Hồ sơ hưởng bảo hiểm xã hội một lần gồm những gì? Hướng dẫn cách tính BHXH một lần trên ứng dụng VssID?

Nội dung chính

Hồ sơ hưởng bảo hiểm xã hội một lần gồm những gì?

Hồ sơ hưởng BHXH một lần được quy định tại Đều 109 Luật Bảo hiểm xã hội 2014 bao gồm:

- Sổ bảo hiểm xã hội.

- Đơn đề nghị hưởng bảo hiểm xã hội một lần của người lao động.

- Đối với người ra nước ngoài để định cư phải nộp thêm bản sao giấy xác nhận của cơ quan có thẩm quyền về việc thôi quốc tịch Việt Nam hoặc bản dịch tiếng Việt được chứng thực hoặc công chứng một trong các giấy tờ sau đây:

+ Hộ chiếu do nước ngoài cấp;

+ Thị thực của cơ quan nước ngoài có thẩm quyền cấp có xác nhận việc cho phép nhập cảnh với lý do định cư ở nước ngoài;

+ Giấy tờ xác nhận về việc đang làm thủ tục nhập quốc tịch nước ngoài; giấy tờ xác nhận hoặc thẻ thường trú, cư trú có thời hạn từ 05 năm trở lên của cơ quan nước ngoài có thẩm quyền cấp.

- Trích sao hồ sơ bệnh án trong trường hợp quy định tại điểm c khoản 1 Điều 60 và điểm c khoản 1 Điều 77 Luật Bảo hiểm xã hội 2014.

- Đối với người lao động quy định tại Điều 65 và khoản 5 Điều 77 Luật Bảo hiểm xã hội 2014 thì hồ sơ hưởng trợ cấp một lần được thực hiện theo quy định tại khoản 2 và khoản 3 Điều 109 Luật Bảo hiểm xã hội 2014.

Hồ sơ hưởng bảo hiểm xã hội một lần gồm những gì? Hướng dẫn cách tính BHXH một lần trên ứng dụng VssID?

Người lao động thuộc trường hợp nào thì được hưởng BHXH một lần?

Căn cứ tại khoản 1 Điều 60 Luật Bảo hiểm xã hội 2014 quy định nội dung này như sau:

Bảo hiểm xã hội một lần

1. Người lao động quy định tại khoản 1 Điều 2 của Luật này mà có yêu cầu thì được hưởng bảo hiểm xã hội một lần nếu thuộc một trong các trường hợp sau đây:

a) Đủ tuổi hưởng lương hưu theo quy định tại các khoản 1, 2 và 4 Điều 54 của Luật này mà chưa đủ 20 năm đóng bảo hiểm xã hội hoặc theo quy định tại khoản 3 Điều 54 của Luật này mà chưa đủ 15 năm đóng bảo hiểm xã hội và không tiếp tục tham gia bảo hiểm xã hội tự nguyện;

b) Ra nước ngoài để định cư;

c) Người đang bị mắc một trong những bệnh nguy hiểm đến tính mạng như ung thư, bại liệt, xơ gan cổ chướng, phong, lao nặng, nhiễm HIV đã chuyển sang giai đoạn AIDS và những bệnh khác theo quy định của Bộ Y tế;

d) Trường hợp người lao động quy định tại điểm đ và điểm e khoản 1 Điều 2 của Luật này khi phục viên, xuất ngũ, thôi việc mà không đủ điều kiện để hưởng lương hưu.

Như vậy, người lao động thuộc đối tượng tham gia BHXH bắt buộc mà có yêu cầu thì được hưởng bảo hiểm xã hội một lần nếu thuộc một trong các trường hợp sau đây:

- Đủ tuổi hưởng lương hưu theo quy định tại các khoản 1, 2 và 4 Điều 54 Luật Bảo hiểm xã hội 2014 mà chưa đủ 20 năm đóng bảo hiểm xã hội; hoặc

Đủ tuổi hưởng lương hưu theo quy định tại khoản 3 Điều 54 Luật Bảo hiểm xã hội 2014 mà chưa đủ 15 năm đóng bảo hiểm xã hội và không tiếp tục tham gia bảo hiểm xã hội tự nguyện;

- Ra nước ngoài để định cư;

- Người đang bị mắc một trong những bệnh nguy hiểm đến tính mạng như ung thư, bại liệt, xơ gan cổ chướng, phong, lao nặng, nhiễm HIV đã chuyển sang giai đoạn AIDS và những bệnh khác theo quy định của Bộ Y tế;

- Trường hợp người lao động quy định tại điểm đ và điểm e khoản 1 Điều 2 Luật Bảo hiểm xã hội 2014 khi phục viên, xuất ngũ, thôi việc mà không đủ điều kiện để hưởng lương hưu.

Mức hưởng bảo hiểm xã hội một lần là bao nhiêu?

Căn cứ vào khoản 2 Điều 60 Luật Bảo hiểm xã hội 2014 quy định mức hưởng bảo hiểm xã hội một lần.

Theo đó, mức hưởng bảo hiểm xã hội một lần được tính theo số năm đã đóng bảo hiểm xã hội, cứ mỗi năm được tính như sau:

- 1,5 tháng mức bình quân tiền lương tháng đóng bảo hiểm xã hội cho những năm đóng trước năm 2014;

- 02 tháng mức bình quân tiền lương tháng đóng bảo hiểm xã hội cho những năm đóng từ năm 2014 trở đi;

- Trường hợp thời gian đóng bảo hiểm xã hội chưa đủ một năm thì mức hưởng bảo hiểm xã hội bằng số tiền đã đóng, mức tối đa bằng 02 tháng mức bình quân tiền lương tháng đóng bảo hiểm xã hội.

Hướng dẫn cách tính BHXH một lần trên VssID?

Dưới đây là các bước tính BHXH một lần trên VssID mà người dân có thể tham khảo:

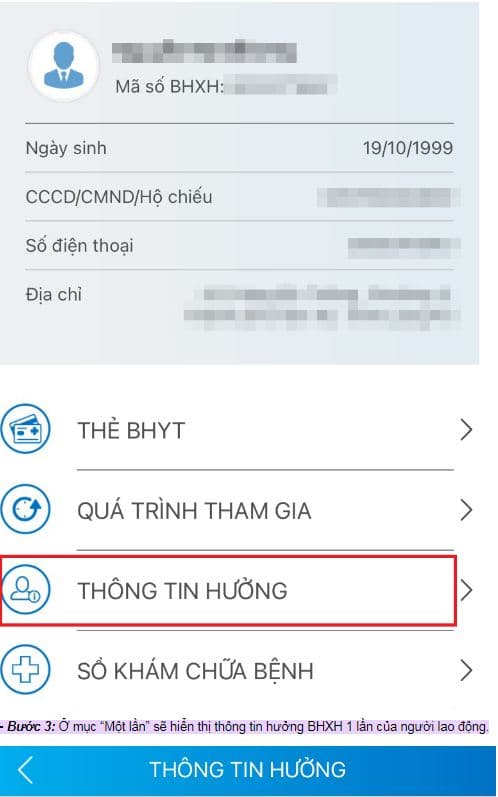

- Bước 1: Đăng nhập vào ứng dụng VssID.

- Bước 2: Chọn “Thông tin hưởng”.

- Bước 3. Tại mục Một lần, bạn sẽ thấy thông tin hưởng BHXH 1 lần của mình. Ngoài ra, chọn Quá trình tham gia > BHXH để xem lại quá trình tham gia BHXH của bạn.