What are the regulations on good-received note and good-dispatch note for business households and individuals in Vietnam?

- What are the purposes of good-received note and good-dispatch note for business households and individuals in Vietnam?

- What are the regulations forms and methods of good-received note for business households and individuals in Vietnam?

- What are the regulations forms and methods of good-dispatch note for business households and individuals in Vietnam?

What are the purposes of good-received note and good-dispatch note for business households and individuals in Vietnam?

Pursuant to Section 2, Appendix 1 issued together with Circular 88/2021/TT-BTC, with the purpose of good-received note and good-dispatch note as follows:

A goods-received note is issued to certify the quantity of materials, devices, products or goods received for use as the basis of movement of goods into the warehouse and recording entries in the book of materials, devices, products and goods.

The goods-dispatch note is issued to certify the quantity of materials, devices, products or goods delivered to departments of a household business or individual business and used as the basis for monitoring business expenses.

What are the regulations on good-received note and good-dispatch note for business households and individuals in Vietnam?

What are the regulations forms and methods of good-received note for business households and individuals in Vietnam?

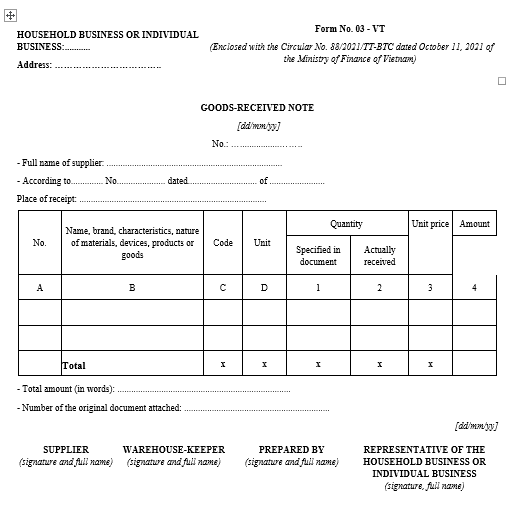

At the latest, the form of good-received note for business households and individuals is specified in Form 03-VT issued together with Circular 88/2021/TT-BTC as follows:

Download the form of good-received note for business households and individuals: Here.

In addition, the method for preparing good-received note for business households and individuals, according to Section 2, Appendix 1 issued together with Circular 88/2021/TT-BTC, has the following instructions:

Name and address of the household business or individual business must be clearly indicated in the upper left-hand corner of the goods-received note. A goods-received note is used to record materials, devices, products or goods received from external vendors, in-plant production or outsourced processing facilities or found to be in surplus during stocktaking.

The goods-received note must clearly indicate its reference number and date, full name of the supplier, number of invoice or warehousing order, and place of receipt.

Columns A, B, C, D: the ordinal number, name, brand, characteristics, nature, code and unit of materials, devices, products or goods are specified.

Column 1: Quantity specified in document (invoice or warehousing order) is specified.

Column 2: Quantity of materials, devices, products or goods actually received is specified.

Columns 3, 4: The unit price and amount of each type of materials, devices, products or goods actually received are specified.

“Total” line: Total amount of materials, devices, products and goods received under a goods-received note.

“Total amount (in words)” line: Total amount is specified in the goods-received note in words.

A goods-received note is made in 2 copies using carbon paper.

A goods-received note must adequately bear signatures and full names of all of relevant persons. Copy 1 of the goods-received note is kept by the household business or individual business for recording entries in the accounting book while copy 2 is delivered to the supplier.

The representative of the household business/individual business who is also the warehouse-keeper or preparer may append his/her signature to parts of such concurrent positions on the goods-received note.

What are the regulations forms and methods of good-dispatch note for business households and individuals in Vietnam?

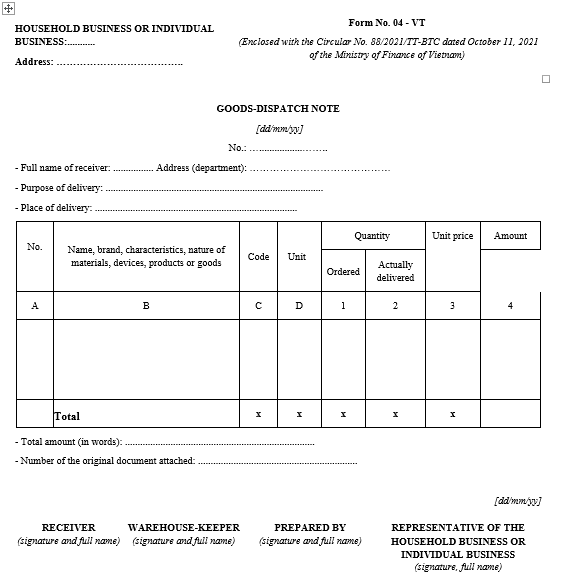

The latest, the form of good-dispatch note for business households and individuals is specified in Form No. 04-VT issued together with Circular 88/2021/TT-BTC as follows:

Download form of good-dispatch note for business households and individuals: Here.

In addition, the method of preparing good-dispatch note for business households and individuals, according to Section 2, Appendix 1 issued together with Circular 88/2021/TT-BTC, has the following instructions:

Name of the household business or individual business must be clearly indicated in the left-hand corner of the goods-dispatch note. A goods-dispatch note may cover one or multiple types of materials, devices, products or goods stored in the same warehouse and recorded in the same item of expenses or used for the same purpose.

Full name of receiver, name of unit (department), number of date of the goods-dispatch note, purpose and place of delivery of materials, devices, products or goods.

- Columns A, B, C, D: the ordinal number, name, brand, characteristics, nature, code and unit of materials, devices, products or goods.

- Column 1: Quantity of materials, devices, products or goods ordered is specified.

- Column 2: Quantity of materials, devices, products or goods actually delivered (which may be equal to or fewer than the one ordered) is specified.

- Columns 3, 4: The unit price and amount of each type of materials, devices, products or goods actually delivered (column 4 = column 2 x column 3) are specified.

“Total” line: Total amount of materials, devices, products or goods actually delivered is specified.

“Total amount (in words)” line: Total amount is specified in the goods-dispatch note in words.

The goods-dispatch note is made in 2 copies using carbon paper.

A goods-dispatch note must adequately bear signatures and full names of all of relevant persons. Copy 1 of the goods-dispatch note is kept by the household business or individual business for recording entries in the accounting book while copy 2 is delivered to the receiver.

The representative of the household business/individual business who is also the warehouse-keeper or preparer may append his/her signature to parts of such concurrent positions on the goods-dispatch note.

Thư Viện Pháp Luật