What are the procedures for extension of payment deadline for VAT, CIT, PIT and land rents in Vietnam in 2023?

What are the procedures for extension of payment deadline for tax and land rents in Vietnam?

The order of carrying out procedures for extension of payment deadline for VAT, CIT, PIT and land rents in Vietnam is specified in Article 5 of Decree No. 12/2023/ND-CP as follows:

- Taxpayers who declare and pay tax to tax authorities and are eligible for payment deadline extension shall submit application for tax and land rent payment extension (hereinafter referred to as “Application for extension”) for the first time or as revision in case of error to supervisory tax authorities once for all the taxes and land rents that arise during tax period of which payment deadline is extended and period in which the monthly (or quarterly) tax return is filed in accordance with tax administration laws.

If the application for extension is not filed at the same time as the monthly (or quarterly) tax return, as long as the application for extension is filed before the end of September 30, 2023, tax authorities shall still extend payment deadline of taxes and land rents of periods eligible for extension prior to the filing date of application for extension.

- Methods of submission:

+ Electronically

+ Physically to tax authorities

+ Post services

If taxes and land rents of taxpayers eligible for extension are located in many jurisdictions of different tax authorities, supervisory tax authorities of the taxpayers are responsible for communicating and transferring application for extension to relevant tax authorities.

- Taxpayers shall determine and assume responsibility for applying for extension in accordance with Decree No. 12/2023/ND-CP.

- Taxpayers who submit application for extension to tax authorities after September 30, 2023 shall not be eligible for extension of payment deadline of taxes and land rents.

- If taxpayers file additional tax returns for tax periods in which they are eligible for payment deadline extension thereby increasing the amount payable and submit additional tax returns to tax authorities before the end of the extended period, tax amounts to be extended shall also include amounts under the additional tax returns.

- If taxpayers file additional tax returns for tax periods in which they are eligible for payment deadline extension after the extended period has ended, tax amounts under the additional tax returns shall not be eligible for extension.

- Tax authorities are not required to inform taxpayers about whether or not payment deadline extension of their taxes and land rents are approved.

If tax authorities have sufficient ground to deem taxpayers not eligible for payment deadline extension during extended period, tax authorities shall inform taxpayers about immediate ceasing of extension and require taxpayers to submit taxes, land rents, and late payment interest for the extended period to state budget.

If competent authorities find taxpayers ineligible for payment deadline extension in accordance with this Decree after extended period has ended through means of inspection, taxpayers must pay tax arrears, fine, and late payment interest to the state budget.

- Late payment interests shall not be calculated for taxes and land rents eligible for payment deadline extension during extended period (including the case where taxpayers submit application for extension to tax authorities after filing tax returns in accordance with Clause 1 of this Article and the case where competent authorities find taxpayers have additional amounts payable within the extended period through means of inspection).

If tax authorities have calculated late payment interest (if any) of tax returns eligible for payment deadline extension in accordance with this Decree, tax authorities shall adjust and no longer impose late payment interest.

- When project developers of constructions and work items who carry out capital construction utilizing state budget, amounts from state budget dedicated to capital construction of projects that utilize ODA and are susceptible to VAT proceeds with payment procedures with the State Treasury, the project developers must attach written notice of tax authorities regarding receipt of application for extension or application for extension verified by tax authorities filed by contractors).

The State Treasury shall rely on documents submitted by project developers to deduct VAT that arise during the extended period. At the end of the extended period, contractors must pay all extended tax amounts as per the law.

What are the procedures for extension of payment deadline for VAT, CIT, PIT and land rents in Vietnam in 2023?

How long does the extension of payment deadline for tax and land rents last?

According to the provisions of Article 6 of Decree No. 12/2023/ND-CP on the time of entry into force as follows:

Organizing implementation and entry into force

1. This Decree comes into force from the date of signing until the end of December 31, 2023.

2. When the extended periods under this Decree end, payment deadline of taxes and land rents shall conform to applicable laws.

3. The Ministry of Finance is responsible for coordinating, organizing implementation, and resolving difficulties that arise during implementation of this Decree.

4. Ministers, heads of ministerial agencies, heads of Governmental agencies, Chairpersons of People’s Committees of provinces and central-affiliated cities, and relevant enterprises, organizations, households, household businesses, and individuals are responsible for implementation of this Decree.

Thus, the regulations on the extension of payment deadline for tax and land rents in 2023 will be applied from April 14, 2023 to the end of December 31, 2023.

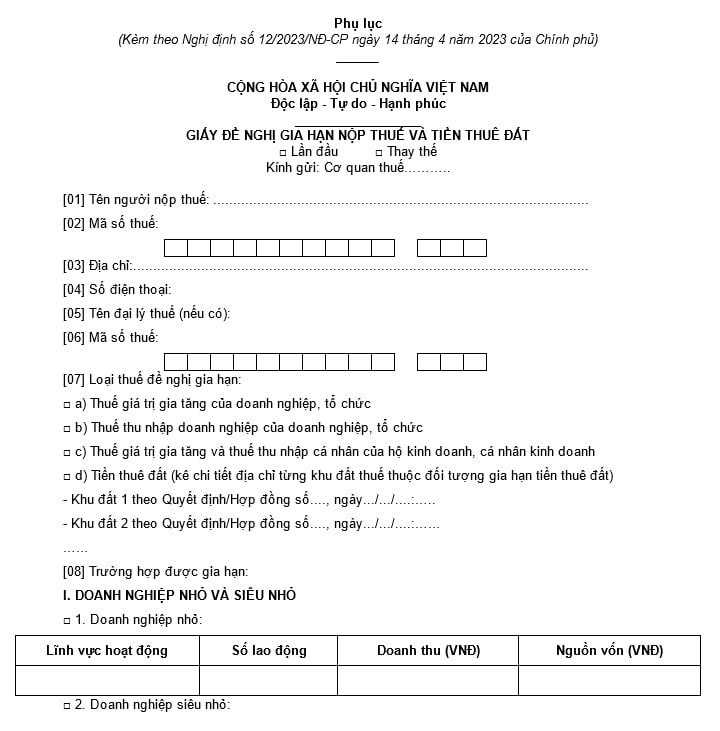

What is the application form for extension of payment deadline for VAT, CIT, PIT and land rents in 2023?

The application form for extension of payment deadline for tax and land rents is prescribed according to the form in the Appendix issued with Decree No. 12/2023/ND-CP as follows:

Download the application form for extension of payment deadline for tax and land rents: Click here.

LawNet