Template of the Record on Administrative Violations Regarding Taxes, Invoices by Electronic Means is Regulated How?

What Constitutes Administrative Violations in Taxation and Invoicing?

According to Clause 1 and Clause 2 Article 2 Decree 125/2020/ND-CP, administrative violations in taxation and invoicing are defined as follows:

- Administrative violations in taxation are fault-based actions by organizations or individuals that violate legal regulations on tax management, tax law, and other receivables that are not criminal offenses but are subject to administrative penalties according to legal provisions.

These other receivables include:

+ Land use fees;+ Land rents, surface water rents;+ Fees for granting the right to exploit minerals;+ Fees for granting the right to exploit water resources;+ Post-tax profits remaining after setting up funds of enterprises 100% capital held by the State;+ Dividends and profits distributed to the State's capital in joint-stock companies, limited liability companies with two or more members.

- Administrative violations in invoicing are fault-based actions by organizations or individuals that violate legal regulations on invoicing, which are not criminal offenses but are subject to administrative penalties according to legal provisions.

How is the sample of administrative violation records in taxation and invoicing by electronic means regulated?

General Department of Taxation's Guidance on the Application of Fines with Aggravating and Mitigating Circumstances

The application of fines for administrative violations in taxation and invoicing is regulated at Clause 1 Article 9 Decree 118/2021/ND-CP. To be specific:

Application of fines; temporary suspension of licenses, professional certificates; temporary suspension of operations; confiscation of materials, means of administrative violations, and application of remedial measures

1. The determination of fines for a specific administrative violation in cases with multiple aggravating and mitigating circumstances is applied according to the following principles:

a) When determining the fine for an organization or individual violation with both aggravating and mitigating circumstances, the aggravating circumstances are reduced by one mitigating circumstance each;

b) The specific fine for an administrative violation is the average of the penalty range regulated for that violation. In cases with two or more mitigating circumstances, the minimum of the penalty range is applied; in cases with two or more aggravating circumstances, the maximum of the penalty range is applied.

The determination of fines for a specific administrative violation in cases with multiple aggravating and mitigating circumstances is governed by the principles:

- With both aggravating and mitigating circumstances, reduce an aggravating by a mitigating circumstance;- Two or more mitigating circumstances apply the minimum penalty range;- Two or more aggravating circumstances apply the maximum penalty range.

To be specific:, General Department of Taxation has issued Official Dispatch 4485/TCT-PC 2022 on the handling of administrative violations in taxation and invoicing as follows:

- Apply the minimum range for cases with two or more mitigating circumstances; apply the maximum range for cases with two or more aggravating circumstances as per point b Clause 1 Article 9 Decree 118/2021/ND-CP.

- Aggravating and mitigating circumstances used to determine the penalty range cannot be reused to determine the specific fine amount.

- The specific fine for an administrative violation is the average of the fine range.

How is the Electronic Sample of Administrative Violation Record in Taxation and Invoicing Regulated?

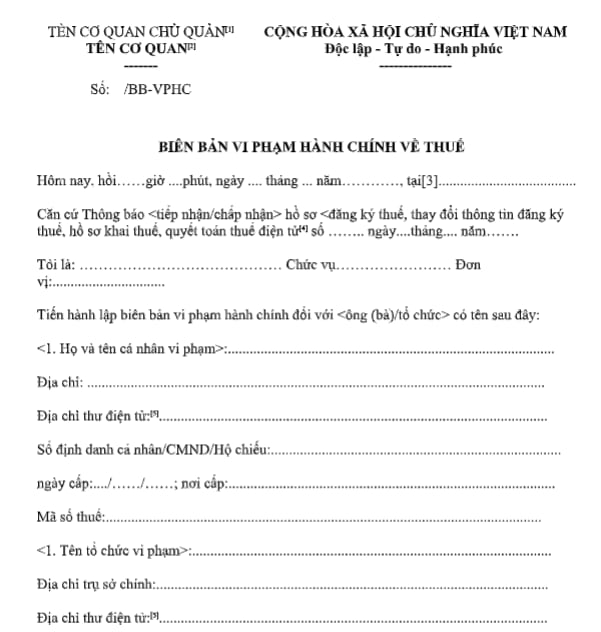

According to regulations at point b Clause 2 Article 36 Decree 125/2020/ND-CP, in cases of tax and invoice violations, the Tax Authority is responsible for drafting and sending to taxpayers an electronic administrative violation record. To be specific:

Drafting administrative violation records in taxation and invoicing

...

2. Drafting administrative violation records

...

b) Drafting electronic administrative violation records

In cases where taxpayers delay filing taxpayer registration, delays in changing taxpayer registration information, delays in tax declaration filings, or finalization filings by electronic means, no later than one working day from the date the tax authority sends a receipt notification for taxpayer registration documents, changes in the taxpayer registration or acceptance of tax declaration, tax finalization by electronic means, the tax authority drafts and sends an electronic administrative violation record to the taxpayer via the General Department of Taxation's electronic portal, even if the taxpayer submits multiple tax profiles.

The electronic administrative violation records must comply with the requirements for electronic transactions in the taxation field and serve as a basis for the tax authority to issue administrative penalty decisions.

The electronic administrative violation record must clearly state the date, month, year, location of drafting; name, title of the person drafting the record; the digital signature of the person drafting the record; name, address, tax identification number, identification number or citizen identification number of the violator or the name, address, tax identification number of the violating organization; the time of violation; administrative violation act; the rights and time for explanations of the violator; the authority receiving explanations. Electronic administrative violation records do not require the signature of the violating organization or individual.

The tax authority is responsible for building an information technology system to meet the requirement of drafting and sending electronic administrative violation records. When the information technology system meets the conditions for drafting and sending electronic administrative violation records for other tax procedure violations, the Minister of Finance will regulate the drafting and sending of electronic administrative violation records.

Additionally, as per Section 6 Official Dispatch 4485/TCT-PC 2022 issued by the General Department of Taxation, the following instructions apply:

...

6. Use form 01A/BB issued with Decree 125/2020/ND-CP for electronic administrative violation records in taxation.

for electronic administrative violation records are regulated as follows:

Download form 01A/BB issued with Decree 125/2020/ND-CP here.

Additionally, Official Dispatch 4485/TCT-PC 2022 also notes several details when using the administrative violation record form in taxation and invoicing as follows:

- Regarding tax identification numbers: add the tax identification number information to the violating organization/individual information section.

- Regarding remedial measures in point 6.c Article 1 of Decision form 02: refer to point 6.c of form 01/QD issued with Decree 125/2020/ND-CP to ensure full content of remedial measures according to each tax category, economic content (sub-items), the accounting location of National Revenue, the tax authority managing the revenue, the back-tax amount...

LawNet