Cases in which enterprises must use e-invoices with tax authority codes

In what cases is an enterprise required to use electronic invoices with an authentication code from the tax authorities? This is a question that Secretary of Law has recently received quite frequently from our Valued Customers and Members. Secretary of Law would like to address it as follows:

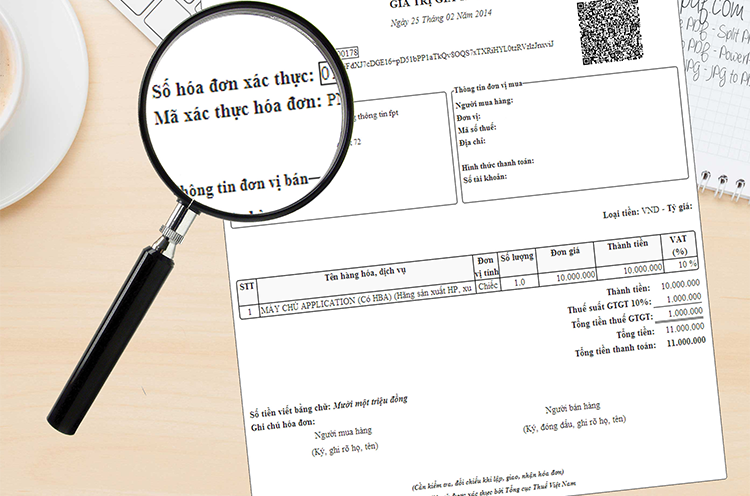

Illustrative Image

According to Clause 3 Article 6 of Circular 68/2019/TT-BTC, sellers of goods and service providers classified as high tax risk must use electronic invoices with tax authority authentication codes, regardless of the transaction value.

In particular, enterprises considered high tax risk are those with owner’s equity of less than VND 15 billion and any of the following indicators:

- No legal ownership or usage rights for the following facilities: factories; production workshops; warehouses; transportation means; stores, and other facilities.

- Enterprises engaged in soil, stone, sand, or gravel exploitation.

- Enterprises involved in suspicious bank transactions as per anti-money laundering laws.

- Enterprises with revenue from selling goods or providing services to other businesses where the owners of these businesses have a parent-child, spouse, sibling relationship, or cross-shareholding that constitutes over 50% of the total business revenue in the Corporate Income Tax finalization declaration of the year.

- Enterprises failing to file tax declarations as required: Not submitting tax declaration dossiers or submitting after 90 days since the deadline or from the business commencement date as per the business registration certificate, or suspending business activities beyond the notified period without updating the tax authority, and during inspection, found to be conducting business without tax declaration; no longer operating at the registered address and not notifying the tax authority or the authority unable to determine the registered legal representative’s residence.

- Enterprises using electronic invoices that change their business address more than twice within 12 months without reporting or failing to declare and pay taxes at the new registration location as required.

- Enterprises buying invoices from the tax authority (as per the Decision on high-risk enterprise transition to tax authority invoices) notified to switch to electronic invoices with tax authority codes.

- Within one year up to the evaluation time:+ Enterprise penalized by the tax authority for administrative invoice violations involving unauthorized or illegal use of invoices leading to tax evasion, fraud, late tax payment, misstatement, and fined from VND 20 million or more;+ Enterprise penalized for administrative invoice violations twice a year with total fines of VND 8 million or more;+ Enterprise penalized for administrative invoice violations three times a year.

Therefore, enterprises with owner's equity under VND 15 billion falling into one of the above categories must use electronic invoices with tax authority authentication codes.

The supervising tax authorities (Department of Taxation, Sub-department of Taxation) are responsible for notifying enterprises and economic organizations classified as high tax risk to switch to electronic invoices with tax authority codes.

Enterprises and economic organizations using electronic invoices in high tax risk situations must apply electronic invoices with tax authority codes for 12 continuous operating months. After this period, if they are re-evaluated by the tax authority and deemed risk-free, qualifying to use non-code electronic invoices, and they request such use, they can register for non-code electronic invoices under the provisions of Article 20 of Decree 119/2018/ND-CP.

Nguyen Trinh

- Number of deputy directors of departments in Vietnam in accordance with Decree 45/2025/ND-CP

- Cases ineligible for pardon in Vietnam in 2025

- Decree 50/2025 amending Decree 151/2017 on the management of public assets in Vietnam

- Circular 07/2025 amending Circular 02/2022 on the Law on Environmental Protection in Vietnam

- Adjustment to the organizational structure of the Ministry of Health of Vietnam: Certain agencies are no longer listed in the organizational structure

- Vietnam aims to welcome 22-23 million international tourists in Vietnam in 2025

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

Article table of contents

Article table of contents