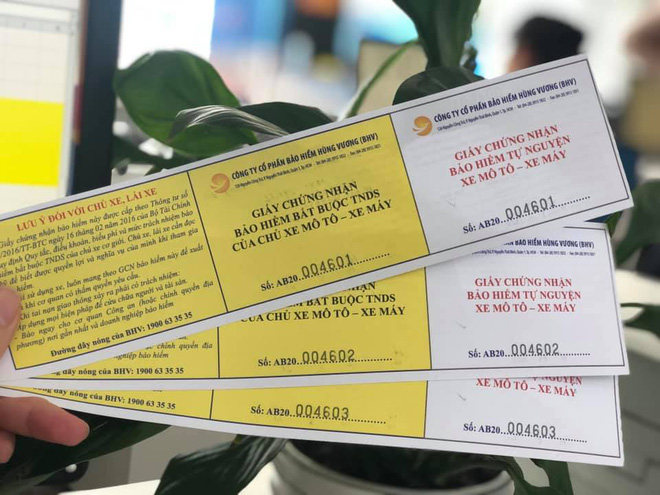

Recently, the Ministry of Finance of Vietnam issued the Circular No. 04/2021/TT-BTC elaborating to the Decree No. 03/2021/NĐ-CP on compulsory civil liability insurance of motor vehicle users.

Annex I on compulsory civil liability insurance of motor vehicle users is issued together with the Circular No. 04/2021/TT-BTC of the Ministry of Finance of Vietnam, takes effect from March 01, 2021 and replaces the Annex V attached to the Circular No. 22/2016/TT-BTC. Specifically as follows:

* Insurance premiums in other cases

1. Vehicles for driving lessons

Equal 120% of insurance premiums applicable to vehicles of the same types specified under Section IV and Section VI.

2. Taxis

Equal 170% of insurance premiums applicable to commercial vehicles with the same seat number specified under Section V.

3. Specialized vehicles

- Insurance premiums of ambulance equal 120% of those of vehicles that transport both passengers and cargoes (pickup trucks, minivans) for commercial purposes.

- Insurance premiums of money trucks equal 120% of those of vehicles with under 6 seats specified under Section IV.

- Insurance premiums of other specialized vehicles mandated by the laws in terms of design weight equal 120% of those of cargo vehicles with the same weight specified under Section VI; insurance premiums of specialized vehicles not mandated by the laws in terms of design weight equal 120% of those of cargo vehicles under 3 tonnes (Currently, the premium is equal to 120% that of an under-3-tonne vehicle for the transport of goods specified in Section V of the Circular No. 22/2016/TT-BTC).

4. Trailer towing vehicles

Equal 150% of insurance premiums applicable to vehicles above 15 tonnes. Insurance premiums of vehicles towing trailers apply to both towing vehicles and trailers.

5. Tractors and heavy-duty vehicles (Currently, there is just provision on heavy-duty vehicles)

Equal 120% of insurance premiums of cargo vehicles under 3 tonnes specified under Section VI (insurance premiums of tractors apply to both towing vehicles and trailers).

6. Buses

Equal insurance premiums applicable to non-commercial vehicles with the same seat number specified under Section IV.

Note: Insurance premiums mentioned above do not include VAT

It can be seen that the compulsory insurance premium for civil liability of motor vehicle owners in Circular No. 04/2021/TT-BTC has basically not changed much compared to the provisions of Circular No. 22/2016/TT-BTC of the Minister of Vietnam, most fees are remained the same as current provisions.

- Key word:

- Circular No. 04/2021/TT-BTC

Article table of contents

Article table of contents

.jpg)

.Medium.png)

.Medium.png)

.Medium.png)

.Medium.png)