-

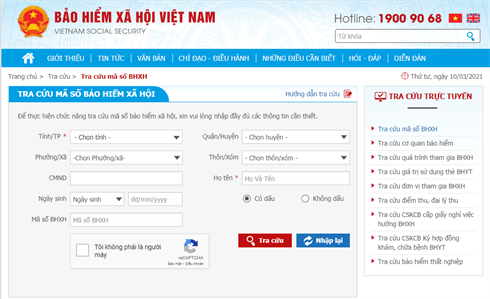

- Guidance on how to look up social insurance information online in Vietnam in 2021 (Newest)

- 23:32, 09/07/2024

- Online social insurance information lookup is one of the useful tools that help everyone quickly and accurately look up their social insurance information. Below is a complete guide on how to search for social insurance information online in Vietnam.

-

- What benefits for family members of employees entitled to when the employees pass away due to occupational accidents in Vietnam?

- 23:16, 09/07/2024

- Annually, our country witnesses numerous cases of occupational accidents resulting in significant human and property losses, including instances where these accidents lead to fatalities. So, which policies will the relatives of these employees be entitled to?

-

- What should employees do when the former company does not close the Social Insurance Book in Vietnam?

- 21:59, 09/07/2024

- Social insurance is a crucial basis to determine the levels of maternity, illness, retirement, and unemployment insurance benefits for employees in Vietnam. In the case where the former company does not finalize the social insurance book when an employee terminates the contract, how can the employee's rights be protected?

-

- Compilation of 47 Effective Legal Documents on Social Insurance, Unemployment Insurance, Health Insurance in Vietnam

- 21:07, 09/07/2024

- Insurance policies are an issue of great concern not only for businesses but also for employees in Vietnam. Below is a compilation of 47 latest documents regarding social insurance, unemployment insurance, and health insurance to help everyone easily understand the legal regulations on this matter in Vietnam.

-

- From 2021: What amounts shall be paid by employers to employees who are not covered by compulsory social insurance in Vietnam?

- 20:04, 09/07/2024

- Currently, there are instances where employees do not contribute to compulsory social insurance during their tenure at the company. In this case, what allowances must the company provide to the employees?

-

- How to receive a pension upon reaching retirement age for case not have sufficient years of social insurance contributions in Vietnam?

- 19:30, 09/07/2024

- Pension is an important policy aimed at ensuring income for workers who have reached retirement age in order to stabilize their lives. In the case where a worker has reached the retirement age but has not yet accumulated the required number of years of Social Insurance contributions, how can they receive a retirement pension?

-

- Strict handling of enterprises delaying payments of social insurance, health insurance, and unemployment insurance premiums in Vietnam

- 19:25, 09/07/2024

- Recently, Vietnam Social Security has issued the Action Program for the implementation of the 5-year Socio-Economic Development Plan 2021-2025 of the Social Insurance sector under Decision 1320/QD-BHXH. The entire Social Insurance sector is enhancing inspection, examination, and strictly handling enterprises delaying payments of social insurance, health insurance, and unemployment insurance premiums in Vietnam according to the provisions of the law.

-

- Vietnam: 10 tasks and solutions to implement the 5-year plan for social insurance sector's socio-economic development

- 19:25, 09/07/2024

- In order to achieve the objectives set out in Decision 1320/QD-BHXH on the Action Program for the implementation of the 5-year socio-economic development plan (2021-2025) of the social insurance sector, Vietnam Social Insurance has identified 10 groups of tasks and key solutions to implement the 5-year socio-economic development plan.

-

- Vietnam: If the original documents are no longer available, how will employees be eligible for social insurance benefits?

- 19:11, 09/07/2024

- How is an employee handled for social insurance policies when there are no original records indicating their working period before January 01, 1995? This is the question that was received by LawNet from Ho Cam V** on November 02, 2020.

-

- Vietnam: Which entities are required to pay compulsory social insurance premiums in 2021?

- 19:02, 09/07/2024

- Employees and employers in Vietnam must pay compulsory social insurance premiums - a type of social insurance organized by the State. So, which entities are required to pay compulsory social insurance premiums in 2021?

Most view

SEARCH ARTICLE

JUST UPDATED

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

Most view