Vietnam: What is the family deduction in 2023? How is the dependent registration declaration regulated?

What is a family deduction in Vietnam?

According to the provisions of Clause 1, Article 19 of the Law on Personal Income Tax 2007 (amended by Clause 4, Article 1 of the Amended Law on Personal Income Tax 2014), family deduction is the amount deducted from taxable income before tax calculation for income from business, wages and wages of taxpayers who are resident individuals.

The determination of the family deduction for dependents follows the principle that each dependent can only be deducted once on a taxpayer.

Vietnam: What is the family deduction in 2023? How is the dependent registration declaration regulated?

How is the family deduction in 2023 regulated in Vietnam?

Family deductions include: family deduction for the taxpayer himself and family deduction for dependents.

The family deduction in 2023 is implemented according to Article 1 of Resolution 954/2020/UBTVQH14, as follows:

- The deduction for tax payers is 11 million VND/month (132 million VND/year);

- The deduction for each dependent is 4.4 million VND/month.

Specifically, dependents for family deduction are defined as follows:

According to the provisions of Clause 3, Article 19 of the Law on Personal Income Tax 2007, dependents are persons that taxpayers are responsible for nurturing, including:

- Minors; the child is disabled, incapable of working;

- Individuals who have no income or whose income does not exceed the prescribed level, including adult children attending university, college, professional high school or apprenticeship; spouses who are incapable of working; parents who have reached the end of working age or are unable to work; others have no place to rely on that taxpayers have to directly nurture.

How is the dependent's tax registration file for family deduction regulated in Vietnam?

According to Clause 10 Article 7 of Circular 105/2020/TT-BTC, for dependents as prescribed at Point l Clause 2 Article 4 of this Circular 105/2020/TT-BTC, the first tax registration dossier shall be submitted as follows:

- In case an individual authorizes the income-paying agency to register for tax for dependents, he/she shall submit a tax registration dossier at the income-paying agency.

Tax registration dossiers of dependents include: Written authorization and documents of dependents (copy of citizen identity card or copy of valid identity card for dependents with Vietnamese nationality from full 14 years old or older; copy of birth certificate or copy of valid passport for dependents with national Vietnamese nationality under the age of 14; copy of passport for dependents who are foreign nationals or Vietnamese nationals living abroad).

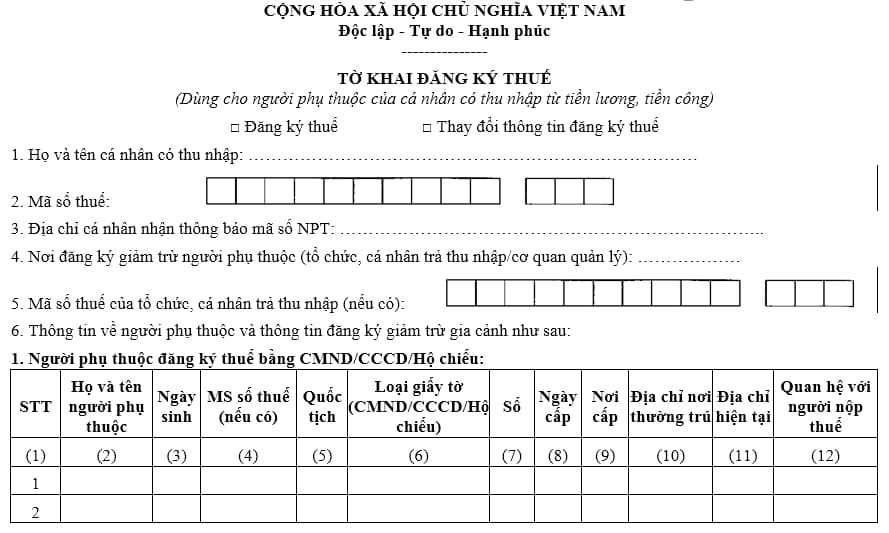

The general income payment agency and send the Tax Registration Declaration Form No. 20-DK-TH-TCT issued together with Circular 105/2020 / TT-BTC to the tax authority directly managing the income-paying agency.

- In case the individual does not authorize the income-paying agency to register tax for dependents, submit the tax registration dossier to the corresponding tax authority as prescribed in Clause 9 Article 7 of Circular 105/2020 / TT-BTC. Tax registration dossiers include:

- Tax registration declaration form No. 20-DK-TCT issued together with Circular 105/2020/TT-BTC;

- A copy of the citizen identity card or a copy of a valid identity card for dependents with Vietnamese nationality at least 14 years old; a copy of a valid birth certificate or passport for dependents of Vietnamese nationality under 14 years of age; a copy of a valid passport for dependents who are foreign nationals or Vietnamese nationals living abroad.

In case an individual subject to personal income tax payment has submitted a dependent registration dossier for family deduction before the effective date of Circular 95/2016/TT-BTC but has not yet registered for tax for dependents, the above-mentioned tax registration dossier shall be granted a tax identification number for dependents.

How is the Dependent Registration Form for family deduction regulated in Vietnam?

Form of declaration of registration of dependents with family deduction (Form 20-DK-TH-TCT) issued together with Circular 105/2020 / TT-BTC.

Download the family deduction dependents registration form here

LawNet