Recently, the Government of Vietnam has issued the Decree No. 03/2021/NĐ-CP compulsory civil liability insurance of motor vehicle users, replaces the Decree No. 103/2008/NĐ-CP and Decree No. 214/2013/NĐ-CP .

According to Articles 14, 15 and 16 of the Decree No. 03/2021/NĐ-CP issued by the Vietnam Government, if accidents within insurance liabilities occur, insurance enterprises must reimburse insurance beneficiaries for the payment that has been made or will be made to the accident victims by the insurance beneficiaries (Clause 1 Article 14). Insurance enterprises are responsible for cooperating with insurance buyers and relevant parties in producing insurance claim dossiers and being legally responsible for accuracy, adequacy and legitimacy of insurance claim dossiers (Clause 1 Article 15). Moreover, the insurance enterprises have also to ensure the deadline for claim request and payment as prescribed in Article 16 of this Decree.

1. Insurance claim dossiers

Insurance claim dossiers shall compose of following documents:

- Documents related to vehicles, vehicle operators (certified true copies or copies bearing confirmation of insurance enterprises) provided by insurance buyers or insurance beneficiaries:

+ Vehicle registration (or certified true copies of vehicle registration and master registers of valid notice of receipt of credit institutions during the period in which the credit institutions hold master registers of vehicle registration) or documents on transfer of vehicle ownership and certificates of vehicle origin (in case vehicle registration is not available).

+ Driving license.

+ ID cards, Citizen Identity Cards, passports or other personal documents of vehicle operators.

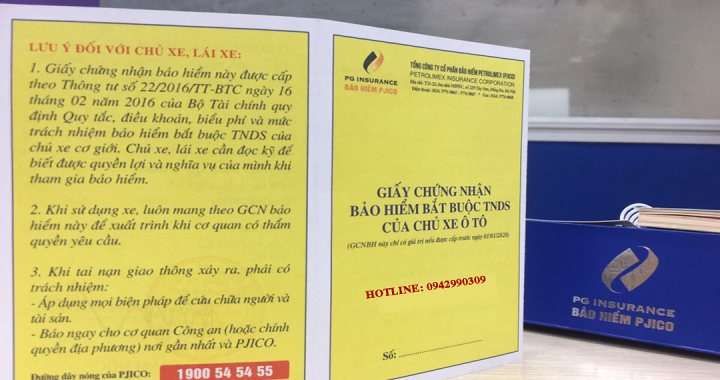

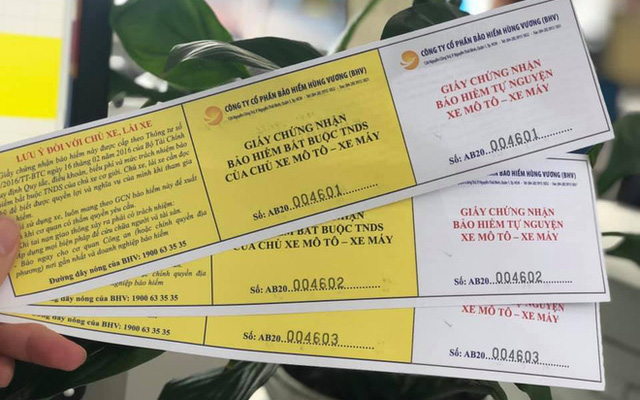

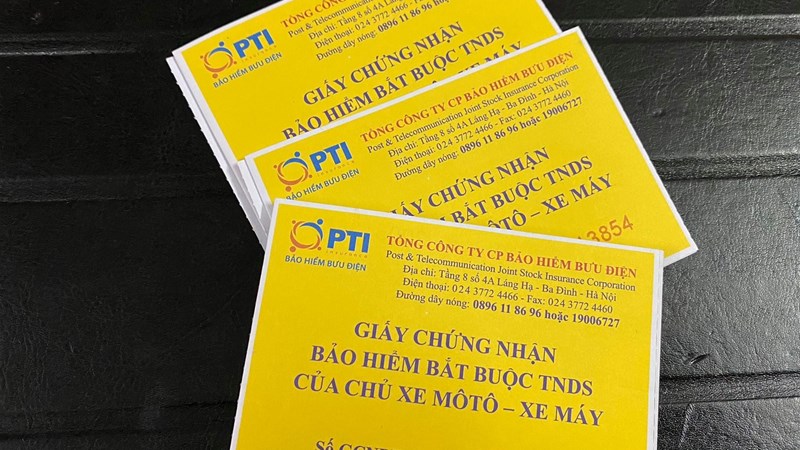

+ Certificates of insurance.

- Documents proving damage to life and/or health (copies of medical establishments or copies bearing confirmation of insurance enterprises) provided by insurance buyers or insurance beneficiaries:

+ Written proof of injuries.

+ Medical records.

+ Excerpts of death certificates, death notices, written confirmation of police authorities or assessment results of forensic examining bodies in case victims decease while mounting vehicles or decease due to accidents.

- Documents proving property damage provided by insurance buyers or insurance beneficiaries:

+ Valid invoices and instruments on repair and/or replace of properties damaged due to traffic accidents (in case insurance enterprises repair and remediate the damage, the insurance enterprises are responsible for collecting such documents).

+ Documents, invoices and instruments related to additional costs incurred by motor vehicle users to reduce the damage or follow instructions of insurance enterprises.

- Copies of relevant documents of police authorities collected by insurance enterprises in lethal accidents for third party and passengers, including: notice of traffic accident investigation, verification, resolution results or notice of accident investigation and resolution results.

- Assessment records for identifying causes and levels of damage produced by insurance enterprise on the basis of consensus between insurance enterprises and insurance buyers, insurance beneficiaries.

2. Deadline for claim request and payment

- Deadline for requesting claims shall be 1 year from the date on which accidents occur except for cases of delay due to objective reasons or force majeure as per the law. Within 5 working days from the date on which accidents occur (except for force majeure), insurance buyers or insurance beneficiaries must send notice of accidents in writing or electronically to insurance enterprises.

- Deadline for making claim of insurance enterprises shall be 15 days from the date on which adequate applications for insurance claims are received and 30 days from the date on which adequate applications for insurance claims are received in case verification is required.

Note: In case of rejecting insurance claims, insurance enterprises must inform insurance buyers or insurance beneficiaries in writing about reasons for rejection within 30 days from the date on which adequate applications for insurance claims are received.

Above is the entire guidance on the application file and time limit for claiming and paying insurance compensation when having an accident while participating in traffic. Hopefully, this information will help customers and members of LawNet to have more understanding about compulsory civil liability insurance for motor vehicle owners.

Le Thanh

- Key word:

- Decree No. 03/2021/NĐ-CP

Article table of contents

Article table of contents

.jpg)

.Medium.png)

.Medium.png)

.Medium.png)

.Medium.png)