The Decree No. 03/2021/NĐ-CP on compulsory civil liability insurance of motor vehicle users is officially effective from March 01, 2021. This Decree specifically stipulates the rights and obligations of insurance enterprises in Vietnam.

1. Insurance enterprises rights

Firstly, insurance enterprises rights in accordance with the Law on insurance business 2000 of Vietnam:

Pursuant to Clause 1 Article 17 of the Law on insurance business 2000 of Vietnam, an insurance enterprise shall have the following rights:

(1) To collect premiums as agreed upon in the insurance contract;

(2) To request the insurance buyer to fully and honestly supply information relating to the conclusion and performance of the insurance contract;

(3) To unilaterally suspend the performance of the insurance contract according to the provisions in Clause 2 of Article 19, Clause 2 of Article 20, Clause 2 of Article 35 and Clause 3 of Article 50, of this Law;

(4) To decline to pay the insurance money to the beneficiary or to pay indemnity to the insured for cases outside the scope of insurance liability or cases of exclusion of insurance liability as agreed upon in the insurance contract;

(5) To request the insurance buyer to take measures to prevent or limit losses according to the provisions of this Law and other relevant law provisions;

(6) To request the third party to refund the insurance money which the insurance enterprise has indemnified the insured for the losses caused by the third party to the property and civil liability;

(7) Other rights prescribed by law.

Secondly, insurance enterprises rights according to the Decree No. 03/2021/NĐ-CP of the Government of Vietnam on compulsory civil liability insurance of motor vehicle users:

Pursuant to Article 19 of the Decree No. 03/2021/NĐ-CP, in addition to rights under Law on Insurance Business, insurance enterprises have the rights to:

(1) Request insurance buyers and insurance beneficiaries to fully and truthfully provide details specified under certificates of insurance; inspect motor vehicle conditions before issuing certificates of insurance.

(2) Reduce up to 5% of property damage claims in case insurance buyers or insurance beneficiaries fail to notify insurance enterprises about accidents according to Clause 2 Article 16 of this Decree or fail to notify in case of changes to factors which serve as the basis for calculating insurance premiums thereby increasing insured risks after insured events have occurred.

(3) After paying advance compensation according to Point b Clause 2 Article 14 of this Decree, requesting Board for operating motor vehicle insurance funds to reimburse the advance payment in case accidents are identified to be within insurance liability exclusion or in case the advance payment exceeds insurance claims when the accidents are within scope of compensation.

(4) Request police authorities to provide copies of documents related to accidents specified under Clause 4 Article 15 of this Decree.

(5) Propose revision of principles, clauses, insurance premium schedules and compulsory civil liability insurance of motor vehicle users depending on practical implementation of the insurance.

2. Insurance enterprises obligations

Firstly, the general obligations of insurance enterprises are according to the Law on insurance business 2000 of Vietnam:

Pursuant to Clause 2 Article 17 of the Law on insurance business 2000 of Vietnam, an insurance enterprise shall have the following obligations:

(1) To explain to the insurance buyer the insurance conditions and provisions; the rights and obligations of the insurance buyers;

(2) To issue to the insurance buyer the insurance certificate, the insurance policy immediately after the conclusion of the insurance contract;

(3) To pay insurance money to the beneficiary in time or the indemnity to the insured when the insured event occurs;

(4) To explain in writing the reasons for declining to pay the insurance money or the indemnity;

(5) To coordinate with the insurance buyer in settling the third party’s claim for compensation for the losses which fall under the insured liability when the insured event occurs;

(6) Other obligations prescribed by law.

Secondly, insurance enterprises obligations according to the Decree No. 03/2021/NĐ-CP of the Government of Vietnam on compulsory civil liability insurance of motor vehicle users:

Pursuant to Article 20 of the Decree No. 03/2021/NĐ-CP, in addition to obligations under Law on Insurance Business, insurance enterprises have the obligations to:

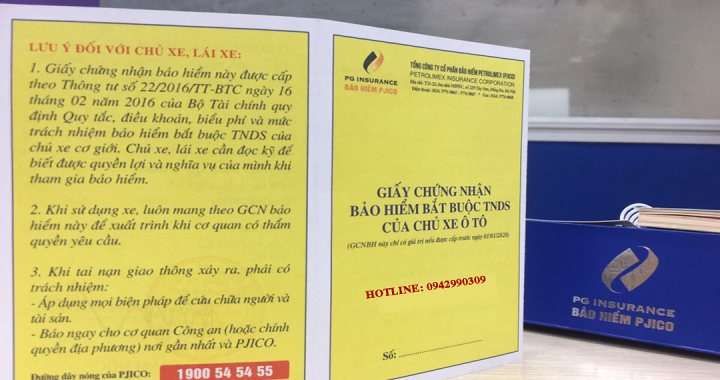

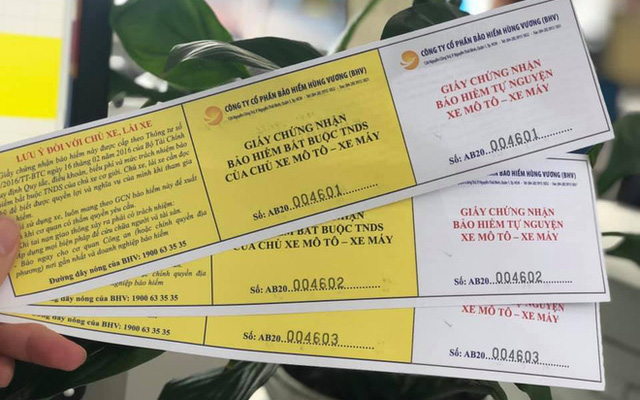

(1) Sell compulsory civil liability insurance of motor vehicle users according to this Decree and issue certificates of insurance for insurance buyers according to Clause 3 Article 6 of this Decree.

(2) Establish and maintain round the clock operation of hotline to promptly receive information on accidents, instruct and answer insurance buyers, insurance beneficiaries and relevant parties about issues related to compulsory civil liability insurance of motor vehicle users.

(3) Integrate ability to search certificates of insurance on website of insurance enterprises to enable inspecting and supervisory authorities and insurance buyers, insurance beneficiaries to search and verify insurance duration and effect of certificates of insurance.

(4) Within 1 hour after receiving notice on the accidents, insurance enterprises must inform insurance buyers, insurance beneficiaries and motor vehicle users about safety measures to minimize loss of life and property, provide guidelines on applications and procedures for requesting insurance claims; closely cooperate with insurance buyers, insurance beneficiaries, third party and relevant parties within 24 hours in organizing assessment of damage to determine causes and level of damage which serve as the basis for insurance claims.

(5) Inform insurance buyers, insurance beneficiaries and accident victims about compensation for life, health and pay according to Point a Clause 3 Article 14 of this Decree.

(6) Clarify principles, clauses and premiums of compulsory civil liability insurance of motor vehicles to enable insurance buyers and insurance beneficiaries to distinguish compulsory civil liability insurance of motor vehicle users from other forms of voluntary insurance.

(7) Actively collect documents required under insurance claim dossiers within responsibilities of insurance enterprises according to Article 15 of this Decree.

(8) Pay advance compensation, pay compensation quickly and precisely according to this Decree.

(9) Inform insurance buyers in writing according to Point c Clause 1, Point a Clause 2 and Point b Clause 3 Article 11 of this Decree.

(10) Pay police authorities fees for copying accident documents and records provided as per the law and keep secrets during investigation process.

(11) Within 15 days before insurance expires, inform insurance buyers and insurance beneficiaries about expiration of insurance contracts.

(12) Contribute to motor vehicle insurance fund according to Article 26 of this Decree.

(13) Keep separate accounts of insurance premiums, premiums, compensations and costs related to compulsory civil liability insurance of motor vehicle users. Costs related to compulsory civil liability insurance of motor vehicle users do not include non-commission financing for insurance agencies which insurance agencies are eligible for benefiting according to the Ministry of Finance, promotion and payment discount in any shape or form.

(14) Develop, implement and assign personnel to control implementation of professional principles and procedures, control risks, control internally, anti-fraud in insurance business related to compulsory civil liability insurance of motor vehicles.

(15) Be subject to inspection and supervision of competent authorities when implementing compulsory civil liability insurance of motor vehicle users.

(16) Organize implementation of compulsory civil liability insurance of motor vehicle users.

More rights and obligations of the motor vehicle users can be found at the Decree No. 03/2021/NĐ-CP of the Government of Vietnam, replacing the Decree No. 103/2008/NĐ-CP from March 01, 2021.

- Key word:

- Decree No. 03/2021/NĐ-CP

Article table of contents

Article table of contents

.jpg)

.Medium.png)

.Medium.png)

.Medium.png)

.Medium.png)