Circular 65: Responsibility of merchants in purchasing temporary stored rice in Vietnam

On May 19, 2014, the Ministry of Finance issued Circular 65/2014/TT-BTC providing guidance on interest rate support for bank loans to purchase temporary stored rice for the 2013-2014 Winter-Spring crop.

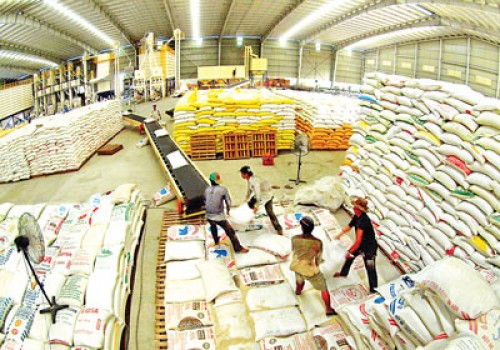

Circular 65: Responsibility of merchants in purchasing temporary stored rice in Vietnam (Illustrative Image)

Circular 65/2014/TT-BTC stipulates the responsibilities of merchants in purchasing temporary stored rice. To be specific:

-

Execute the purchase of temporary stored rice as directed by the Prime Minister of the Government of Vietnam in Decision 373a/QD-TTg with the supervision of the Ministry of Agriculture and Rural Development, the Ministry of Industry and Trade, the People's Committees of provinces and centrally-run cities in the Mekong Delta, and the Vietnam Food Association.

-

Be responsible for the authenticity of the import, export, and inventory of temporary stored rice and the credit contracts for purchasing temporary stored rice. Additionally, be accountable for the accuracy of the reported figures in the interest rate support application dossier.

-

Keep records, and documents of import, export, and bank loans, and maintain separate accounting books for the purchase of temporary stored rice as per the directives of the Prime Minister of the Government of Vietnam in Decision 373a/QD-TTg.

-

Be responsible for the business efficiency concerning the purchase of temporary stored rice.

-

Be legally responsible if violating financial and accounting regulations in the execution of temporary stored rice.

-

Must return to the state budget the interest rate support funds granted if state management agencies inspect and detect any violations. Additionally, the merchant must pay late payment interest on the amount to be refunded.

Note: The determination of late payment interest is calculated from when the merchant received the funds until the refund to the state budget at an interest rate of 150% of the average loan interest rate at the commercial banks that the merchant borrowed to purchase temporary storage.

Details can be found at Circular 65/2014/TT-BTC which took effect on May 19, 2014.

Ty Na

- Number of deputy directors of departments in Vietnam in accordance with Decree 45/2025/ND-CP

- Cases ineligible for pardon in Vietnam in 2025

- Decree 50/2025 amending Decree 151/2017 on the management of public assets in Vietnam

- Circular 07/2025 amending Circular 02/2022 on the Law on Environmental Protection in Vietnam

- Adjustment to the organizational structure of the Ministry of Health of Vietnam: Certain agencies are no longer listed in the organizational structure

- Vietnam aims to welcome 22-23 million international tourists in Vietnam in 2025

-

- Application for considering interest rate support ...

- 12:37, 10/07/2024

-

- Responsibilities of state agencies related to ...

- 12:37, 10/07/2024

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

Article table of contents

Article table of contents