Contribution Rates of Social Insurance for Employees in Vietnam in 2018

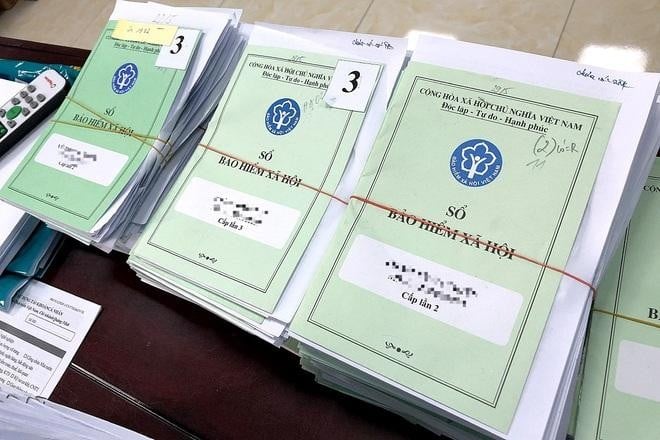

Currently, according to Decision 595/QD-BHXH, there are a total of 03 types of insurance that enterprises must contribute for their employees, including: social insurance (retirement, sickness, maternity), health insurance, and unemployment insurance.

The contribution rates for these types of insurance are as follows:

| Contribution items | Employer Contribution Rate | Employee Contribution Rate |

| Social Insurance | 3% sickness and maternity | 8% retirement and survivorship |

| 14% retirement and survivorship | ||

| 0.5% occupational accidents, BNN | ||

| Health Insurance | 3% | 1.5% |

| Unemployment Insurance | 1% | 1% |

| Total | 21.5% | 10.5% |

| 32% | ||

Thus, every month, the employer must contribute and deduct from the employee's salary to pay for the insurance contributions for the employee at a total rate of 32% of the salary for the purpose of social insurance contributions.

Salary for Insurance Contribution Calculation

From January 01, 2018, onwards, the monthly salary for compulsory social insurance contributions includes salary, salary allowances, and other additional amounts. Specifically:

- Salary is recorded according to the wage scale and salary table built by the employer following labor law regulations as agreed upon by both parties. For employees paid by piece or contract wages, the recorded salary is based on the time to determine the unit price of product or contract wages;

- Salary allowances to compensate for factors regarding working conditions, job complexity, living conditions, and the level of labor attraction that the agreed salary in the labor contract has not taken into account or has not fully considered;

- Additional amounts that can be determined as fixed together with the agreed salary in the labor contract and are paid regularly in each salary period.

The above content is based on Decision 595/QD-BHXH issued on April 14, 2017.

- Number of deputy directors of departments in Vietnam in accordance with Decree 45/2025/ND-CP

- Cases ineligible for pardon in Vietnam in 2025

- Decree 50/2025 amending Decree 151/2017 on the management of public assets in Vietnam

- Circular 07/2025 amending Circular 02/2022 on the Law on Environmental Protection in Vietnam

- Adjustment to the organizational structure of the Ministry of Health of Vietnam: Certain agencies are no longer listed in the organizational structure

- Vietnam aims to welcome 22-23 million international tourists in Vietnam in 2025

-

- Social insurance regime for regular militia and ...

- 17:32, 08/02/2025

-

- Guidelines on the form for Notification No. 01 ...

- 11:00, 04/02/2025

-

- Coefficient of compulsory social insurance price ...

- 15:24, 22/01/2025

-

- Subjects adjusted for salaries and monthly income ...

- 17:59, 20/01/2025

-

- Social insurance price slippage coefficient for ...

- 10:47, 20/01/2025

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

Article table of contents

Article table of contents