:12, 11/07/2024

-

- Distinguishing region-based minimum wage and statutory ...

- 14:28, 11/07/2024

-

- From July 1, 2018: Employees in Vietnam to Receive ...

- 12:27, 11/07/2024

-

- Social Insurance in Vietnam provides guidance ...

- 09:23, 11/07/2024

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

Article table of contents

Article table of contents