The formula for calculating teachers' salaries in 2024 and the retention differential coefficient according to Circular 07/2024/TT-BNV in Vietnam

The formula for calculating teachers' salaries in 2024 according to Circular 07/2024/TT-BNV in Vietnam

Article 3 of Circular 07/2024/TT-BNV guides the calculation of salaries, allowances, and activity expenses for those entitled to the new statutory pay rate of 2.34 million VND/month from July 1, 2024, under Clauses 1, 2, 3, 4, 5, 8, and 9 of Article 1 Circular 07/2024/TT-BNV.

Teachers are categorized into two groups: public employee teachers and teachers working under labor contracts.

Thus, public employee teachers, who are subject to a statutory pay rate increase from 1.8 million VND to 2.34 million VND, will apply the salary calculation formula as guided in Circular 07/2024/TT-BNV.

The formula for calculating teacher salaries according to the new statutory pay rate is:

| Salary effective from July 1, 2024 = Statutory pay rate 2.34 million/month x Salary coefficient |

In which:

- The salary coefficient for preschool teachers is applied according to Article 8 of Circular 01/2021/TT-BGDDT.

- The salary coefficient for primary teachers is applied according to Article 8 of Circular 02/2021/TT-BGDDT.

- The salary coefficient for secondary school teachers is applied according to Article 7 of Circular 03/2021/TT-BGDDT as amended by Clause 8, Article 3 of Circular 08/2023/TT-BGDDT.

- The salary coefficient for high school teachers is applied according to Article 8 of Circular 04/2021/TT-BGDDT.

- The salary coefficient for university lecturers is applied according to Article 10 of Circular 40/2020/TT-BGDDT.

Note: The above method for calculating teacher salaries is based solely on the salary coefficient and statutory pay rate as prescribed and does not include allowances (if any).

The formula for calculating teachers' salaries in 2024 and the retention differential coefficient according to Circular 07/2024/TT-BNV in Vietnam (Image from the Internet)

The formula for the retention differential coefficient according to Circular 07/2024/TT-BNV in Vietnam

Differential coefficients are used to balance the new salary with the current salary to ensure the rights and benefits of officials and public employees in general and public employee teachers in particular.

Based on point c, Clause 1, Article 3 of Circular 07/2024/TT-BNV, the formula for calculating the amount by differential coefficients is as follows:

Formula for calculating the amount of differential coefficients (if any):

| The amount of differential coefficient effective from July 1, 2024 | = | (Statutory pay rate 2,340,000 VND/month) | x | (Current differential coefficient (if any)) |

Earlier, Clause 3, Article 3 of Decree 73/2024/ND-CP stipulated:

- For central agencies and units applying special financial and income mechanisms:

+ Maintain the differential between June 2024 salaries and additional income of officials and public employees and post-July 1, 2024 salaries after amending or abolishing the financial and income mechanisms.

+ During the period of non-amendment or non-abolition of these mechanisms, implement the monthly salary and additional income calculated according to the statutory pay rate of 2,340,000 VND/month to ensure it does not exceed June 2024 salary and additional income (excluding adjustments to salary coefficients due to rank and step promotions).

+ If the salary and additional income post-July 1, 2024, by special mechanisms are lower than the regulated salary, implement the salary policies as per common regulations.

What are details of the new teacher salary table from July 1, 2024 in Vietnam?

Following 04 Circulars from the Ministry of Education and Training specify the salary coefficients for teachers at various levels, including Circular 01/2021/TT-BGDDT, Circular 02/2021/TT-BGDDT, Circular 03/2021/TT-BGDDT, Circular 04/2021/TT-BGDDT, and as amended by Circular 08/2023/TT-BGDDT.

Based on Article 3 of Circular 07/2024/TT-BNV, the salary of public employee teachers is calculated as follows:

Salary = Coefficient x Statutory pay rate

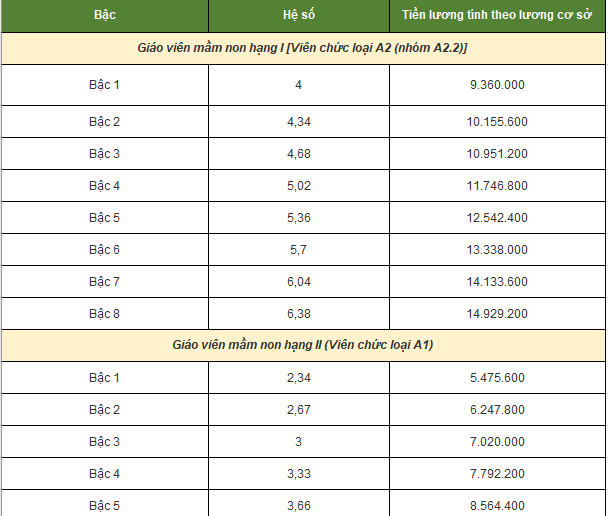

The teacher salary table based on the statutory pay rate is as follows:

View the detailed new teacher salary table from July 1, 2024 here.

What are changes of the salary of non-public employee teachers in 2024 in Vietnam?

Based on Article 90 of the Labor Code 2019

Salary

1. Salary is the amount paid by the employer to the employee as agreed upon to perform the job, including the pay for the job or position, salary allowances, and other additional amounts.

2. The pay for the job or position must not be lower than the minimum wage.

3. Employers must ensure equal pay, without gender discrimination, for employees performing jobs of equal value.

The salary will be determined based on the agreement between the teacher and the school. This agreement needs to comply with the minimum wage.

According to Article 91 of the Labor Code 2019, the minimum wage is stipulated as follows:

Minimum wage

1. The minimum wage is the lowest wage paid to an employee performing the simplest job under normal working conditions, ensuring the minimum living standards of the employee and their family, in line with socioeconomic development conditions.

2. The minimum wage is determined according to regions and specified by month, hour.

3. The minimum wage is adjusted based on the minimum living standards of the worker and their family; the proportional relationship between the minimum wage and wages on the market; consumer price index, economic growth rate; labor supply and demand; employment and unemployment; labor productivity; the payment capacity of enterprises.

4. The Government of Vietnam specifies this Article; decides and announces the minimum wage based on recommendations of the National Wage Council.

Clause 1, Article 3 of Decree 74/2024/ND-CP stipulates the monthly minimum wage and hourly minimum wage for employees working for employers by region as follows:

| Region | Monthly Minimum Wage (Unit: VND/month) |

Hourly Minimum Wage (Unit: VND/hour) |

| Region 1 | 4,960,000 | 23,800 |

| Region 2 | 4,410,000 | 21,200 |

| Region 3 | 3,860,000 | 18,600 |

| Region 4 | 3,450,000 | 16,600 |