06 invoice types at Decree No. 123/2020/NĐ-CP of Vietnam’s Government

Recently, the Government of Vietnam has issued the Decree No. 123/2020/NĐ-CP prescribing invoices and records.

According to Article 8 of the Decree No. 123/2020/NĐ-CP of Vietnam’s Government, invoices prescribed herein are classified into the following types:

1. Value-added tax (VAT) invoice is an invoice which may be used by organizations making VAT declaration by employing the credit-invoice method for the following activities:

- Domestic sale of goods or provision of services;

- Provision of international transport services;

- Export of goods to free trade zones and other cases considered as export of goods;

- Export of goods or provision of services in a foreign market.

2. Sales invoice is an invoice which may be used by the following organizations and individuals:

* Organizations or individuals that declare and calculate VAT by employing direct method for the following activities:

- Domestic sale of goods or provision of services;

- Provision of international transport services;

- Export of goods to free trade zones and other cases considered as export of goods;

- Export of goods or provision of services in a foreign market.

* Organizations or individuals in free trade zones that sell goods or provide services to the domestic market, sell goods or provide services to other organizations/individuals in free trade zones, or sell goods or provide services to a foreign market. In such cases, invoices must bear the phrase “Dành cho tổ chức, cá nhân trong khu phi thuế quan” ("For organizations/individuals in free trade zones”).

3. Public property electronic sales invoice is used when selling the following types of property:

- Public property at authorities, organizations or units (including state owned houses);

- Infrastructure property;

- Public property that is managed by enterprises as assigned by the Government, excluding state capital invested in enterprises;

- Property of state-funded projects;

- Property under the established all-people ownership;

- Public property appropriated under decisions issued by competent regulatory authorities or officials;

- Raw materials and supplies obtained from the disposal of public property.

4. Electronic sales invoice on national reserve goods is used when a state reserves agency or unit sells national reserve goods in accordance with regulations and laws.

5. Other invoices, including:

- Stamps, tickets and cards in the form and containing contents prescribed herein;

- Air freight receipts; receipts of international transport charges; receipts of banking service charges, except the cases prescribed in Point a of this Clause where a record whose format and contents are made according to international practices and regulations of relevant laws.

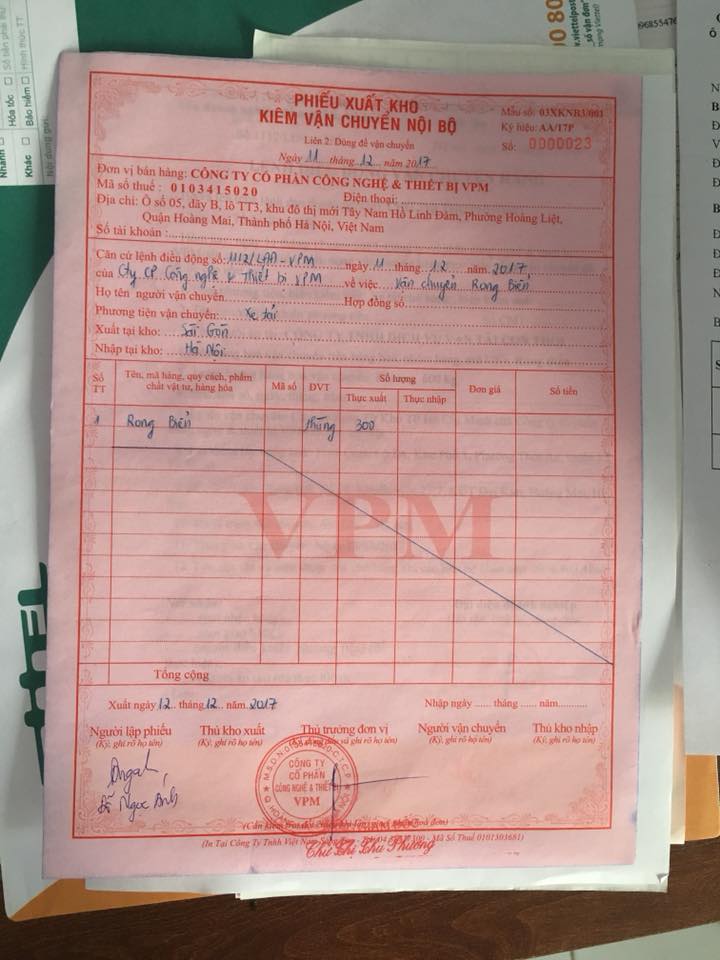

6. Records printed, issued, used and managed in the same manner as invoices, including delivery and internal transfer note, and delivery notes for goods sent to sales agents.

View more details at the Decree No. 123/2020/NĐ-CP of Vietnam’s Government, effective from July 01, 2022.

Le Vy

- Key word:

- Decree No. 123/2020/NĐ-CP

- Number of deputy directors of departments in Vietnam in accordance with Decree 45/2025/ND-CP

- Cases ineligible for pardon in Vietnam in 2025

- Decree 50/2025 amending Decree 151/2017 on the management of public assets in Vietnam

- Circular 07/2025 amending Circular 02/2022 on the Law on Environmental Protection in Vietnam

- Adjustment to the organizational structure of the Ministry of Health of Vietnam: Certain agencies are no longer listed in the organizational structure

- Vietnam aims to welcome 22-23 million international tourists in Vietnam in 2025

-

- Vietnam: Entities subject to use of tax authority ...

- 15:36, 06/04/2023

-

- Update all 15 Decrees in several fields will be ...

- 08:10, 29/12/2020

-

- What entities are obliged to use e-invoices with ...

- 08:09, 21/12/2020

-

- Instructions for formatting e-invoices according ...

- 09:30, 05/11/2020

-

- Vietnam: Enterprises and business entities must ...

- 16:30, 26/10/2020

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

Article table of contents

Article table of contents