Guidance on Initial Taxpayer Registration for Dependents for Individuals Required to Submit Documents Directly at the Tax Authority

Procedures for initial taxpayer registration for dependents of individuals who submit applications directly at the tax authority

According to the guidance in sub-item 17, Section 2, Part 2 of Administrative Procedures issued together with Decision 2589/QD-BTC in 2021 as follows:

Step 1: Individuals prepare a taxpayer registration file for dependents to claim personal deductions and submit it to the directly managing tax authority;

The deadline for submitting the taxpayer registration file for dependents to claim personal deductions is the same as the deadline for completing the personal deduction registration procedures as stipulated by personal income tax law.

- For electronic taxpayer registration files: The taxpayer (NNT) accesses the electronic information portal of their choice (the General Department of Taxation's Portal/ Competent authorities' portals, including the National Public Service Portal, Ministry-level, provincial Public Service Portals as per the regulation on the single-window, interlinked single-window mechanism in administrative procedure resolution, which are connected to the General Department of Taxation's Portal/ Portal of T-VAN service providers) to fill in the form and attach required documents electronically (if available), sign digitally, and submit to the tax authority through the selected electronic portal;

NNT submits the file (taxpayer registration file together with the business registration file through the one-stop-shop interlinked mechanism) to the competent state management authority as per regulations. The competent state management authority forwards the received information of the NNT to the tax authority through the General Department of Taxation's Portal.

Step 2: The tax authority receives the file:

- For paper taxpayer registration files:

+ Where the file is submitted directly at the tax authority: The tax officer receives the file, stamps the receipt on the taxpayer registration file, specifying the date of receipt, the number of documents according to the document list in case of directly submitted taxpayer registration files at the tax authority. The tax officer issues a receipt slip indicating the return date and processing time for the received file;

+ Where the taxpayer registration file is sent by postal service: The tax officer stamps the receipt, records the date of receipt on the file, and notes the tax authority's document number;

The tax officer reviews the taxpayer registration file. If the file is incomplete requiring explanation, supplement of information or documents, the tax authority notifies the taxpayer using form number 01/TB-BSTT-NNT in Appendix II issued together with Decree 126/2020/ND-CP dated October 19, 2020 of the Government of Vietnam within 02 (two) working days from the date of receipt of the file.

- For electronic taxpayer registration files:

The tax authority receives the file through the General Department of Taxation's Portal, and processes it via the electronic data processing system of the tax authority:

+ File reception: The General Department of Taxation's Portal sends a receipt notification to the NNT confirming that the file submission is received via the selected electronic portal (General Department of Taxation's Portal/ Competent authorities' Portal or T-VAN service provider’s portal), no later than 15 minutes from the time of receiving the electronic taxpayer registration file from the taxpayer;

+ File review and processing: The tax authority reviews and processes the taxpayer's file as per regulations on taxpayer registration and returns the results through the selected electronic portal:

++ If the file is complete and in compliance with the procedures, the tax authority sends the processing result to the selected electronic portal within the stipulated timeframe as per Circular 105/2020/TT-BTC dated December 03, 2020 of the Ministry of Finance guiding taxpayer registration;

++++ If the file is incomplete or not compliant with the procedures, the tax authority sends a non-acceptance notification to the selected electronic portal within 02 (two) working days from the date on the file receipt notification.

Guidelines for initial taxpayer registration for dependents for individuals who submit applications directly at the tax authority?

What does the initial taxpayer registration file for dependents of individuals who submit applications directly at the tax authority include?

The initial taxpayer registration file for dependents of individuals who submit applications directly at the tax authority is stipulated in sub-item 17, Section 2, Part 2 of Administrative Procedures issued together with Decision 2589/QD-BTC in 2021 and includes:

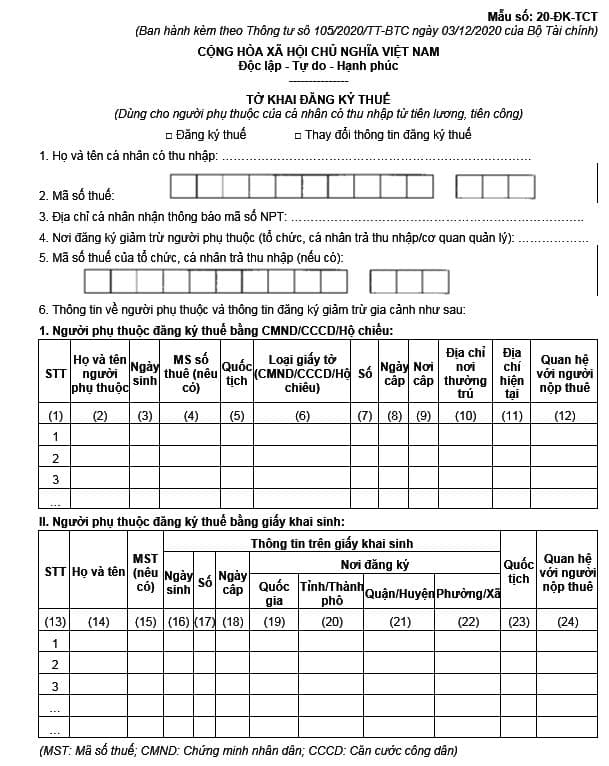

- Taxpayer registration form number 20-DK-TCT issued together with Circular 105/2020/TT-BTC dated December 03, 2020 of the Ministry of Finance.

- A photocopy of the Citizen Identification Card or valid Identity Card for dependents who are Vietnamese nationals aged 14 years or older;

- A photocopy of the Birth Certificate or valid Passport for dependents who are Vietnamese nationals under 14 years old;

- A photocopy of the valid Passport for dependents who are foreign nationals or Vietnamese nationals living abroad.

How is the initial taxpayer registration form for dependents of individuals who submit applications directly at the tax authority prescribed?

The taxpayer registration form number 20-DK-TCT issued together with Circular 105/2020/TT-BTC dated December 03, 2020 of the Ministry of Finance is as follows:

Download the initial taxpayer registration form for dependents of individuals who submit applications directly at the tax authority here

LawNet