What are the procedures for declaration of VAT on revenue using direct method in Vietnam?

- What is the application for the implementation of the procedure for declaration of VAT on revenue using direct method in Vietnam?

- How to fill out VAT declaration form for taxpayers using the direct method in Vietnam?

- What are the procedures for declaration of VAT on revenue using direct method in Vietnam?

What is the application for the implementation of the procedure for declaration of VAT on revenue using direct method in Vietnam?

Based on the provisions in Section 3 of Part II of the Administrative Procedure attached to Decision 1462/QD-BTC in 2022, the List of Tax Declaration Documents in Appendix I issued with Decree 126/2020/ND-CP and Appendix II issued with Circular 80/2021/TT-BTC, the documentation for the implementation of the procedure for declaring VAT on revenue using the direct method includes:

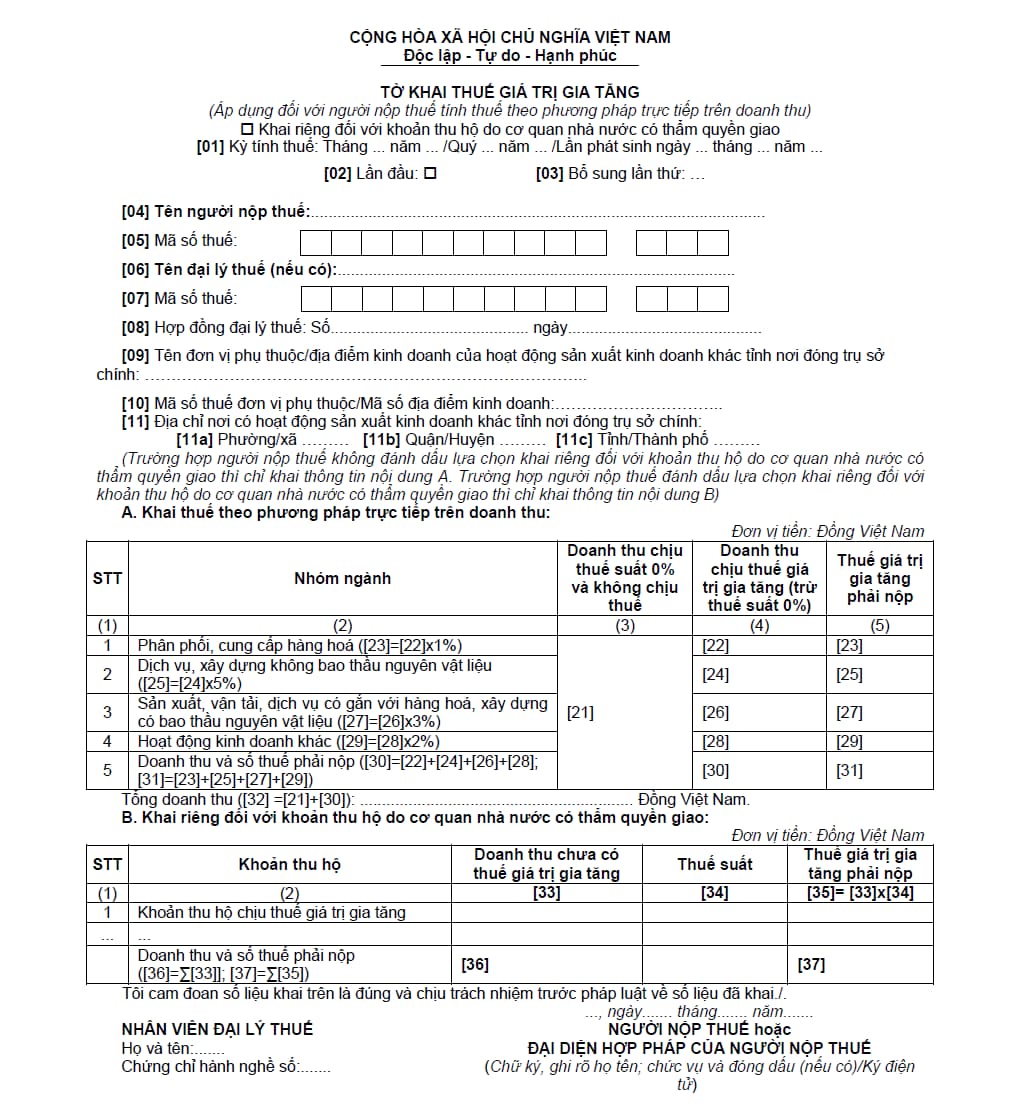

VAT Declaration Form (applicable to taxpayers using the VAT calculation on revenue using the direct method), form No. 04/GTGT.

Download the VAT Declaration Form applicable to taxpayers using the VAT calculation on revenue using the direct method here.

What are the procedures for declaration of VAT on revenue using direct method in Vietnam?

How to fill out VAT declaration form for taxpayers using the direct method in Vietnam?

To fill out the VAT declaration form (form number 04/GTGT) for taxpayers using the direct method in Vietnam, follow the instructions below:

General Information:

- If the taxpayer has revenue collected by a competent state agency as prescribed in point c, clause 2, Article 7 of Decree 126/2020/ND-CP dated October 19, 2020, select the checkbox "Separate declaration for revenue collected by a competent state agency" and provide details in section B of the form.

- Item [01] - Tax period: Declare the tax period, which is the month when the tax liability arises. If the taxpayer is approved by the tax authority to declare taxes on a quarterly basis or if the taxpayer is a newly established entity, declare the tax period as the quarter when the tax liability arises. If there are non-regular business activities, declare each occurrence of the tax liability.

- Items [02], [03]: Tick "First time". If the taxpayer discovers any mistakes or omissions in the initial tax declaration submitted to the tax authority, provide supplementary declarations according to the sequence number for each supplementary declaration.

Note:

- For taxpayers who submit electronic declarations, the Etax system will assist in determining the corresponding "First time" declaration for each business activity in item [01a].

- Once the Etax system accepts the initial tax declaration, subsequent tax declarations for the same tax period and business activities should be marked as "Supplementary" declarations. Taxpayers must submit "Supplementary" declarations according to the regulations on supplementary declarations.

- Items [04], [05]: Provide information on the taxpayer's name and tax identification number based on the business registration or tax registration information.

- Items [06], [07], [08]: In the case of a tax representative, provide information on the tax representative's name, tax identification number, and the contract number and date of the tax representative agreement. The tax representative must have a tax registration status of "Active," and the agreement must be valid at the time of tax declaration.

Note:

For taxpayers who submit electronic declarations, the Etax system will automatically display information about the tax representative and the tax representative agreement registered with the tax authority for selection if there are multiple tax representatives or agreements.

Items [09], [10], [11]: Provide information on the dependent unit, business location situated in a different province from the main headquarters as stipulated in point b, clause 1, Article 11 of Decree 126/2020/ND-CP dated October 19, 2020.

If there are multiple dependent units or business locations in different districts managed by the Tax Department, select one representative unit to declare in this item. If there are multiple dependent units or business locations in different districts managed by the Regional Tax Department, select one representative unit for the district managed by the Regional Tax Department to declare in this item.

For taxpayers who submit electronic declarations, the Etax system will automatically display information about the dependent unit and registered business location for selection.

Part of the declaration of the items in the table:

A. Declaration of tax according to revenue using direct method:

Based on the invoices and documents issued during the period, declare them in this section.

Item [21]: Declare information on taxable revenue at 0% tax rate and non-taxable revenue, not required to be detailed by industry groups.

Item [22]: Declare information on value-added tax (excluding 0% tax rate) applicable to the distribution and supply of goods sector.

Item [23]: Declare the value-added tax payable for the distribution and supply of goods sector, calculated based on the formula [23]=[22]x1%.

Item [24]: Declare information on value-added tax (excluding 0% tax rate) applicable to the service sector and non-material procurement construction sector.

Item [25]: Declare the value-added tax payable for the service sector and non-material procurement construction sector, calculated based on the formula [25]=[24]x5%.

Item [26]: Declare information on value-added tax (excluding 0% tax rate) applicable to the manufacturing, transportation, and service sectors related to goods and construction with material procurement.

Item [27]: Declare the value-added tax payable for the manufacturing, transportation, and service sectors related to goods and construction with material procurement, calculated based on the formula [27]=[26]x3%.

Item [28]: Declare information on value-added tax (excluding 0% tax rate) applicable to other business activities.

Item [29]: Declare the value-added tax payable for other business activities, calculated based on the formula [28]=[29]x2%.

Item [30]: Declare the total taxable value-added revenue (excluding 0% tax rate) calculated based on the formula [30]=[22]+[24]+[26]+[28].

Item [31]: Declare the total value-added tax payable calculated based on the formula [31]=[23]+[25]+[27]+[29].

Item [32]: Declare the total revenue calculated based on the formula [32]=[21]+[30].

B. Declaration specifically for collections under the authority of state agencies:

In case the taxpayer has collections under the authority of state agencies as regulated in point c, clause 2, Article 7 of Decree No. 126/2020/ND-CP dated October 19, 2020, the details should be declared in this section.

Column [33]: Declare the revenue subject to VAT of the collections under the authority of state agencies.

Column [34]: Declare the VAT tax rate of the collections under the authority of state agencies.

Column [35]: Declare the value-added tax payable for the collections under the authority of state agencies, calculated based on the formula [35]=[33]x[34].

Item [36], Item [37]: Declare the total revenue without VAT and the VAT payable, calculated based on the formulas [36]=sum of column [33], [37]=sum of column [35].

Signature and stamp section:

The legal representative of the taxpayers or the authorized representative of the taxpayer should sign, stamp, or electronically sign the declaration and take legal responsibility for the declared information. In case a tax agent declares on behalf of the taxpayer, the legal representative of the tax agent should sign, stamp, or electronically sign on behalf of the taxpayers and provide additional information about themselves and the name of the tax agent's staff directly responsible for tax declaration, including their professional certificate number, in the corresponding information.

What are the procedures for declaration of VAT on revenue using direct method in Vietnam?

Based on Section 3 of Section II of the Administrative Procedures issued with Decision 1462/QD-BTC in 2022, the procedure for the declaration of VAT on revenue using the direct method includes the following steps:

Step 1: The taxpayer applies the VAT calculation method according to the revenue using the direct method as prescribed by the VAT law (including separate declaration of VAT for collections under the authority of state agencies). They prepare the declaration form and submit it to the tax authorities no later than the 20th day of the following month for monthly VAT declaration; no later than the last day of the first month of the next quarter for quarterly VAT declaration; no later than the 10th day from the date of occurrence of the VAT liability for ad hoc VAT declaration.

For cases where the taxpayer submits documents electronically: The taxpayer accesses the chosen electronic portal (the Electronic Portal of the General Department of Taxation/ Electronic Portal of the competent state agency, including the National Public Service Portal, portals provided by the Ministry or Provincial Department implementing the one-stop, inter-agency procedure settlement and connected to the Electronic Portal of the General Department of Taxation) to submit the electronic VAT declaration and attached annexes (if any), electronically sign them, and submit them to the tax authorities through the chosen electronic portal.

Step 2: Receipt by the tax authorities:

For cases where the documents are submitted directly at the tax authorities or sent by mail: The tax authorities receive the documents as prescribed.

For cases where the documents are submitted electronically, the receipt, verification, acceptance, and processing of the documents are done through the electronic data processing system of the tax authorities:

Receipt of documents: The Electronic Portal of the General Department of Taxation sends a receipt notice or a notice of non-acceptance of the documents to the taxpayers through the chosen electronic portal (The Electronic Portal of the General Department of Taxation/ Electronic Portal of the competent state agency, or the T-VAN service provider), within 15 minutes from the time of receiving the electronic VAT declaration from the taxpayer.

Verification and processing of documents: The tax authorities verify and process the taxpayers' VAT declaration documents according to the provisions of the Tax Administration Law and related guidelines:

The tax authorities send an acceptance/non-acceptance notice to the chosen electronic portal (The Electronic Portal of the General Department of Taxation/ Electronic Portal of the competent state agency, or the T-VAN service provider) within 01 working day from the date stated on the receipt notice of the electronic VAT declaration.

LawNet