Vietnam: Who is the Form No. 02/GTGT of VAT declaration applicable to? Instructions on how to fill in Form No. 02/GTGT?

Form No. 02/GTGT - What is the latest form of VAT declaration in Vietnam?

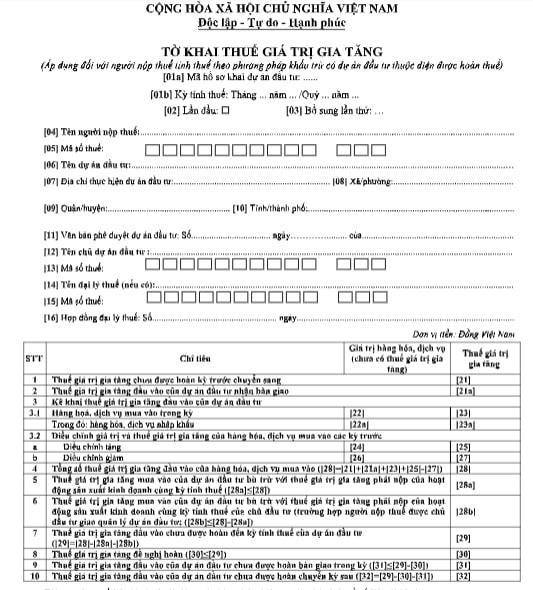

The form of VAT declaration in Vietnam according to Form No. 02/GTGT specified in Appendix II issued with Circular No. 80/2021/TT-BTC has the following form:

Download Form No. 02/GTGT - VAT declaration in Vietnam: Click here.

Vietnam: Who is the Form No. 02/GTGT of VAT declaration applicable to? Instructions on how to fill in Form No. 02/GTGT?

How does the General Department of Taxation guide how to fill in Form No. 02/GTGT?

General information section:

Target [01a] - investment project declaration code: Taxpayers self-determine the investment project declaration code must be unique according to the taxpayer's tax identification number for each investment project with the following information: information from targets [06] to [13].

Target [01b] - Tax period: The tax period declaration is the month in which the tax liability arises. If the taxpayer is approved by the tax authority to declare quarterly tax or is a newly established taxpayer, the tax period shall be recorded as the quarter in which the tax liability arises.

Targets [02], [03]: Check “First time”. In case the taxpayer discovers that the first-time tax declaration dossier submitted to the tax agency contains errors or omissions, an additional declaration shall be made according to the ordinal number of each supplement.

Note:

- Taxpayers make electronic declarations, Etax system supports taxpayers to determine the "First time" tax declaration corresponding to each business and production activity at target [01a].

- From the time the Etax System has the Notice of Acceptance of Tax Returns for the "First-Time" Tax Return, subsequent tax declarations of the same tax period, with the same production and business activities are the declarations "Additional". The taxpayer must submit the "Additional" Declaration in accordance with the regulations on additional declarations.

Targets [04], [05]: Declare the information "Taxpayer's name and tax identification number" according to the taxpayer's business registration or tax registration information.

Targets [06], [07], [08], [09], [10], [11]: Declare information about the name of the investment project, the address of the investment project, the document approving the project investment project according to the information of the project for which the taxpayer is making tax declaration.

Targets [12], [13]: Declare information about the name of the investor of the investment project, the tax identification number of the owner of the investment project assigned to perform the project for which the taxpayer is making tax declaration.

Targets [14], [15], [16]: In case the tax agent makes a tax declaration: Declare the information "name of tax agent, tax identification number" "number, date of tax agent contract". The tax agent must have "Active" tax registration status and the Contract must be valid at the time of tax return.

Note: Taxpayers make electronic tax declarations, Etax system automatically supports displaying information about tax agents, Tax agency contracts registered with tax authorities for taxpayers to choose in case taxpayers have many tax agents. , Contract.

* The declaration of the table's criteria:

1. Value-added tax that has not been refunded before it is transferred to:

Target [21]: Declare VAT information that has not been refunded before the transfer. This data is taken from target 32 "Input value-added tax of investment projects that has not been refunded to the next period" of the VAT declaration form No. 02/GTGT of the preceding tax period.

2. Input value-added tax of investment projects to be handed over:

Target [21a]: Declare the input value-added tax amount of the investment project in the case of VAT refund assigned by the project owner to manage the project or from other units assigned to manage by the project owner.

3. Declaration of input value-added tax of investment projects:

3.1. Value and value-added tax of purchased goods and services:

Target [22] and target [23]: Declare information on the value of goods and services and the VAT amount of goods purchased by taxpayers in the period directly serving the investment project.

In case the purchase invoice is a specific type of invoice or document such as stamps, freight tickets, etc., but the purchase price is inclusive of VAT, then, based on the VAT-inclusive purchase price, to calculate the VAT-exclusive purchase sales according to the following formula:

Purchase price excluding VAT = Selling price stated on the invoice / (1+ Tax rate)

Particularly, illegal invoices are not declared in this entry.

Targets [22a], [23a]: The data recorded in this target is similar to the way of declaring the targets [22], [23] but only for the purchase value and the purchased VAT of imported goods and services.

3.2. Adjustment of value and value-added tax of goods and services purchased in previous periods:

Targets from [24] to [27]: Declare the corresponding adjusted declared data in the additional declaration dossiers of the previous tax periods. Particularly in cases where the tax authority, the competent authority has issued the conclusion and decision on tax settlement with adjustment corresponding to the previous periods, then declare in the tax declaration file of the tax period to receive the conclusion and decision on tax handling (not required to make additional declaration to the tax declaration dossier).

4. Total input value-added tax on purchased goods and services:

Target [28]: The data to be declared in this target is determined by the formula [28]=[21]+[21a]+[23]+[25]-[27]

5. Value-added tax on purchases of investment projects is offset against payable value-added tax of production and business activities in the same tax period:

Target [28a]: Declare VAT on purchases of investment projects to offset with payable VAT of production and business activities at target [40b] of VAT declaration form No. 01/GTGT of the same tax period of the project owner in case the investor directly declares the VAT declaration form No. 02/GTGT. Target [28a] ≤ target [28].

6. Value-added tax on purchases of investment projects shall be offset with payable value-added tax of production and business activities in the same tax period of the investor (in case the taxpayer is assigned to manage the investment project by the investor).

Target [28b]: Declare purchase VAT of investment projects to offset with payable VAT of production and business activities at target [40b] of VAT declaration form No. 01/GTGT of the same tax period of the project owner. In case the taxpayer is a branch, the project management board is assigned by the investor to manage the investment project. Target [28b] ≤ Target [28] - Target [28a].

7. Input value-added tax not yet refunded to the tax period of the investment project:

Target [29]: The data recorded in this target is determined by the formula [29]=[28]-[28a]-[28b].

8. Value added tax to be refunded:

Target [30]: Declare the VAT amount eligible for refund in accordance with the law on VAT that the taxpayer requests for refund. Target [30] ≤ target [29].

9. Input value-added tax of investment projects that have not been refunded and handed over in the period:

Target [31]: When the investment project to establish an enterprise has been completed and the procedures for business registration and tax payment have been completed, the investor of the investment project must sum up the unpaid value added tax of the project to hand over to the newly established enterprise and declare it in this target. Target [31] ≤ (criteria [29] - target [30]).

10. Input value-added tax of investment projects that have not been refunded is carried forward to the following period:

Target [32]: The data recorded in this target is determined by the formula [32]=[29]-[30]-[31].

* Signing and stamping section:

The legal representative of the taxpayer or the legal representative of the taxpayer shall sign, seal or electronically sign the declaration to submit the declaration to the tax office and take responsibility before law for the declared data.

In case the tax agent declares on behalf of the taxpayer, the legal representative of the tax agent shall sign, seal or digitally sign on behalf of the taxpayer and add the full name of the tax agent employee who directly makes the tax return and the number of this employee's practice certificate in the corresponding information.

Who is the Form No. 02/GTGT of VAT declaration applicable to?

Pursuant to Form No. 02/GTGT specified in Appendix II issued together with Circular No. 80/2021/TT-BTC, which clearly states that Form No. 02/GTGT applies to VAT payers by the deduction method who have projects investment eligible for tax refund.

Specifically, the General Department of Taxation also clearly states that the form No. 02/GTGT applies to taxpayers who are subject to VAT by the deduction method that are operating and have investment projects eligible for VAT refund in an area other than the province or centrally run city where the taxpayer's head office is located, a separate value-added tax return must be made for each investment project and submitted to the Tax Department where the investment project is located.

In case the investment project owner assigns the project management board and branch in a province other than the locality where the investment project owner is headquartered on behalf of the investment project owner to directly manage one or more investment projects in many localities, the project management board and branch must make separate tax declaration dossiers for each investment project and submit it to the tax authority of the locality where the investment project is located and must offset the input VAT amount of the investment project with the payable VAT amount of all business activities in the same tax period of the investment project owner.

LawNet