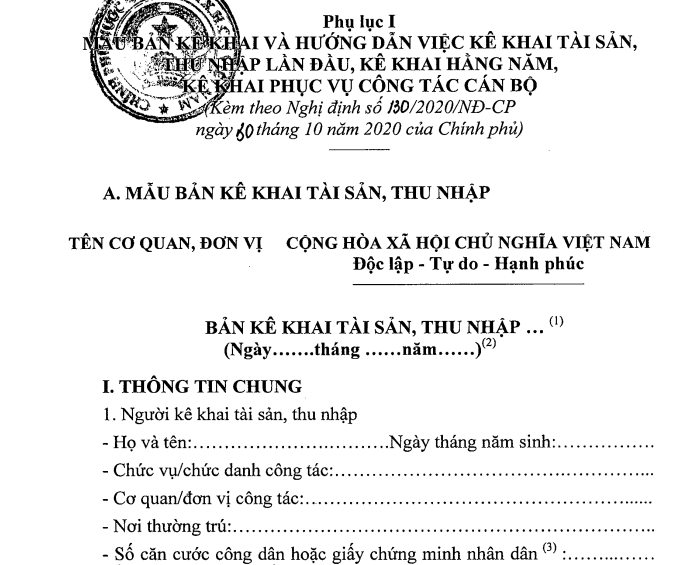

Forms of asset, income declarations of officials and public employees are attached to the Decree No. 130/2020/NĐ-CP of Vietnam’s Government on controlling asset and income of persons holding titles and powers in agencies, organizations and entities.

According to Article 35 of the Anti-corruption Law 2018 of Vietnam, the following assets and income shall be declared:

- Land use rights, houses, construction works and other property attached thereto;

- Previous metals, gemstones, cash, financial instruments and other real property each of which is assessed at VND 50.000.000 or above;

- Overseas property and accounts;

- Total income between 02 declarations.

Besides, according to Clause 2 Article 3 of the Decree No. 130/2020/NĐ-CP of Vietnam’s Government, “declaration of assets, income” refers to clear, adequate and accurate depiction of assets, income, fluctuation of assets, income to be declared, origin of additional assets, income.

Persons specified in Article 10 of this Decree are obliged to declare assets and income annually using the following forms:

- First-time declaration, annual declaration and declaration for officer affairs shall conform to declaration form and declaration guidelines under Annex I attached to this Decree.

DOWNLOAD: Form of annual declaration of assets and income

- Additional declaration shall conform to declaration form and declaration guidelines under Annex II attached to this Decree.

DOWNLOAD: Form of additional declaration of assets and income

View more details at the Decree No. 130/2020/NĐ-CP of Vietnam’s Government, effective from December 20, 2020, replacing the Decree No. 78/2013/NĐ-CP.

Le Hai

- Key word:

- Decree No. 130/2020/NĐ-CP

Article table of contents

Article table of contents

![[InfoGraphic] 6 forms of discipline for officials and public employees under Decree 71/2016/ND-CP](https://cdn.lawnet.vn//uploads/NewsThumbnail/2016/07/12/1319291-01.png)

.Medium.png)

.Medium.png)

.Medium.png)

.Medium.png)