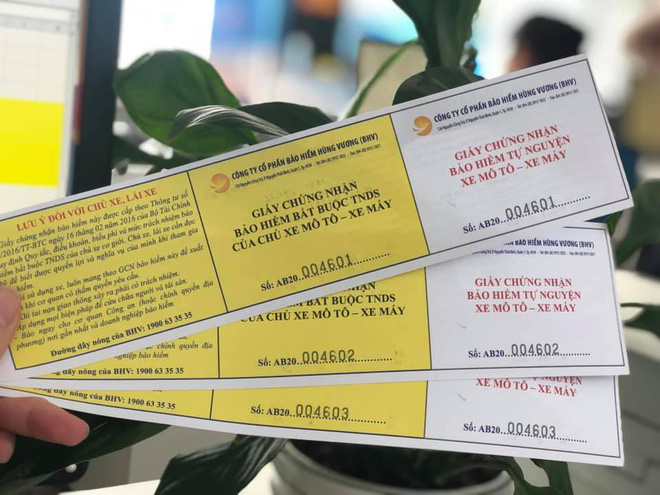

This is a notable content of the Circular No. 04/2021/TT-BTC on elaborating to the Decree No. 03/2021/NĐ-CP on compulsory civil liability insurance of motor vehicle users.

According to the previous provision of the Decree No. 03/2021/NĐ-CP of the Government of Vietnam, motor vehicle insurance fund refers to fund established to make humanitarian payments; prevent and limit damage and road traffic accidents; publicize and educate on road traffic safety, compulsory civil liability insurance of motor vehicles and relevant activities to protect public interest and ensure social safety.

According to the Decree No. 03/2021/NĐ-CP, motor vehicle insurance fund is made of from the following sources:

(1) Contribution of insurance enterprises permitted to implement compulsory civil liability insurance of motor vehicle users. In particular, insurance enterprises are responsible for extracting up to 1% of total insurance premiums of compulsory civil liability insurance of motor vehicle users collected from principal insurance contracts in the previous financial year to contribute to the motor vehicle insurance fund before December 31 each year.

(2) Interests from deposits.

(3) Excess of the motor vehicle insurance fund of the previous year permitted to be retained for the following year.

(4) Contributions and financing of organizations and individuals.

(5) Other legal revenues (if any).

The motor vehicle insurance fund is managed and used transparently, effectively and for the right purposes as prescribed in Article 27 of the Decree No. 03/2021/NĐ-CP of the Government of Vietnam.

Also in this Decree, the Government clarifies that the Ministry of Finance of Vietnam shall elaborate specific rate of expenses specified under Clause 1 Article 27 of this Decree, prioritizing expenses on performing humanitarian purposes, preventing and remediating traffic accidents and publicizing, educating to meet objectives of motor vehicle insurance fund.

Thus, based on this provision of the Government, the Ministry of Finance of Vietnam issued Circular No. 04/2021/TT-BTC on January 15, 2021.

Specifically, pursuant to Article 5 of the Circular No. 04/2021/TT-BTC, rate of expenses made by motor vehicle fund mentioned at the Decree No. 03/2021/NĐ-CP is prescribed as following:

(1) Humanitarian payments: No lower than 25% of total annual contribution to motor vehicle fund and balance of motor vehicle fund in previous years (if any).

(2) Road traffic accident prevention and mitigation: No more than 20% of total annual contribution to motor vehicle fund and balance of motor vehicle fund in previous years (if any).

(3) Organization of education about road traffic safety and compulsory civil liability insurance of motor vehicle users: No more than 15% of total annual contribution to motor vehicle fund and balance of motor vehicle fund of previous years (if any).

(4) Financing for police authorities in cooperating with the Insurance Association of Vietnam (IAV), Council for managing motor vehicle insurance fund and non-life insurance enterprises in preventing, remediating and countering fraud in insurance business and complying with regulations on compulsory civil liability insurance of motor vehicle users: No more than 10% of total annual contribution to motor vehicle fund.

(5) Commendation for organizations and individuals with merits in implementing compulsory civil liability insurance of motor vehicle users, preventing and remediating damage, traffic accidents and ensuring road traffic safety: No more than 5% of total annual contribution to motor vehicle fund.

(6) Completion and maintenance of database on compulsory civil liability insurance of motor vehicle users: No more than 10% of total annual contribution to motor vehicle fund.

(7) Operation of ASEAN Program for compulsory civil liability insurance and operation of Vietnamese agency implementing Protocol No. 5 on ASEAN Program for compulsory civil liability insurance: No more than 5% of total annual contribution to motor vehicle fund.

(8) Management of motor vehicle fund: No more than 8% of total annual contribution to motor vehicle fund (including paying salaries, allowances, deductions according to salary (social insurance, health insurance, unemployment insurance, trade union expenses) and reward and welfare for employees of the Office of Motor Vehicle Insurance Fund; paying responsibility allowances for the management and administration apparatus of the Motor Vehicle Insurance Fund and part-time employees of the Office of the Motor Vehicle Insurance Fund; expenses for office rental, equipment procurement, banking and postal services; hiring auditors; expenses for travel and meetings of the Motor Vehicle Insurance Fund).

The Circular No. 04/2021/TT-BTC issued by the Ministry of Finance of Vietnam and takes effect on March 01, 2021.

- Key word:

- Circular No. 04/2021/TT-BTC

Article table of contents

Article table of contents

.jpg)

.Medium.png)

.Medium.png)

.Medium.png)

.Medium.png)