Currently, what are the regulations on the participation in compulsory civil liability insurance for motor vehicle users in Vietnam? - Tra Vinh (Dieu Nhi)

Vietnam: 04 things to know about compulsory civil liability insurance for motor vehicle users (Source: Internet)

1. Insurance participation principles in compulsory civil liability insurance of motor vehicle users in Vietnam

According to Article 4 of Decree 03/2021/ND-CP stipulating the principle of participating in compulsory civil liability insurance for motor vehicle owners as follows:

- Insurance enterprises and insurance buyers shall implement compulsory civil liability insurance of motor vehicle users according to this Decree.

- For each motor vehicle, responsibility for paying for compulsory civil liability insurance of motor vehicle users shall only derive from a single insurance contract.

- In addition to participation in compulsory civil liability insurance of motor vehicle users according to the regulations:

Motor vehicle users and insurance enterprises may agree to extend insurance requirements, excess insurance liabilities and respective additional insurance premiums.

In this case, insurance enterprises are responsible for separating compulsory civil liability insurance of motor vehicle users in certificates of insurance.

2. Scope of compensation for damage with compulsory civil liability insurance for motor vehicle owners in Vietnam

The scope of compensation for damage with compulsory civil liability insurance for motor vehicle owners according to Article 5 of Decree 03/2021/ND-CP is as follows:

- Non-contract damage such as health, life and assets done to a third party by motor vehicles.

- Damage to health and lives of passengers done by motor vehicles.

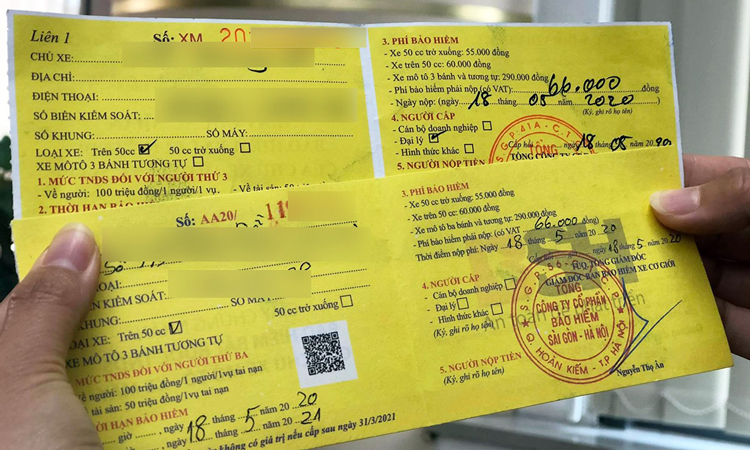

3. Certificate of compulsory civil liability insurance of motor vehicle users in Vietnam

The certificate of compulsory civil liability insurance for motor vehicle owners specified in Article 6 of Decree 03/2021/ND-CP is as follows:

(1) Certificates of compulsory civil liability insurance of motor vehicle users are proof of concluding compulsory civil liability insurance contracts between motor vehicle users and insurance enterprises.

Each motor vehicle shall be issued with 1 certificate of insurance. Motor vehicle users whose certificates of insurance are lost must request insurance enterprises (which have previously issued the lost certificates of insurance) in writing to reissue certificates of insurance.

(2) Upon purchasing compulsory civil liability insurance of motor vehicle users, motor vehicle users shall be issued with certificates of insurance by insurance enterprises.

Insurance enterprises shall only issue certificates of insurance for motor vehicle users if the motor vehicle users have adequately paid insurance premiums or agreed with the insurance enterprises on deadline for paying insurance premiums according to Ministry of Finance.

(3) Certificates of insurance shall be designed by insurance enterprises and include following details:

- Name, address and phone number (if any) of motor vehicle users.

- License plate or chassis number, engine number.

- Type of vehicle, payload, number of seats and use purpose in case of automobiles.

- Name, address and hotline number of insurance enterprises.

- Civil insurance liabilities for third party and passengers.

- Responsibilities of motor vehicle users and operators in case of accidents.

- Insurance duration, insurance premiums and payment deadline of insurance premiums.

- Date of issue of certificates of insurance.

- Number code and barcode registered, managed and used according to Ministry of Science and Technology to enable storage, transmission and extraction of ID information of insurance enterprises and basic contents of certificates of insurance.

(4) In case of issuance of electronic certificates of insurance, insurance enterprises must comply with Law on Electronic Transactions and guiding documents; Electronic certificates of insurance must closely comply with applicable regulations and law and item (3)

4. Insurance premiums and payment of compulsory civil liability insurance premium for motor vehicle owners in Vietnam

According to Article 7 of Decree 03/2021/ND-CP stipulating insurance premiums and payment of compulsory CIT premiums for motor vehicle owners as follows:

- Insurance premiums refer to payment made by motor vehicle users to insurance enterprises when purchasing compulsory civil liability insurance of motor vehicle users.

- Ministry of Finance of Vietnamshall prescribe insurance premiums on the basis of statistical figures to ensure payment capacity of insurance enterprises corresponding to insurance requirements, insurance liabilities and level of risks by type of motor vehicles and use purposes.

- Based on accident records of each motor vehicle and insurance enterprises’ risk tolerance capacity, insurance enterprises shall consider and increase insurance premiums. Insurance premiums can be increased by up to 15% of insurance premiums prescribed by Ministry of Finance.

- For motor vehicles permitted to purchase insurance with duration other than 1 year, insurance premiums shall be determined based on insurance premiums prescribed by Ministry of Finance of Vietnamand insurance duration. To be specific:

Payable insurance premiums = (Annual insurance premiums by types of motor vehicles/365 (days)) x (Insurance duration (days)

In case insurance duration is 30 days or less, payable insurance premiums shall be determined by dividing annual insurance premiums by types of motor vehicle by 12 months.

Quoc Dat

Article table of contents

Article table of contents

.jpg)

.Medium.png)

.Medium.png)

.Medium.png)

.Medium.png)