What is the salary of senior accountants in Vietnam in 2023? What are the criteria to become a senior accountant in 2023?

What is the salary of senior accountants in Vietnam in 2023?

Pursuant to Point a, Clause 1, Article 24 of Circular 29/2022/TT-BTC of Vietnam stipulating as follows:

Salary classification of civil servants specialized in accounting, tax, customs, reservation

1. The ranks of civil servants specialized in accounting, tax, customs, and reserves specified in this Circular may apply the professional salary table for cadres and civil servants in State agencies (Table 2) promulgated together with the Government's Decree No. 204/2004/ND-CP dated December 14, 2004 on the salary regime for cadres, civil servants, public employees and the armed forces and amended in Decree No. No. 17/2013/ND-CP dated February 19, 2013 of the Government as follows:

a) The ranks of senior tax inspector (code 06.036) and senior customs inspector (code 08.049) are entitled to the salary coefficient of grade A3, group 1 (A3.1), from the salary coefficient. 6.20 to 8.00 salary multiplier.

The senior accountant rank (code 06.029) is entitled to the salary coefficient of civil servants grade A3, group 2 (A3.2), from salary coefficient 5.75 to salary coefficient 7.55;

...

Thus, according to the above regulations, senior accountants apply salaries of civil servants A3, group 2 (A3.2) with a salary coefficient from 5.75 to 7.55.

Pursuant to Clause 2, Article 3 of Decree 38/2019/ND-CP of Vietnam stipulating as follows:

Statutory pay rate

1. The statutory pay rate is the basis for:

a) Determining the levels of salaries in payrolls, allowances and other benefits as per the law with regard to individuals as defined in Article 2 hereof;

b) Determining subsistence allowances as per the law;

c) Determining contributions and benefits concerning the statutory pay rate.

2. From July 1, 2019, the statutory pay rate is VND 1,490,000 per month.

3. The Government shall request the National Assembly to consider adjusting the statutory pay rate in conformity with the capacity of the state budget, consumer price index and national economic growth rate.

Thus, according to the above regulations, the statutory pay rate of senior accountants is VND 1,490,000 per month. However, on November 11, 2022, at the National Assembly session, the delegates agreed to increase the statutory pay rate from VND 1,490,000 per month currently applied to VND 1,800,000 per month from July 1, 2023.

Therefore, the statutory pay rate applied in the calculation of salaries of senior accountants in 2023 will include two levels of VND 1,490,000 per month and VND 1,800,000 per month in the following two periods:

- Phase 1: From now until the end of June 30, 2023: Salary of civil servant of senior accountant = Coefficient x VND 1,490,000 per month.

- Phase 2: From July 1, 2023 until a new policy on salary applies to civil servants and public employees: Salary of civil servant of senior accountant = VND 1,800,000 per month x coefficient.

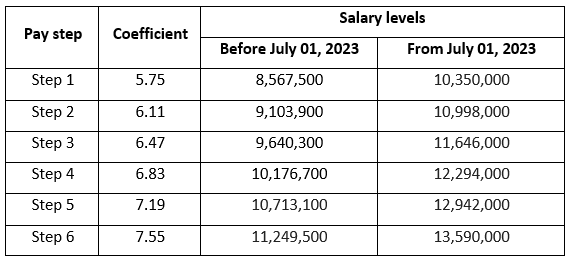

Specifically, the salary of senior accountants in 2023 will be as follows:

What are the duties of a senior accountant?

Pursuant to Clause 2, Article 5 of Circular 29/2022/TT-BTC of Vietnam stipulating the duties of senior accountants as follows:

- Presiding over the research and development of legal documents on finance and accounting; strategic projects to develop accounting work for industries and fields.

- To assume the prime responsibility for organizing the professional coordination of the related fields among the management levels in the same field of the branches to ensure uniformity and synchronization throughout the country.

- Presiding over the development of documents, textbooks and instructions for training and fostering accounting staff.

- Presiding over, organizing, directing and performing accounting work, checking accounting operations.

- Presiding over the organization of summarizing, evaluating, analyzing financial, drawing experience and proposing plans to adjust, amend or supplement the business process; amending and supplementing current accounting regulations in order to organize strict management more effectively and efficiently.

What is the salary for senior accountants in Vietnam in 2023? What are the criteria to become a senior accountant in 2023? (Image from the Internet)

What are the criteria to become a senior accountant in 2023?

Pursuant to Clauses 3 and 4, Article 5 of Circular 29/2022/TT-BTC of Vietnam stipulating the criteria for becoming a senior accountant in 2023 as follows:

- Standards of professional competence:

+ Firmly grasp the Party's guidelines and policies, the State's laws, and firmly grasp the administrative management, administrative reform and socio-economic development strategies of the Government, branches and fields; organizational structure of the unit and the provisions of the law on accounting.

+ Understand and comply with the Accounting Law, accounting standards, state financial and accounting regimes, international laws related to the accounting work of the industry, field and specific accounting regimes applied in the industries and fields.

+ Capable of proposing, advising on policy making, presiding over the development of laws, ordinances, and projects related to accounting and submitting them to competent authorities for consideration and decision.

+ Having deep and wide expertise in accounting theory and practice, methods and development trends of domestic and international accounting and auditing work.

+ Capable of doing scientific research and organizing and directing the application of modern technical advances to improve the accounting management system.

+ Having basic information technology skills and using foreign languages or using ethnic minority languages for civil servants working in ethnic minority areas as required by the job position.

- Standards of training and retraining qualifications

+ Possess a university degree or higher in accounting, auditing or finance.

+ Possessing an advanced diploma in political theory or an advanced political-administrative theory or having a certificate of equivalent advanced level of political theory from a competent authority.

+ Possessing a certificate of state management knowledge and skills training for civil servants with the rank of senior expert and equivalent or an advanced degree in political-administrative theory.

Thư Viện Pháp Luật