Are students entitled to participate in health insurance in Vietnam?

Are students entitled to participate in health insurance in Vietnam?

According to Article 12 of the 2008 Health Insurance Law (amended by Clause 6, Article 1 of the 2014 Amended Health Insurance Law), the entities eligible for health insurance participation are regulated as follows:

Entities eligible for health insurance participation

...

4. Groups partially subsidized by the state budget, including:

a) Members of near-poor households;

b) Students.

5. Family-based health insurance participants consist of those who are members of a household, except for those specified in Clauses 1, 2, 3, and 4 of this Article.

6. The Government of Vietnam stipulates other entities besides those specified in Clauses 3, 4, and 5 of this Article; stipulates the issuance of health insurance cards for entities managed by the Ministry of Defense and the Ministry of Public Security and the entities specified in Point 1, Clause 3 of this Article; stipulates the roadmap for implementing health insurance, the scope of benefits, the level of health insurance enjoyment, health insurance medical examination and treatment, the management and use of the fund dedicated to health insurance medical examination and treatment, health insurance assessment, payment, and settlement for the entities specified in Point a, Clause 3 of this Article.

Thus, according to the above provisions, students belong to the group receiving partial state budget support for health insurance contribution rates.

Are students entitled to participate in health insurance in Vietnam? (Image from the Internet)

How to calculate health insurance contribution rates for students in Vietnam?

Based on Article 7 of Decree 146/2018/ND-CP, the regulations are as follows:

Health insurance contribution rates and responsibilities for premium payments

1. The monthly health insurance premium rates for different entities are specified as follows:

a) 4.5% of the monthly wage of employees for those specified in Clause 1, Article 1 of this Decree.

- Employees who take sick leave for 14 days or more in a month according to the social insurance law are not required to pay health insurance contribution rates but are still entitled to health insurance benefits;

- Employees who are temporarily detained, held, or suspended from work pending investigation and conclusion on whether they have violated the law or not shall pay 4.5% of 50% of their monthly wage during such time. If competent authorities conclude no violation of the law, employees must retrospectively pay health insurance contribution rates on the retrieved wage amount;

b) 4.5% of the retirement wage, loss of labor capacity allowance for those specified in Clause 1, Article 2 of this Decree;

c) 4.5% of the monthly wage of employees before maternity leave for those specified in Clause 5, Article 2 of this Decree;

d) 4.5% of the unemployment allowance for those specified in Clause 6, Article 2 of this Decree;

đ) 4.5% of the statutory pay rate for other entities;

e) health insurance contribution rates for those specified in Article 5 of this Decree are as follows: The first member pays 4.5% of the statutory pay rate; the second, third, and fourth members pay 70%, 60%, and 50%, respectively, of the first member's premium; from the fifth member onward, the premium is 40% of the first member's premium.

The reduction of health insurance contribution rates as specified in this Point applies when family members collectively participate in health insurance within the same fiscal year.

...

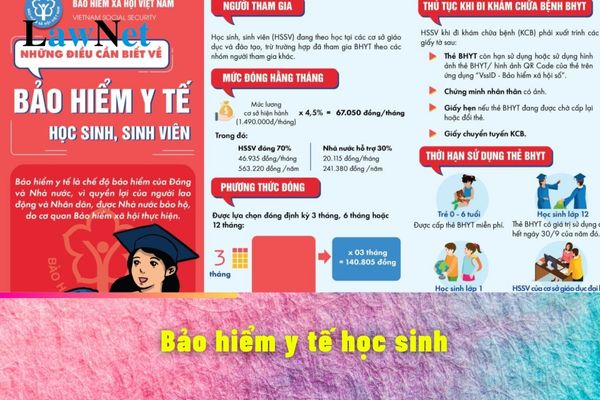

Thus, students' health insurance contribution rates are calculated as 4.5% of the statutory pay rate.

The current statutory pay rate according to Clause 2, Article 3 of Decree 73/2024/ND-CP is VND 2,340,000/month.

Therefore, the health insurance premium for students = 4.5% of VND 2,340,000/month = VND 105,300. (In which, the State supports 30%, and the rest is paid by the students themselves.)

What is the support rate from the state budget for students participating in health insurance in Vietnam?

Based on Article 8 of Decree 146/2018/ND-CP (amended by Point a, Clause 3, Article 1 of Decree 75/2023/ND-CP), the regulations are as follows:

State budget support levels

1. From the effective date of this Decree, the state budget support levels for certain entities are as follows:

...

b) Minimum support of 70% of the health insurance premium for those specified in Clauses 1, 2, and 5, Article 4 of this Decree;

c) Minimum support of 30% of the health insurance premium for those specified in Clauses 3 and 4, Article 4 of this Decree.

2. If an individual is eligible for health insurance premium support from the state budget under multiple categories specified in Clause 1 of this Article, they shall receive support according to the category with the highest support level.

3. Provincial and city-level People's Committees shall, based on local budget capabilities and other legal sources, including the 20% fund specified in Point a, Clause 3, Article 35 of the Health Insurance Law (if any), develop and present higher health insurance premium support levels than the minimum support specified in Clause 1 of this Article to the local People's Council for approval.

Additionally, Clause 3, Article 4 of Decree 146/2018/ND-CP specifies:

Groups partially subsidized by the state budget

...

3. Students.

...

Thus, according to the above regulations, monthly, students must pay health insurance contribution rates equal to 4.5% of the statutory pay rate. Of this, the State supports 30%, equivalent to VND 31,590.