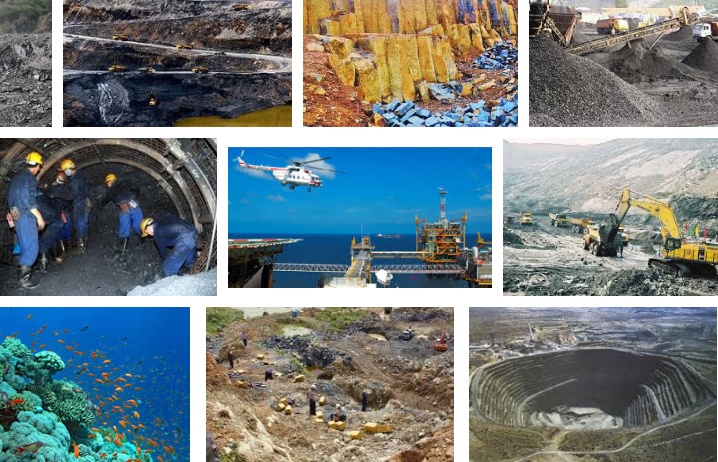

09 types of resources that are subject to severance tax according to Vietnam’s regulations

Recently, the Government of Vietnam issued Decree No. 50/2010/ND-CP guiding the Law on Severance tax 2009 of Vietnam. This Decree specifies 9 types of resources that are subject to severance tax.

According to Article 2 of Decree No. 50/2010/ND-CP of Vietnam’s Government, 09 severance tax-liable objects include:

- Metallic minerals.

- Non-metallic minerals.

- Crude oil.

- Natural gas.

- Coal gas.

- Natural forest products, including plants of all kinds and other natural forest products, other than animals and anise, cinnamon, amomum and cardamom which are grown by royalty payers in natural forest areas allocated to them for zoning off and protection.

- Natural marine products, including marine animals and plants.

- Natural water, including surface water and groundwater.

- Natural swallow's nests.

- Other resources, which shall be proposed by the Ministry of Finance in coordination with concerned ministries and branches to the Government for submission to the National Assembly Standing Committee for consideration and decision.

View more details at Decree No. 50/2010/ND-CP of Vietnam’s Government, effective from July 01, 2010.

Nguyen Phu

- Key word:

- Decree No. 50/2010/ND-CP

- Number of deputy directors of departments in Vietnam in accordance with Decree 45/2025/ND-CP

- Cases ineligible for pardon in Vietnam in 2025

- Decree 50/2025 amending Decree 151/2017 on the management of public assets in Vietnam

- Circular 07/2025 amending Circular 02/2022 on the Law on Environmental Protection in Vietnam

- Adjustment to the organizational structure of the Ministry of Health of Vietnam: Certain agencies are no longer listed in the organizational structure

- Vietnam aims to welcome 22-23 million international tourists in Vietnam in 2025

-

- Vietnam: Cases of severance tax exemption and ...

- 11:20, 12/12/2017

-

- Vietnam: How to determine royalty-liable prices ...

- 17:00, 20/05/2010

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

Article table of contents

Article table of contents