Drivers for Grab, Go Viet with income over 100 million VND are required to pay Personal Income Tax (PIT)

This is an important detail mentioned in the latest Notice from the Ho Chi Minh City Tax Department regarding tax obligations for individuals engaging in transportation business partnerships with organizations (such as Grab Company Limited under forms like grabbike, grabexpress, grabfood).

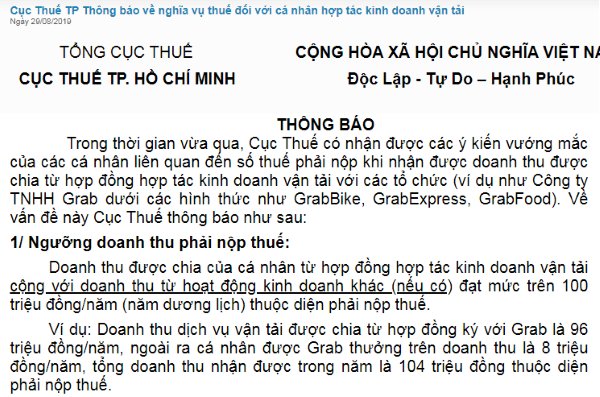

Notice from the Ho Chi Minh City Department of Taxation outlines several details regarding personal income tax obligations for Grab and GoViet drivers. To be specific:

1. Revenue Threshold for Tax Payment

The revenue shared with an individual from a transportation business cooperation contract combined with revenue from other business activities (if any) that exceeds VND 100 million/year (calendar year) is subject to tax payment.

Example: The revenue from a transportation service contract with Grab is VND 96 million/year, in addition, the individual receives VND 8 million/year as an incentive from Grab on the revenue, totaling VND 104 million/year, which is subject to tax payment.

Part of the Notice from the Ho Chi Minh City Department of Taxation

2. Taxes to be Paid

The taxes to be paid include value-added tax and personal income tax.

Based on Point b Clause 2 Article 2 Circular 92/2015/TT-BTC dated June 15, 2015 of the Ministry of Finance to determine the taxes to be paid for transportation activities:

+ VAT = Revenue enjoyed X 3%

+ PIT = Revenue enjoyed X 1.5%

Example: if the revenue from transportation activities enjoyed by an individual is VND 120 million/year, the taxes to be paid are:

+ VAT = VND 120 million x 3% = VND 3.6 million

+ PIT = VND 120 million x 1.5% = VND 1.8 million

For incentive payments based on revenue: No VAT is calculated, and PIT is calculated at a rate of 1% on the incentive. For performance-based incentive payments evaluated by stars: No VAT is calculated, and PIT is 10% on incentives from VND 2 million per instance or more.

3. Taxable Revenue

According to regulations, value-added tax and personal income tax are calculated on the revenue enjoyed multiplied by the tax rate, so individuals are not allowed to deduct expenses (fuel, car maintenance, car repairs, etc.).

4. Family Circumstance Deductions

In this case, the individual's income is not salary or wage income, so when calculating personal income tax, family circumstance deductions are not considered.

5. Tax Filing and Payment, Issuance of Tax Deduction Certificates

According to the provisions of Clause 1b Article 7 Circular 92/2015/TT-BTC, Official Dispatch 384/TCT-TNCN dated February 8, 2017 of the General Department of Taxation, Official Dispatch 11428/CT-TTHT dated November 23, 2016 of the Ho Chi Minh City Department of Taxation guiding the case of Grab:

- The organization cooperating with the individual (such as Grab) is responsible for filing and paying taxes on behalf of the individual.

- The organization cooperating with the individual issues certificates confirming the deducted taxes upon the partner's request.

Duy Thinh

- Number of deputy directors of departments in Vietnam in accordance with Decree 45/2025/ND-CP

- Cases ineligible for pardon in Vietnam in 2025

- Decree 50/2025 amending Decree 151/2017 on the management of public assets in Vietnam

- Circular 07/2025 amending Circular 02/2022 on the Law on Environmental Protection in Vietnam

- Adjustment to the organizational structure of the Ministry of Health of Vietnam: Certain agencies are no longer listed in the organizational structure

- Vietnam aims to welcome 22-23 million international tourists in Vietnam in 2025

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

Article table of contents

Article table of contents