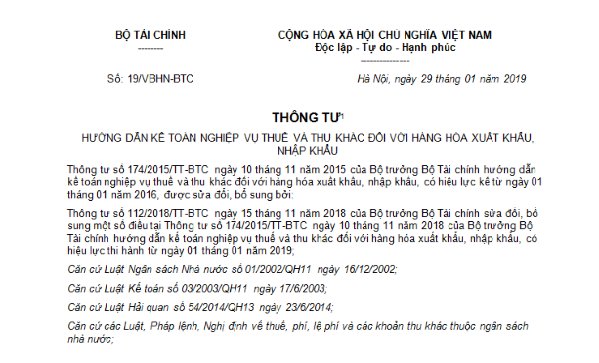

Consolidated Document Guiding the Accounting of Import and Export Goods Operations

Law Secretary respectfully introduces to esteemed members Unified Document 19/VBHN-BTC of 2019, consolidating the Circular guiding the accounting of tax operations and other charges for exported and imported goods.

Part of Consolidated Document 19/VBHN-BTC

The guidance document on accounting for tax transactions is consolidated from two documents, including:

- Circular 174/2015/TT-BTC guiding the accounting of tax transactions and other revenues for import and export goods.

- Circular 112/2018/TT-BTC amending Circular 174/2015/TT-BTC guiding the accounting of tax transactions and other revenues for export and import goods.

Members can easily look up issues related to tax transaction accounting in a single Consolidated Document without having to open two documents simultaneously.

Download and view the full content of Consolidated Document 19/VBHN-BTC guiding accounting for tax transactions with import and export goods HERE.

Duy Thinh

- It is possible to lease premises for the temporary storage of customs violation exhibits

- Official Dispatch Addressing Concerns Regarding Decree 59 and Circular 39 on Customs

- Summary of 05 Important Newly Issued Policies on Customs

- Preferences for Goods Imported under the Vietnam-Laos Trade Agreement

- Vietnam: All forms and detailed instructions for declaring various types of C/O forms

- List of 10 Special Preferential Import Tariff Schedules of Vietnam (Period 2018 - 2023)

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

Article table of contents

Article table of contents