administrative sanctions

-

- Regulations on the authority of Chairpersons of the People's Committees at various levels in imposing land-related administrative sanctions in Vietnam

- 19:30, 08/10/2024

- Below is the content of the regulations on the authority of Chairpersons of the People's Committees at various levels in imposing land-related administrative sanctions in Vietnam

-

- Administrative sanctions for violations against regulations on documents, certificates in land use in Vietnam

- 14:49, 07/10/2024

- The Government of Vietnam promulgated Decree 123/2024/ND-CP on October 4, 2024, stipulating land-related administrative sanctions in Vietnam.

-

- Contents of the decisions on administrative sanctions in Vietnam

- 09:30, 26/07/2024

- Below are the contents of the decisions on administrative sanctions in Vietnam according to the Law on Handling of Administrative Violations 2012.

-

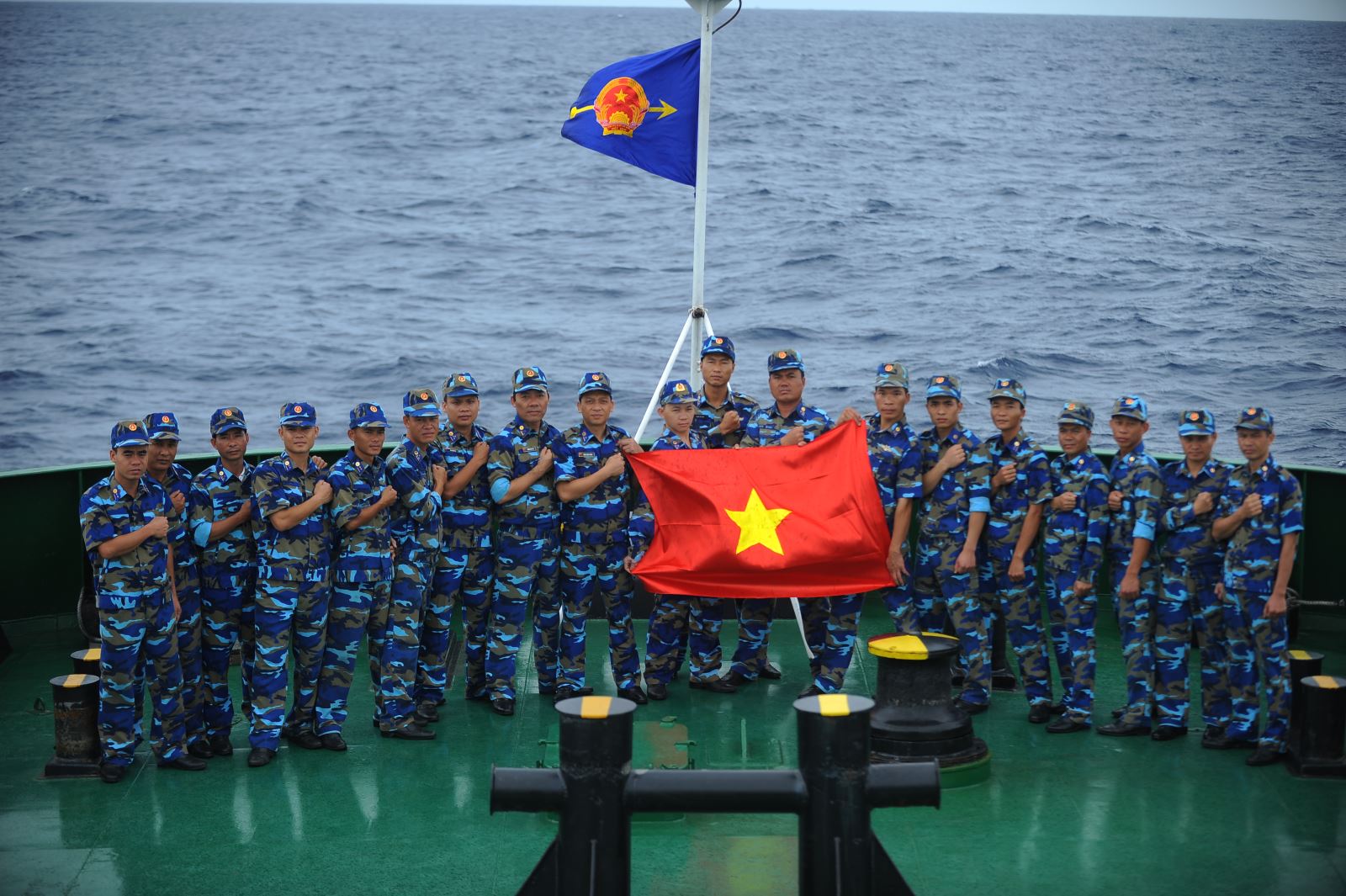

- Compilation of 37 documents on administrative sanctions by the coast guard in Vietnam

- 18:22, 09/07/2024

- The jurisdiction of the Coast Guard in Vietnam in imposing penalties is not limited to the field of waterway and maritime traffic, but also extends to various other fields such as banking and currency, tourism, health, etc.

-

- The positions of Head of the People's Public Security Department eligible to impose administrative sanctions in a number of areas in Vietnam

- 11:30, 30/11/2023

- On November 17, 2023, the Minister of Public Security issued Circular 65/2023/TT-BCA stipulating that the Head of the Professional Department of the People's Public Security (CAND) has the authority to sanction administrative violations in the field of security, order and social safety; Prevention of social evils; fire protection and prevention; rescue and salvage; prevent and combat domestic violence in Vietnam.

-

- Administrative sanctions for violation against regulations on operation of bailiff office in Vietnam

- 17:08, 13/07/2023

- What are the administrative sanctions for violation against regulations on operation of bailiff office in Vietnam? - Que Anh (Lam Dong)

-

- Vietnam: How shall enterprises sanctioned for late submission of tax declarations?

- 15:38, 18/05/2020

- I want to ask how will enterprises making late submission of tax declarations such as VAT, PIT, etc. be handled? This is the question of Mr. Ha Van Manh in Ho Chi Minh City sent to LawNet on May 14, 2020.

-

- Vietnam: Summary of violations pertaining to taxation and corresponding fines

- 09:03, 04/05/2020

- In order to support Customers and Members to conveniently monitor and grasp Vietnam’s current legal regulations on administrative penalties for violations pertaining to taxation, LawNet would like to summarize all fines for tax violations in the table below.

-

- Vietnam: Trading fertilizers which have expired shall be fined up to VND 80,000,000

- 09:46, 18/04/2018

- This is a notable new point specified in Decree No. 55/2018/ND-CP of Vietnam’s Government prescribing administrative penalties for violations arising in the fertilizer sector.

Most view

SEARCH ARTICLE