How does compensation for costs of training for public employees differ from for employees in Vietnam? – This is the question that Lawnet received from Mr. Duc Nghia living in Ho Chi Minh City.

How does compensation for costs of training for public employees differ from for employees in Vietnam? (Illustration)

Regarding this matter, LawNet would like to answer as follows:

According to current regulations in Vietnam, the conditions for postgraduate training for public employees are stipulated as follows:

- Completed probation period;

- Committed to fulfilling duties and professional activities at the agency or unit after completing the training program for a period of at least twice the training duration;

- Training specialization matches the job position.

In case of being sent to study under programs of cooperation with foreign countries signed or joined on behalf of the State, the Government of the Socialist Republic of Vietnam, apart from the above conditions, other requirements of the cooperation program must also be met.

Public employees who meet these conditions are sent for training. In cases where public employees are sent for training from intermediate level or higher using the state budget or funds from the managing agency that employs officials and public employees, but they voluntarily quit school, quit the job, or unilaterally terminate the employment contract during training, or do not receive a graduation certificate from the training institution, or have completed and received a graduation certificate but leave/terminate the employment contract before serving for a period of at least twice the training period, they must compensate the training costs to the unit that paid for the course.

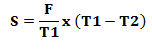

According to Article 8 Decree 101/2017/ND-CP, the compensation costs include tuition fees and all other expenses serving the course, excluding salary and allowances (if any). For cases of voluntary quitting, quitting the job, or unilaterally terminating the employment contract during the training period or not receiving a graduation certificate from the training institution, the public employee must repay 100% of the compensation costs. For cases where the employee has completed and received a graduation certificate but leaves/terminates the employment contract before serving for a period of at least twice the training duration, the compensation costs are calculated according to the following formula:

Where:

- S is the compensation cost;

- F is the total cost paid by the agency, unit sending officials and public employees to study, particularly for 1 person attending the course;

- T1 is the required service time after completing the course(s), calculated in full months;

- T2 is the service time after training, calculated in full months.

Example: Mr. A is sent by the agency to study for a master's degree for 2 years (= 24 months), costing 30 million VND. According to the commitment, Mr. A must serve at least 48 months after returning. After graduating, Mr. A served the agency for 24 months before he voluntarily quit. The training cost Mr. A must compensate is:

.png)

Therefore, Mr. A must compensate the training cost of 15 million VND to the unit.

Additionally, for each year of service by the public employee (excluding probation period and post-training service time), the compensation cost is reduced by 1%. For female employees or ethnic minorities, each year of service reduces the compensation cost by up to 1.5%. Therefore, if Mr. A had served at the unit for 2 years before being sent for training, the compensation cost would be reduced by 2% and would amount to 15 million - (15 million x 2%) = 14.7 million VND.

In contrast, compensation for training costs for employees is not clearly regulated but mainly based on mutual agreement. According to Article 43 of the Labor Code 2012, in cases where an employee unilaterally terminates the contract illegally, they must repay the training costs as agreed to the employer, including expenses with valid receipts for payment to the instructor, learning materials, school, class, machinery, equipment, practice materials, other expenses supporting the learner, and salary, social insurance, and health insurance during the study period. If the employee is sent for training abroad, the training costs also include travel and living expenses abroad.

In cases of unilaterally terminating the contract in accordance with Article 37 of the 2012 Labor Code, the current law does not specify whether such termination requires compensation. Therefore, it depends on the parties' responsibilities, obligations, penalty clauses, and compensation stipulated in the contract and agreements. If the agreement specifies that in any case of terminating the labor contract, the employee must compensate for training costs, then the employee must compensate as agreed. If the agreement does not cover compensation for unilaterally terminating the labor contract, the employer has no basis to request compensation when the contract is terminated.

Thus, compensation for training costs for public employees is more clearly regulated compared to employees. Additionally, the process is more transparent and public since it involves the Compensation Review Council. Meanwhile, employee compensation is mainly based on mutual agreement, which can increase or decrease compensation levels compared to the agreed commitment depending on the will of both parties.

Le Hau

Article table of contents

Article table of contents

![[InfoGraphic] 6 forms of discipline for officials and public employees under Decree 71/2016/ND-CP](https://cdn.lawnet.vn//uploads/NewsThumbnail/2016/07/12/1319291-01.png)

.Medium.png)

.Medium.png)

.Medium.png)

.Medium.png)