How to determine the CIT amount payable to tax authorities in Vietnam? What are the principles of determining the place of payment of corporate income tax in Vietnam?

How to determine the CIT amount payable to tax authorities in Vietnam?

Pursuant to Article 13 of Circular No. 78/2014/TT-BTC stipulating the determination of the CIT amount payable to tax authorities in Vietnam as follows:

- An CIT amount calculated and paid in a province or centrally run city where a dependent cost-accounting production establishment is based is the payable CIT amount in a period multiplied by (x) the ratio between expenses incurred by such production establishment and total expenses incurred by the enterprise.

- The ratio of expenses is that between total expenses incurred by the dependent cost-accounting production establishment and total expenses incurred by the enterprise. The ratio of expenses shall be determined as follows:

Ratio of expenses incurred by the dependent cost-accounting production establishment = Total expenses incurred by the dependent cost-accounting production establishment/Total expenses incurred by the enterprise

- The ratio of expenses shall be determined based on the enterprise’s income tax finalization data in the year preceding the tax year, which shall be determined by the enterprise itself as a basis for determining the payable amount and used for the CIT declaration and payment for subsequent years.

- An operating enterprise which has different dependent cost-accounting production establishments in different geographical areas shall determine by itself data used for determining the ratio of expenses incurred by the enterprise in the locality where it is headquartered and expenses incurred by its dependent cost-accounting production establishments, based on the 2008 CIT finalization data. This ratio will be used stably from 2009 onwards.

- A newly established enterprise or an operating enterprise which increases or reduces its dependent cost-accounting production establishments in geographical areas shall determine by itself the ratio of expenses in the first tax period in this case. From the subsequent tax period, the ratio of expenses shall be determined on the above principle.

- Dependent cost-accounting units of enterprises applying entire-sector accounting and earning incomes outside their main business lines shall pay tax in provinces or centrally run cities where such business activities are conducted.

How to determine the CIT amount payable to tax authorities in Vietnam? What are the principles of determining the place of payment of corporate income tax in Vietnam?

What are the principles of determining the place of payment of corporate income tax in Vietnam?

Pursuant to Article 12 of Circular No. 78/2014/TT-BTC stipulating the principles of determining the place of payment of corporate income tax in Vietnam as follows:

Principles of determination

Enterprises shall pay tax in geographical areas where they are headquartered. For an enterprise that has dependent cost-accounting production establishments (including processing and assembly establishments) operating in provinces or centrally run cities other than the locality where it is headquartered, the tax must be calculated and paid in both the locality where the enterprise is headquartered and the geographical areas where its production establishments are based.

The distribution of payable tax amounts referred to in this Clause is not applicable to enterprises having works, work items or dependent cost- accounting construction establishments.

Thus, the place of payment of corporate income tax is determined based on the following principles:

(1) Enterprises shall pay tax in geographical areas where they are headquartered.

(2) For an enterprise that has dependent cost-accounting production establishments (including processing and assembly establishments) operating in provinces or centrally run cities other than the locality where it is headquartered, the tax must be calculated and paid in both the locality where the enterprise is headquartered and the geographical areas where its production establishments are based.

(3) The distribution of payable tax amounts referred to in this Clause is not applicable to enterprises having works, work items or dependent cost- accounting construction establishments.

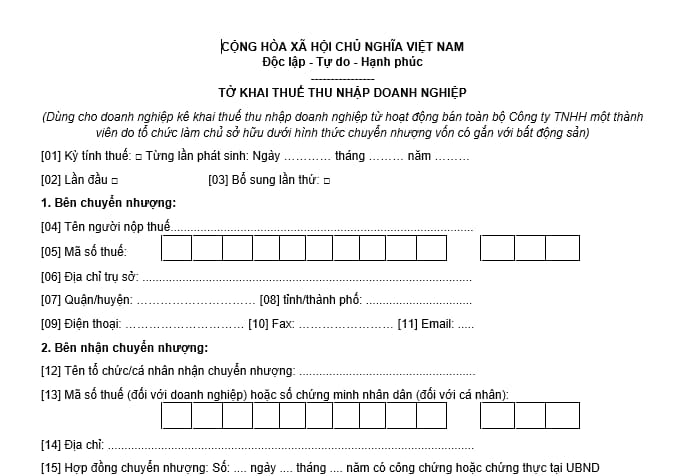

How is corporate income tax declaration regulated?

The corporate income tax declaration is specified in Form No. 08/TNDN issued together with Circular No. 78/2014/TT-BTC as follows:

Download the corporate income tax declaration: here.

LawNet