What is the latest confirmation form for student loan in Vietnam in 2024?

What is the latest confirmation form for student loan in Vietnam in 2024?

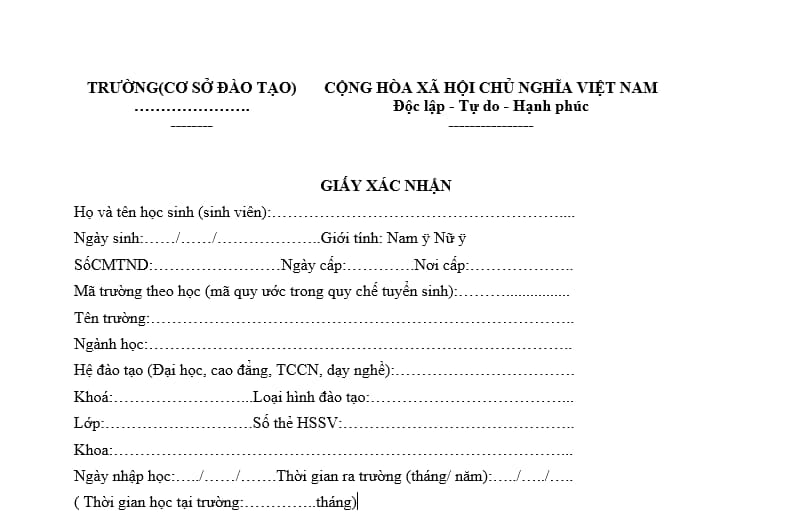

The latest confirmation form for student loan 2024 is Form 01/TDSV issued with Official Dispatch 7375/BGDDT-CTHSSV in 2008.

Download the latest confirmation form for student loan 2024 here: download

What is the latest confirmation form for student loan in Vietnam in 2024? (Image from the Internet)

Vietnam: What is the maximum student loan amount per month?

According to Article 5 of Decision 157/2007/QD-TTg as amended by Clause 2, Article 1 of Decision 05/2022/QD-TTg, the loan amount is regulated as follows:

Loan Amount:

The maximum loan amount is VND 4,000,000 per month per student.

The Vietnam Bank for Social Policies stipulates the specific loan amount for students based on tuition fees of each school and living expenses by region but does not exceed the maximum loan amount specified in Clause 1 of this Article.

When the State's tuition policy changes and living costs fluctuate, the Vietnam Bank for Social Policies, in agreement with the Minister of Finance, submits to the Prime Minister of the Government of Vietnam for consideration and decision on adjusting the loan amount.

Thus, the maximum student loan amount is VND 4,000,000 per month per student.

The specific loan amount for each student will follow the regulations of the Vietnam Bank for Social Policies based on the tuition fees of each school and living expenses by the region but will not exceed the maximum loan amount of VND 4,000,000 per month per student.

Which students are eligible for student loans in Vietnam?

According to Article 2 of Decision 157/2007/QD-TTg as amended by Clause 1, Article 1 of Decision 05/2022/QD-TTg, the students eligible for loans include those with difficult circumstances studying at universities (or equivalent), colleges established and operating under the laws of Vietnam, including:

- Orphaned students who have lost both parents or lost one parent and the other is unable to work.- Students from families belonging to one of the following categories:

+ Poor households according to legal standards.+ Near-poor households according to legal standards.+ Households with an average living standard according to legal standards.

What are the methods of student loans in Vietnam?

According to Article 3 of Decision 157/2007/QD-TTg, the loan methods for students are defined as follows:

Loan Method:

Loans for students are provided through the household. The household representative directly borrows the loan and is responsible for repaying the Vietnam Bank for Social Policies. In cases where the student is orphaned and has lost both parents or lost one parent and the other is unable to work, the student can borrow directly from the Vietnam Bank for Social Policies where the school is located.

The Vietnam Bank for Social Policies is designated to provide loans to students.

Thus, students can borrow through the following methods:

- Borrow through the household;- Directly borrow for orphaned students who have lost both parents or lost one parent and the other is unable to work.

What is the student loan interest rate in Vietnam?

According to Article 7 of Decision 157/2007/QD-TTg, the regulations are as follows:

Loan Interest Rate:

The preferential loan interest rate for students is 0.5% per month.

The overdue debt interest rate is calculated at 130% of the loan interest rate.

In Clause 1, Article 1 of Decision 750/QD-TTg in 2015, it is prescribed that:

Adjustment of Loan Interest Rates for Certain Policy Credit Programs at the Vietnam Bank for Social Policies as follows:

1. The loan interest rate for poor households, students, policy beneficiaries working abroad for a limited time, and loans from the National Employment Fund is 6.6% per year (0.55% per month). This provision replaces the regulation in Decision No. 872/QDD-TTg dated June 6, 2014, by the Prime Minister of the Government of Vietnam on the adjustment of loan interest rates for certain policy credit programs at the Vietnam Bank for Social Policies.

- The loan interest rate for the Rural Clean Water and Sanitation Program, loans to households for production and business in difficult areas is 9.0% per year (0.75% per month). This provision replaces the regulations in Clauses 2 and 3, Article 1, Decision No. 1826/QD-TTg dated October 9, 2013, by the Prime Minister of the Government of Vietnam on the adjustment of loan interest rates for certain policy credit programs at the Vietnam Bank for Social Policies.

Thus, the student loan interest rate is 6.6% per year (equivalent to 0.55% per month).

What are the regulations on the student loan term in Vietnam?

According to Article 6 of Decision 157/2007/QD-TTg, the student loan term is regulated as follows:

- The loan term is the period from the date the borrower starts receiving the loan until the principal and interest are fully repaid, as recorded in the credit contract. The loan term includes the disbursement period and the repayment period.

- The disbursement period is the time from the date the borrower receives the first loan installment until the student completes the course, including the time students are allowed to take temporary leave and have their study results preserved (if any).

The disbursement period is divided into disbursement terms as stipulated or agreed upon by the Vietnam Bank for Social Policies and the borrower.

- The repayment period is the time from the date the borrower makes the first repayment until the loan (principal and interest) is fully repaid.

For training programs with a duration of up to one year, the maximum repayment term is twice the disbursement period. For other training programs, the maximum repayment term is equal to the disbursement period.

The repayment period is divided into repayment terms as stipulated by the Vietnam Bank for Social Policies.